Navigating the world of stock options can be both exhilarating and perilous. The potential for significant returns is undeniable, but so too is the risk of substantial losses. Understanding and avoiding common pitfalls is crucial for success in this dynamic market. This guide dissects key mistakes novice and even experienced traders often make, providing strategies to mitigate risk and enhance your trading performance.

From neglecting fundamental analysis to succumbing to emotional decision-making, the path to profitable options trading is paved with careful planning, disciplined execution, and a deep understanding of the underlying mechanics. We’ll explore the nuances of options contracts, the impact of volatility and time decay, and the importance of robust risk management techniques. By understanding these critical elements, you can significantly improve your odds of achieving consistent, positive outcomes.

Understanding Stock Options Basics

Stock options are derivative instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). Understanding the core components is crucial before engaging in options trading. Misinterpreting these elements can lead to significant financial losses.Options trading involves two primary contract types: calls and puts.

A call option gives the buyer the right to

- buy* the underlying asset at the strike price, while a put option gives the buyer the right to

- sell* the underlying asset at the strike price. The price paid to acquire an option contract is called the premium. This premium is the cost of purchasing the right to exercise the option. The expiration date is the final day the option can be exercised. After this date, the option becomes worthless.

Call and Put Options

A call option is profitable for the buyer if the price of the underlying asset rises above the strike price before expiration. Conversely, a put option is profitable for the buyer if the price of the underlying asset falls below the strike price before expiration. The seller of a call option (the writer) profits if the price of the underlying asset remains below the strike price, while the seller of a put option profits if the price remains above the strike price.

The potential profit for buyers is theoretically unlimited for calls (if the underlying stock price goes to infinity), while it is limited to the strike price for puts. Conversely, the maximum loss for a buyer is limited to the premium paid, while the seller’s potential loss is theoretically unlimited.

Strike Price and Expiration Date

The strike price represents the price at which the option holder can buy (call) or sell (put) the underlying asset. The expiration date signifies the last day the option can be exercised. Options contracts typically expire on the third Friday of the expiration month. Choosing the appropriate strike price and expiration date is crucial for managing risk and maximizing potential profit.

For example, a trader might choose a shorter expiration date for a more aggressive strategy or a longer expiration date for a more conservative approach.

Option Premium

The option premium reflects the market’s expectation of the likelihood of the option being exercised. Several factors influence the premium, including the underlying asset’s price, volatility, time to expiration, interest rates, and supply and demand. A higher premium indicates a higher perceived probability of the option being in-the-money (profitable at expiration) or reflects higher volatility in the underlying asset.

Buying and Selling Options Contracts

Buying an options contract grants you the right to buy or sell the underlying asset. The maximum loss is limited to the premium paid. Selling an options contract (writing options) obligates you to buy or sell the underlying asset if the buyer exercises their right. The potential for profit is higher when selling, but the potential loss is also unlimited (for uncovered options).

It is important to fully understand the risks associated with both buying and selling options.

Opening and Closing an Options Trade

Opening an options trade involves placing an order to buy or sell an options contract through a brokerage account. This requires specifying the underlying asset, the type of option (call or put), the strike price, the expiration date, and the number of contracts. Closing an options trade involves placing an order to sell (if you bought) or buy (if you sold) the same options contract to offset your initial position.

This can be done before expiration, allowing you to realize a profit or limit your losses. Profit or loss is determined by the difference between the price you paid for the contract and the price at which you closed the position, plus any adjustments for dividends or other corporate actions.

Poor Risk Management Techniques

Options trading, while offering significant profit potential, carries inherent risks. Ignoring proper risk management can quickly lead to substantial losses, eroding your trading capital and potentially hindering your overall financial goals. Effective risk management isn’t about avoiding risk entirely—it’s about intelligently controlling it to maximize potential gains while minimizing potential losses.Options trading involves leverage, magnifying both profits and losses.

A poorly managed trade can wipe out your entire account balance much faster than in other investment strategies. Therefore, understanding and implementing robust risk management techniques is paramount for long-term success in options trading.

Stop-Loss Orders and Position Sizing

Stop-loss orders and position sizing are two fundamental risk management techniques. Stop-loss orders automatically sell your options contracts when the price reaches a predetermined level, limiting potential losses. Position sizing, on the other hand, dictates how much capital you allocate to each trade, directly impacting your overall risk exposure. A well-defined position sizing strategy ensures that no single trade jeopardizes your entire portfolio.

For example, a conservative approach might limit each trade to no more than 1-2% of your total trading capital. More aggressive traders might risk up to 5%, but this carries significantly higher risk.

Comparison of Risk Management Techniques

Stop-loss orders offer a direct method of limiting losses on individual trades. However, they can also trigger prematurely due to market volatility, resulting in missed profit opportunities. Position sizing, while less direct in its impact on individual trades, provides a broader control over overall portfolio risk. By limiting the amount invested in any single position, it prevents a catastrophic loss from wiping out your account.

A combined approach, using both stop-loss orders and careful position sizing, is generally recommended for a comprehensive risk management strategy.

Risk Management Strategies: Advantages and Disadvantages

| Risk Management Strategy | Advantages | Disadvantages | Example |

|---|---|---|---|

| Stop-Loss Orders | Limits potential losses on individual trades; Provides psychological comfort; Automated protection. | Can trigger prematurely due to market volatility; May result in missed profit opportunities; Not effective against gap-downs. | Selling a call option with a stop-loss order at 50% below the entry price. |

| Position Sizing (Fixed Percentage) | Controls overall portfolio risk; Prevents catastrophic losses; Allows for consistent trading approach. | May limit potential profits; Requires discipline to adhere to the chosen percentage. | Allocating a maximum of 2% of trading capital to each individual option trade. |

| Diversification | Reduces risk by spreading investments across multiple assets; Lessens the impact of individual trade losses. | May require more research and monitoring; Potential for lower overall returns compared to concentrated positions. | Investing in options on different underlying assets (e.g., stocks, indices) with varying expiration dates. |

| Hedging | Reduces risk by offsetting potential losses with offsetting positions; Protects against adverse market movements. | Can reduce potential profits; Requires understanding of complex hedging strategies. | Buying put options to hedge against potential losses in a long stock position. |

Overtrading and Emotional Decision-Making

Options trading, while offering significant potential for profit, is a high-risk endeavor. The allure of quick gains can easily lead to overtrading and impulsive decisions, significantly increasing the likelihood of substantial losses. Understanding and mitigating these emotional pitfalls is crucial for long-term success.Overtrading, characterized by frequent and excessive trading activity, often stems from a combination of factors including fear of missing out (FOMO), the thrill of the trade, and a misguided belief in one’s ability to consistently predict market movements.

Impulsive decisions, fueled by emotions like greed, fear, or anger, further exacerbate the problem. These emotional responses often override rational analysis, leading to poor trading choices and ultimately, financial setbacks. For instance, a trader might panic-sell an option during a temporary market dip, locking in a loss instead of holding for a potential recovery. Conversely, the excitement of a winning trade might lead to overconfidence and excessive risk-taking on subsequent trades.

Such emotional volatility significantly reduces the effectiveness of any trading strategy, regardless of its sophistication.

Strategies for Maintaining Emotional Discipline

Maintaining emotional discipline requires conscious effort and the development of effective coping mechanisms. A key strategy involves creating a structured trading plan that defines entry and exit points, risk tolerance, and position sizing. This plan serves as a roadmap, guiding decisions and preventing impulsive actions based on fleeting emotions. Regularly reviewing and adjusting this plan based on market conditions and personal performance is also essential.

Another crucial element is practicing mindfulness and self-awareness. Recognizing and acknowledging emotional triggers—such as fear, anger, or excitement—is the first step toward managing their impact on trading decisions. Taking breaks from trading during periods of intense emotional stress can also help prevent rash actions. Finally, keeping a detailed trading journal, documenting both successful and unsuccessful trades along with the emotions experienced during each trade, can offer valuable insights into personal trading patterns and help identify emotional triggers.

Developing and Adhering to a Trading Plan

A well-defined trading plan is the cornerstone of successful and disciplined options trading. It should Artikel clear objectives, risk management strategies, and specific entry and exit rules for each trade. Consider including the following components:

- Defined Trading Goals: Clearly articulate your financial objectives, such as profit targets and acceptable loss levels. For example, aiming for a 10% return on your investment portfolio within a year, while accepting a maximum loss of 5% on any single trade.

- Risk Management Strategy: Establish a clear risk management strategy, including position sizing, stop-loss orders, and maximum drawdown limits. This might involve never risking more than 2% of your trading capital on any single trade, using stop-loss orders to limit potential losses, and setting a maximum drawdown limit of 10% before adjusting your trading strategy.

- Entry and Exit Rules: Define precise entry and exit points for each trade, based on technical indicators, fundamental analysis, or a combination of both. This could involve entering a trade when a specific price target is reached and exiting when a predetermined profit target is achieved or a stop-loss order is triggered.

- Trading Journal: Maintain a detailed trading journal, recording all trades, rationale behind each decision, and the emotions experienced during the trading process. This provides a valuable record for identifying patterns and areas for improvement.

- Regular Review and Adjustment: Regularly review and adjust your trading plan based on market conditions and personal performance. This might involve adjusting your position sizing, stop-loss levels, or trading strategies based on market volatility or personal performance.

By adhering to a well-structured trading plan and actively managing emotions, traders can significantly reduce the risks associated with overtrading and impulsive decision-making, paving the way for more consistent and profitable outcomes.

Lack of Proper Research and Due Diligence

Success in options trading hinges significantly on thorough research and due diligence. Ignoring this crucial step can lead to poorly informed decisions and substantial losses. Understanding both the fundamental and technical aspects of the underlying asset is paramount before committing capital to an options trade.Options trading, unlike simply buying and holding stocks, involves intricate calculations of time decay, volatility, and the probability of price movements.

Without a robust understanding of these factors, informed decision-making becomes impossible. Therefore, a comprehensive research process is essential to mitigate risk and improve the chances of profitable outcomes.

Fundamental Analysis in Options Trading

Fundamental analysis focuses on evaluating the intrinsic value of the underlying asset. This involves examining a company’s financial statements, including its revenue, earnings, debt levels, and competitive landscape. Strong fundamentals suggest a company is likely to perform well in the long term, which can positively influence the price of its options. For example, a company announcing unexpectedly strong earnings may see a surge in its stock price, leading to increased value in its call options.

Conversely, negative news about a company’s financial health could depress its stock price and the value of its call options. Analyzing factors such as management quality, industry trends, and regulatory changes are also crucial aspects of fundamental analysis. A thorough understanding of these factors helps in determining the long-term potential of the underlying asset and thus the potential profitability of the options trade.

Technical Analysis in Options Trading

Technical analysis focuses on interpreting price charts and patterns to predict future price movements. This involves studying historical price data, volume, and various technical indicators to identify potential trading opportunities. Technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, can help identify overbought or oversold conditions, potential support and resistance levels, and momentum shifts.

For instance, a stock consistently trading above its 20-day moving average might indicate upward momentum, making call options more attractive. Conversely, a stock breaking below key support levels could signal a potential price decline, making put options more appealing. However, it’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis for a more comprehensive assessment.

The Research Process for Options Trading

Conducting thorough research before entering an options trade involves a multi-step process. First, identify the underlying asset you are interested in trading. This requires considering your investment goals, risk tolerance, and market outlook. Second, conduct fundamental analysis to assess the intrinsic value of the underlying asset. This involves reviewing the company’s financial statements, news articles, and analyst reports.

Third, conduct technical analysis to identify potential entry and exit points. This involves analyzing price charts, volume, and technical indicators. Finally, develop a trading plan that Artikels your entry and exit strategies, position sizing, and risk management rules. This plan should be rigorously followed to ensure disciplined trading and minimize emotional decision-making. By following this structured approach, traders can significantly improve their chances of success.

Neglecting to Understand Underlying Asset

Options contracts derive their value from an underlying asset; understanding this relationship is paramount for successful trading. Ignoring the fundamentals of the underlying asset exposes traders to significant risks, often leading to substantial losses. A deep understanding of the asset’s characteristics, market dynamics, and potential influences is crucial for informed decision-making.Options contracts are derivative instruments, meaning their price is derived from the price of another asset.

This underlying asset could be a stock, an index, a commodity, or even a currency. The option’s value is directly influenced by the price movements of the underlying asset, as well as factors like time to expiration and volatility. Therefore, a thorough grasp of the underlying asset’s behavior is essential for accurately predicting option price fluctuations and managing risk effectively.

Importance of Understanding Underlying Asset Fundamentals

Ignoring the fundamentals of the underlying asset before trading its options is akin to navigating a ship without a map or compass. A solid understanding of the asset’s financial health, industry position, and competitive landscape is crucial for assessing its future price movements. This includes analyzing factors like financial statements, industry trends, management quality, and regulatory changes. By neglecting this crucial step, traders significantly increase their chances of making uninformed decisions that lead to losses.

For example, investing in options on a company facing significant financial difficulties without recognizing this vulnerability can result in substantial losses, even if the initial option price appears attractive.

Examples of Losses Due to Lack of Understanding

Let’s consider an example involving a technology company, “TechCorp.” Suppose an investor buys call options on TechCorp stock without understanding that the company is facing increasing competition and declining market share. While the option contract might initially seem profitable based solely on short-term price fluctuations, the underlying issues with TechCorp will eventually negatively impact its stock price. This can result in the options expiring worthless, leading to a complete loss of the initial investment.Another example involves a commodity like crude oil.

Suppose a trader buys call options on oil without understanding the impact of geopolitical events or changing energy policies. A sudden shift in global oil production or a significant policy change could drastically alter oil prices, potentially leading to substantial losses for those holding call options without considering these fundamental factors. The trader may have misinterpreted a short-term price spike as a long-term trend, resulting in an ill-informed investment decision.

Ignoring Assignment and Exercise Risks

Options trading involves the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) on or before a certain date (the expiration date). Understanding the mechanics of assignment and exercise is crucial to avoid significant financial losses. Ignoring these risks can lead to unexpected and potentially devastating consequences.Options contracts can be either bought (long position) or sold (short position).

When you buy a call option, you have the right to buy the underlying asset; when you buy a put option, you have the right to sell the underlying asset. Conversely, selling a call option obligates you to sell the underlying asset if the buyer exercises their right, and selling a put option obligates you to buy the underlying asset if the buyer exercises their right.

Assignment and Exercise Explained

Assignment occurs when the seller of an option contract is obligated to fulfill their contractual obligation. This happens when a buyer of an option chooses to exercise their right to buy or sell the underlying asset. Exercise is the act of the option buyer invoking their right to buy (call) or sell (put) the underlying asset at the strike price.

The seller is then “assigned” the obligation to complete the transaction. For example, if you sold a call option on 100 shares of XYZ stock with a strike price of $50, and the buyer exercises the option when the market price is $60, you are assigned and must sell 100 shares of XYZ at $50, even though you could sell them for $60 on the open market.

Risks Associated with Assignment and Exercise

The risks associated with assignment and exercise depend on whether you hold a long or short position. For long positions (buying options), the risk is limited to the premium paid for the option. However, for short positions (selling options), the risk is potentially unlimited, especially with uncovered options (those not hedged with the underlying asset). Being assigned on a short call can force you to sell an asset at a price below its market value, while being assigned on a short put forces you to buy an asset at a price above its market value.

This can result in substantial losses. Furthermore, the unexpected need for capital to fulfill the assignment can create liquidity issues.

Scenario Illustrating Potential Consequences

Imagine an investor sells (writes) 10 covered call contracts on a stock they own, with a strike price of $100. Each contract covers 100 shares. The premium received is $5 per share. The investor believes the stock price will stay below $100. However, unexpectedly, the stock price surges to $120.

The option buyers exercise their calls, forcing the investor to sell their 1000 shares at $100, even though they could have sold them at $120 on the open market. The investor loses out on the potential profit of $20 per share ($20,000 total) and only receives the premium of $5,000. This scenario demonstrates the substantial losses possible when ignoring the risks of assignment and exercise, particularly when selling options.

Stock Market, Stock Options, Stock Trading Overview

Understanding the differences between investing in the stock market, trading stock options, and simply buying and selling shares is crucial for navigating the world of finance. Each approach offers unique opportunities and risks, requiring different levels of knowledge, experience, and risk tolerance. This section will clarify the distinctions and highlight key strategies and risk profiles associated with each.Investing in the stock market, stock options trading, and stock trading (buying and selling shares) represent distinct approaches to participating in the equity markets, each with its own characteristics, strategies, and risk levels.

Comparison of Stock Market Investing, Stock Options Trading, and Stock Trading

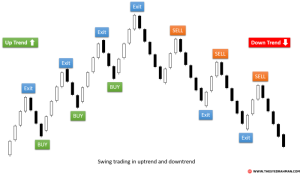

Stock market investing typically involves buying shares of a company and holding them for an extended period, aiming for long-term capital appreciation through dividends and share price growth. Stock trading, on the other hand, focuses on shorter-term price movements, aiming to profit from buying low and selling high within a relatively short timeframe. Stock options trading introduces a layer of complexity, offering the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a specific price (the strike price) on or before a specific date (the expiration date).

Trading Strategies for Different Approaches

Different strategies are employed depending on the chosen approach:

- Stock Market Investing: Buy-and-hold, value investing (identifying undervalued companies), growth investing (focusing on companies with high growth potential), dividend investing (prioritizing companies with strong dividend payouts).

- Stock Trading: Day trading (buying and selling within the same day), swing trading (holding positions for a few days to a few weeks), scalping (profiting from very small price changes).

- Stock Options Trading: Covered call writing (selling call options on shares you already own), cash-secured puts (selling put options with sufficient cash to buy the underlying shares if assigned), long call options (buying the right to buy shares at a specific price), long put options (buying the right to sell shares at a specific price), spreads (combining multiple options positions to manage risk and profit potential).

Risk Levels Associated with Each Approach

The risk associated with each approach varies significantly:

Generally, the risk increases as we move from long-term stock investing to short-term stock trading and then to options trading. Long-term investing carries the risk of market downturns and the potential for slow or no growth, while short-term trading introduces the additional risks of frequent transactions and the need for precise market timing. Options trading carries the highest risk due to the leverage involved and the potential for rapid losses if the market moves against the trader’s position.

Options can expire worthless, resulting in a total loss of the premium paid. For example, buying a call option that expires out-of-the-money represents a complete loss of the premium.

Consider this example: Investing $10,000 in a stock might yield a 10% return over a year ($1,000 profit), while day trading the same amount could result in either a significant profit or a substantial loss depending on market conditions and the trader’s skill. Options trading, with its leverage, could amplify both profits and losses exponentially. A successful options trade could yield significantly higher returns than a stock investment, but an unsuccessful one could lead to greater losses.

For instance, a poorly timed option purchase might result in a complete loss of the premium, which is much higher than the commission fees in a simple buy-and-hold stock strategy.

Visualizing Option Profit/Loss Profiles

Understanding the potential profit and loss scenarios for different options strategies is crucial for effective risk management. Visualizing these profiles helps traders make informed decisions and avoid unexpected losses. This section will describe the profit/loss profiles of long call and long put options, highlighting their key differences.

Long Call Option Profit/Loss Profile

A long call option grants the buyer the right, but not the obligation, to buy the underlying asset at a specific price (the strike price) on or before a specific date (the expiration date). The profit/loss profile for a long call option resembles a hockey stick. The maximum profit is theoretically unlimited, as the price of the underlying asset can rise indefinitely.

However, the maximum loss is limited to the premium paid for the option. Below the strike price, the option expires worthless, and the trader loses the premium. Above the strike price, profits increase linearly with the price of the underlying asset, offset by the premium initially paid.

Long Put Option Profit/Loss Profile

A long put option grants the buyer the right, but not the obligation, to sell the underlying asset at a specific price (the strike price) on or before a specific date (the expiration date). The profit/loss profile for a long put option is also somewhat like an inverted hockey stick. The maximum profit is limited to the strike price minus the premium paid, achieved when the underlying asset price falls to zero.

The maximum loss is the premium paid, as the option expires worthless if the underlying asset price remains above the strike price at expiration. As the underlying asset price falls below the strike price, the profit increases linearly, capped by the maximum profit.

Comparison of Long Call and Long Put Profit/Loss Profiles

Both long call and long put options have asymmetric profit/loss profiles. Long calls profit from rising asset prices, while long puts profit from falling asset prices. The maximum loss for both is limited to the premium paid, making them defined-risk strategies. However, the maximum profit potential differs significantly: unlimited for long calls and limited for long puts.

A trader choosing between these strategies should carefully consider their outlook on the underlying asset’s price movement and their risk tolerance. For instance, a trader bullish on a stock might choose a long call, while a trader bearish on a stock might choose a long put. Understanding these profiles helps in selecting the appropriate strategy aligned with the trader’s market view and risk appetite.

Mastering stock options trading requires a blend of knowledge, discipline, and adaptability. While the allure of quick profits is tempting, sustainable success hinges on a thorough understanding of the inherent risks and a commitment to sound trading practices. By diligently avoiding the common mistakes Artikeld in this guide, and continuously refining your strategies based on market dynamics and personal experience, you can navigate the complexities of options trading with greater confidence and increased potential for success.

Remember that continuous learning and adaptation are key to long-term profitability in this challenging yet rewarding arena.

Frequently Asked Questions

What is the best strategy for managing risk in options trading?

There’s no single “best” strategy, as it depends on your risk tolerance and trading style. However, effective strategies include diversifying your portfolio, using stop-loss orders, and carefully managing position size to limit potential losses.

How often should I review my trading plan?

Regularly review your trading plan, at least monthly, and adjust it as needed based on market conditions and your performance. Flexibility is key, but core principles should remain consistent.

What are some resources for learning more about options trading?

Numerous reputable online resources exist, including educational websites, books, and courses. Always prioritize information from trusted and reliable sources.

Is it possible to lose more money than I invested in options trading?

Yes, options trading involves leverage, meaning you can control a larger position than your initial investment. This magnifies both potential profits and losses; losses can exceed your initial investment.