Navigating the world of stock options can feel like deciphering a complex code, but understanding the underlying strategies can unlock significant opportunities for both seasoned investors and newcomers. This guide delves into the core principles of stock options, demystifying the intricacies of calls, puts, and various trading strategies. We’ll explore both basic and advanced techniques, providing practical examples and insightful analysis to equip you with the knowledge to make informed decisions in the dynamic stock market.

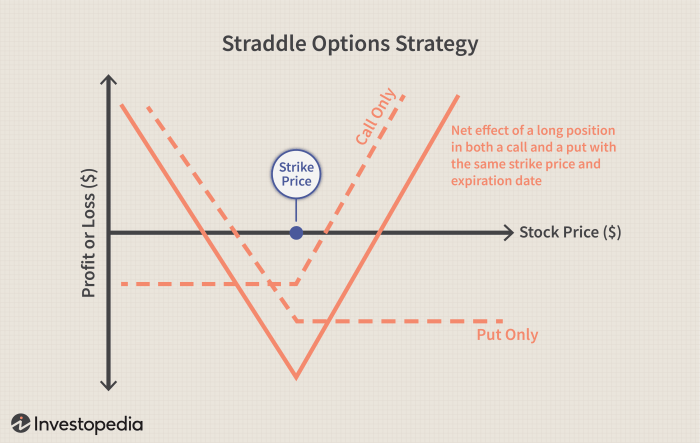

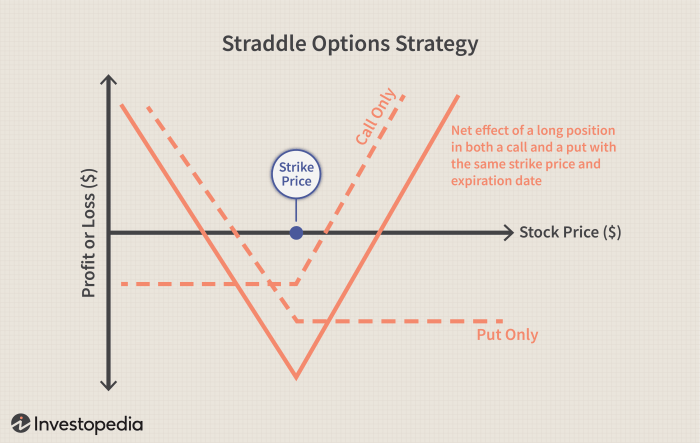

From covered calls and protective puts to more sophisticated strategies like straddles and iron condors, we’ll break down the risk-reward profiles of each, illustrating potential profit and loss scenarios. Understanding the impact of factors like implied volatility and time decay is crucial for success, and we’ll provide the tools to analyze these elements effectively. We’ll also cover essential risk management techniques to help you protect your capital and navigate the market’s inherent uncertainties.

Introduction to Stock Options Strategies

Stock options are derivative instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). They provide investors with a powerful tool to manage risk, speculate on price movements, and generate income. Options trading adds a layer of complexity to investing, but mastering even basic strategies can significantly enhance portfolio management capabilities.Options contracts fundamentally differ based on whether they grant the right to buy or sell the underlying asset.

Call Options versus Put Options

A call option gives the holder the right to

- buy* the underlying asset at the strike price. Investors typically buy call options when they anticipate the price of the underlying asset will rise above the strike price before the expiration date. Conversely, a put option grants the holder the right to

- sell* the underlying asset at the strike price. Put options are often purchased when an investor believes the price of the underlying asset will fall below the strike price before expiration. The profit potential for both call and put options is theoretically unlimited (for calls) or limited to the strike price (for puts), while the maximum loss is limited to the premium paid to acquire the option.

Types of Stock Options Contracts

The two main types of stock options contracts are American and European. American options can be exercised at any time before the expiration date, offering greater flexibility to the option holder. European options, on the other hand, can only be exercised on the expiration date itself. This limitation reduces flexibility but simplifies pricing models. The vast majority of options traded on US exchanges are American-style options.

The distinction between these types impacts the pricing and trading strategies employed. For example, an American option might be exercised early if the underlying asset experiences a significant price jump, whereas a European option would not have this possibility until the expiration date.

Basic Options Strategies

Understanding basic options strategies is crucial for navigating the complexities of the options market. These strategies offer diverse approaches to profit from market movements, hedging against risk, or generating income. This section will delve into three fundamental strategies: covered calls, protective puts, and cash-secured puts.

Covered Call Strategy

The covered call strategy involves selling call options on a stock that you already own. This generates immediate income (the premium) while limiting potential upside gains on the underlying stock. However, it also reduces the risk of significant losses should the stock price decline. The risk-reward profile is generally considered moderate to conservative, depending on the chosen strike price and expiration date.

| Stock Price at Expiration | Premium Received | Profit/Loss | Action Taken |

|---|---|---|---|

| Below Strike Price | $100 | $100 | Stock retained; option expires worthless. |

| At or Above Strike Price | $100 | $100 + (Stock Price – Strike Price) | Stock called away at strike price; option exercised. |

Note: This table assumes a single share and a simple scenario. Real-world scenarios may involve more complex calculations and considerations.

Protective Put Strategy

A protective put strategy involves buying a put option on a stock that you already own (or plan to buy). This acts as insurance against potential losses should the stock price decline. The put option grants you the right to sell the stock at a predetermined price (the strike price) before the expiration date. While this strategy protects against downside risk, it limits potential upside gains due to the cost of the put option premium.

It’s primarily a risk management strategy.

| Market Condition | Protective Put Profit/Loss | Long Stock Profit/Loss | Explanation |

|---|---|---|---|

| Stock Price Increases | -Premium Paid | Profit from Stock Appreciation | Put option expires worthless; profit limited by premium cost. |

| Stock Price Decreases | Strike Price – Stock Price – Premium Paid | Loss from Stock Depreciation | Put option exercised, limiting losses to the difference between the strike price and the current price, less the premium paid. |

Cash-Secured Put Strategy

The cash-secured put strategy involves selling a put option while simultaneously setting aside enough cash to buy the underlying stock if the option is exercised. This strategy is used to potentially acquire shares at a lower price than the current market value. If the option expires out-of-the-money, the seller keeps the premium as profit. However, if the option is exercised, the seller is obligated to buy the shares at the strike price.Example: An investor believes XYZ stock, currently trading at $50, is undervalued and may decline to $45.

They sell a cash-secured put option with a strike price of $45 and a premium of $2. If the stock price remains above $45 at expiration, the investor keeps the $2 premium. If the stock price falls below $45, the investor is obligated to buy 100 shares at $45 (assuming one contract), but effectively paid $43 per share ($45 – $2 premium).

The potential loss is limited to the difference between the strike price and the premium received, however the investor will own shares at a price lower than the current market value. The maximum profit is limited to the premium received.

Stock Market, Stock Options, and Stock Trading Overview

The stock market is a complex ecosystem where buyers and sellers trade shares of publicly listed companies. Understanding its structure, participants, and functions is crucial for anyone considering stock trading, particularly those venturing into the world of options. This section provides an overview of the stock market and its relationship with stock options, outlining the various account types available to traders.The stock market facilitates the buying and selling of company ownership.

It acts as a barometer of economic health, reflecting investor sentiment and overall market confidence. Its structure involves various exchanges (like the New York Stock Exchange and Nasdaq), brokerage firms that connect buyers and sellers, and regulatory bodies that ensure fair and transparent trading. Participants include individual investors, institutional investors (such as mutual funds and pension funds), corporations, and market makers.

The primary function of the stock market is to provide liquidity for company shares, allowing investors to buy and sell readily. This liquidity, in turn, supports economic growth by providing companies with access to capital.

The Relationship Between Stock Options and Stock Trading

Stock options are derivative instruments whose value is derived from the price of an underlying stock. They grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specific number of shares of the underlying stock at a predetermined price (strike price) on or before a specific date (expiration date). Options trading significantly enhances and modifies stock trading strategies.

For example, a trader bullish on a stock might buy call options instead of buying the shares directly, leveraging their capital and potentially limiting their risk to the premium paid for the option. Conversely, a trader anticipating a price decline might buy put options as a hedge against losses in their stock portfolio.Consider a scenario where an investor believes Company XYZ’s stock price, currently at $50, will rise to $60 within the next three months.

Instead of buying 100 shares at $50 (a $5,000 investment), they could buy one call option contract (representing 100 shares) with a strike price of $55 and an expiration date in three months. If the price rises above $55, the option becomes profitable. This illustrates how options provide leverage, potentially amplifying profits (or losses) compared to direct stock trading.

Another example is hedging: An investor holding 100 shares of Company ABC at $100 per share might buy put options with a strike price of $95 to protect against a potential price drop. If the price falls below $95, the put options offset some of the losses on the stock.

Types of Stock Trading Accounts and Their Suitability for Options Trading

Several types of brokerage accounts cater to different levels of trading experience and risk tolerance. A cash account requires full payment for all trades before execution, limiting the risk of incurring debt. This is often a suitable starting point for beginners exploring options, allowing them to gain experience without significant financial exposure. Margin accounts, however, allow traders to borrow funds from their broker to purchase securities, significantly increasing their buying power but also their risk.

Margin accounts are generally more suitable for experienced traders who understand the risks associated with leverage. Finally, certain accounts might offer specialized features tailored for options trading, including advanced charting tools and analytical capabilities. The suitability of each account type depends on the individual trader’s experience, risk tolerance, and trading strategy. Beginners are generally advised to start with cash accounts before progressing to margin accounts as they gain experience and confidence in options trading.

Mastering stock options requires diligent study and practice, but the potential rewards are substantial. This guide has provided a foundational understanding of key strategies and risk management principles. Remember, thorough research, disciplined execution, and a keen awareness of market dynamics are paramount to successful options trading. By applying the knowledge gained here, you can embark on your options trading journey with confidence, strategically navigating the complexities of the market to achieve your financial goals.

FAQs

What is the difference between American and European options?

American options can be exercised at any time before expiration, while European options can only be exercised at expiration.

How can I determine the appropriate position size for options trading?

Position sizing depends on your risk tolerance and account size. Start with smaller positions to gain experience and gradually increase as your confidence and understanding grow. Consider using risk management tools like stop-loss orders.

What are some common mistakes to avoid in options trading?

Common mistakes include ignoring risk management, overtrading, chasing quick profits, and lacking a well-defined trading plan. Thorough research and a disciplined approach are crucial.

Where can I find reliable information and resources for learning more about options trading?

Reputable financial websites, brokerage platforms, and educational resources offer valuable information. However, always verify information from multiple sources and consider seeking advice from a qualified financial advisor.