Predicting stock market crashes remains a complex and captivating challenge, drawing economists, investors, and policymakers alike. Understanding the historical context, from the Great Depression to the 2008 financial crisis, provides crucial insights into potential triggers and consequences. This exploration delves into various predictive methods, the role of investor psychology, and the impact of macroeconomic and geopolitical events, offering a comprehensive overview of this crucial topic.

We’ll examine both quantitative and qualitative factors influencing market volatility, analyzing the limitations of traditional predictive models while exploring potential improvements. The discussion will also encompass the implications for investors, including risk management strategies and the role of regulatory oversight in maintaining market stability.

Stock Options, Trading, and Market Crashes

Market crashes present significant challenges for investors, but understanding various trading strategies and risk management tools can help mitigate losses and potentially capitalize on opportunities. This section explores the role of stock options in hedging, various trading approaches during crashes, and a comparison of their associated risks and rewards.

Hedging Market Risk with Stock Options

Stock options offer a powerful way to hedge against market risk during periods of high volatility. A put option, for example, gives the holder the right, but not the obligation, to sell a specific stock at a predetermined price (the strike price) on or before a specific date (the expiration date). If the market crashes and the stock price falls below the strike price, the put option becomes valuable, offsetting some of the losses in the underlying stock portfolio.

Conversely, if the market performs well, the put option expires worthless, but the investor retains the upside potential of their stock holdings. This strategy limits downside risk while preserving upside potential. The cost of the put option (the premium) represents the insurance cost against potential losses. The selection of appropriate strike prices and expiration dates is crucial for effective hedging.

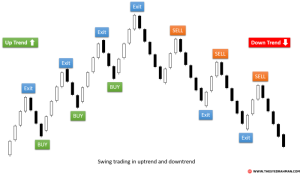

Stock Trading Strategies During Market Crashes

Several strategies are employed during market crashes, each carrying its own level of risk and reward. Two prominent examples are short selling and buying the dip. Short selling involves borrowing shares of a stock, selling them at the current market price, and hoping to buy them back later at a lower price to return them to the lender, profiting from the price difference.

This strategy profits from declining prices but carries significant risk, particularly if the stock price rises instead of falling. Buying the dip, on the other hand, involves purchasing stocks when their prices have fallen significantly, anticipating a future price recovery. This strategy relies on the belief that the market will eventually rebound, but it also carries the risk of further price declines.

Risk and Reward Comparison of Stock Trading Strategies During a Market Crash

The following table summarizes the risk and reward profiles of different stock trading strategies during a market crash. Note that the risk and reward levels are relative and can vary significantly based on factors like market conditions, timing, and the specific stocks involved.

| Strategy | Risk Level | Reward Potential | Example |

|---|---|---|---|

| Buying the Dip | High (potential for further price declines) | High (substantial gains if the market recovers) | Purchasing shares of a technology company after a significant sell-off, anticipating a future rebound. |

| Short Selling | Very High (unlimited potential losses if the stock price rises) | High (substantial gains if the stock price falls) | Borrowing and selling shares of a struggling company, expecting its price to decline further. |

| Put Option Hedging | Moderate (premium cost limits potential losses) | Moderate (limited upside potential, but downside risk is capped) | Purchasing put options on a broad market index to protect against a market-wide downturn. |

| Cash Position | Low (no risk of losing capital from market declines) | Low (no gains from market increases) | Holding a significant portion of assets in cash during a period of high uncertainty. |

Regulatory Responses and Market Stability

Regulatory bodies play a crucial role in maintaining the stability of financial markets and mitigating the risk of catastrophic crashes. Their actions, both preventative and reactive, significantly influence investor confidence and the overall health of the economy. The effectiveness of these interventions, however, is a subject of ongoing debate and analysis.The Securities and Exchange Commission (SEC) in the United States, for example, is a primary regulator responsible for overseeing the stock market.

Their mandate includes protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation. This involves setting and enforcing rules regarding trading practices, corporate disclosures, and the activities of market participants. Similar regulatory bodies exist in other countries, each with its own specific powers and responsibilities.

The SEC’s Role in Maintaining Market Stability

The SEC employs various strategies to maintain market stability. These include enforcing securities laws, conducting market surveillance to detect and prevent fraud and manipulation, and establishing regulations to manage risk. For instance, the SEC’s oversight of publicly traded companies ensures transparency through mandatory disclosures of financial information, allowing investors to make informed decisions. Furthermore, the agency’s enforcement actions against insider trading and market manipulation help to maintain investor confidence and prevent artificial price swings.

The effectiveness of these measures is regularly assessed and adapted based on market dynamics and emerging risks.

Effectiveness of Past Regulatory Interventions

The effectiveness of past regulatory interventions during market crises is a complex issue with varying perspectives. While some argue that regulatory actions have successfully mitigated the severity of crashes, others point to instances where interventions have been insufficient or even counterproductive. The 2008 financial crisis, for example, saw significant government intervention, including bank bailouts and the creation of the Troubled Asset Relief Program (TARP).

While these actions arguably prevented a complete collapse of the financial system, they also sparked considerable debate about the appropriate level and type of government involvement in the market. The subsequent Dodd-Frank Wall Street Reform and Consumer Protection Act represented a major regulatory overhaul aimed at preventing future crises, but its long-term effectiveness remains a topic of ongoing discussion.

Analyzing specific regulatory responses to past events, such as the Black Monday crash of 1987 or the dot-com bubble burst, offers valuable insights into both successes and shortcomings.

Potential Regulatory Reforms to Enhance Market Resilience

Several potential regulatory reforms are being considered to enhance market resilience and reduce the likelihood of future crashes. These include strengthening capital requirements for financial institutions, improving oversight of systemic risk, and enhancing investor protection measures. For example, stricter regulations on derivatives trading could help limit the spread of risk throughout the financial system. Increased transparency in the shadow banking sector could also help regulators better understand and manage potential vulnerabilities.

Furthermore, improvements in market surveillance technologies and data analytics could allow for quicker detection and response to emerging risks. The implementation of such reforms requires careful consideration of their potential impact on market efficiency and economic growth. A balanced approach is crucial, seeking to enhance stability without stifling innovation or unduly hindering economic activity.

Ultimately, predicting stock market crashes remains an imprecise science. While no model can guarantee perfect foresight, understanding the interplay of historical trends, investor behavior, macroeconomic conditions, and geopolitical factors provides a framework for informed decision-making. By combining quantitative analysis with qualitative assessments of market sentiment and global events, investors can better navigate periods of uncertainty and mitigate potential risks.

Continuous monitoring and adaptation are key to successfully navigating the complexities of the stock market.

Key Questions Answered

What are some early warning signs of a potential market crash?

Increased market volatility, sharp declines in key economic indicators (like GDP growth or consumer confidence), rising inflation, and escalating geopolitical tensions can be early warning signs. However, it’s important to remember that these are not definitive predictors.

How can individual investors protect themselves during a market crash?

Diversification of investments, maintaining a sufficient cash reserve, and considering hedging strategies (like options) can help mitigate losses. Avoid panic selling and stick to a well-defined investment plan.

Are there any reliable indicators that consistently predict market crashes?

No single indicator consistently and accurately predicts market crashes. Market behavior is complex and influenced by numerous interconnected factors, making precise prediction extremely challenging.