Navigating the complexities of the stock market requires more than just intuition; it demands a strategic approach fueled by insightful analysis. This guide delves into the world of stock market analysis tools, exploring the diverse range of software and platforms designed to empower investors and traders with data-driven decision-making capabilities. From charting software that visualizes market trends to fundamental analysis tools that dissect financial statements, we’ll uncover the key features and functionalities that can transform your investment strategy.

We will examine both technical and fundamental analysis approaches, providing practical examples and step-by-step guidance on utilizing various indicators and metrics. Understanding the strengths and weaknesses of different tools, along with effective risk management strategies, is crucial for success. We’ll also explore reliable data sources and discuss the nuances of stock market investing, options trading, and traditional stock trading, highlighting how analysis tools can be adapted to each approach.

Introduction to Stock Market Analysis Tools

Navigating the complexities of the stock market requires a robust understanding of various analytical tools. These tools empower investors to make informed decisions, whether through identifying potential investment opportunities or mitigating risks. The right tools can significantly enhance your trading strategy, leading to better returns and reduced losses. Choosing the appropriate tools depends on your investment style, experience level, and financial goals.

The stock market analysis tools landscape is diverse, offering a range of options catering to different needs and preferences. Broadly, these tools can be categorized into charting software, fundamental analysis tools, and technical analysis platforms. Each category offers unique functionalities and approaches to market analysis. Understanding these distinctions is crucial for selecting the most effective tools for your investment strategy.

Types of Stock Market Analysis Tools

Several distinct categories of tools exist, each serving a specific purpose in the overall analysis process. Understanding these differences allows investors to build a comprehensive toolkit tailored to their needs.

Charting Software: These tools provide visual representations of historical and real-time market data. They allow investors to identify trends, patterns, and support/resistance levels through various chart types (candlestick, bar, line). Advanced features often include drawing tools, technical indicators, and customizable layouts. Examples include TradingView and StockCharts.com.

Fundamental Analysis Tools: These tools focus on evaluating the intrinsic value of a company by examining its financial statements, management quality, competitive landscape, and industry trends. They provide metrics like Price-to-Earnings ratio (P/E), Return on Equity (ROE), and debt-to-equity ratio, helping investors assess a company’s financial health and growth potential. Examples include companies that provide financial data and news such as Bloomberg Terminal and Refinitiv Eikon.

Technical Analysis Platforms: These platforms use historical price and volume data to predict future price movements. They employ various technical indicators (moving averages, RSI, MACD) and chart patterns to identify potential buy or sell signals. These platforms often integrate charting capabilities with advanced technical analysis tools. Examples include MetaTrader 4 and NinjaTrader.

Comparison of Stock Market Analysis Tools

Selecting the right tool often involves weighing the strengths and weaknesses of different options. Here’s a comparison of three popular tools:

| Tool Name | Key Features | Cost | User Reviews Summary |

|---|---|---|---|

| TradingView | Extensive charting capabilities, wide range of technical indicators, social features, customizable layouts, free and paid plans. | Free plan available; paid plans range in price. | Generally positive reviews praising its comprehensive features and user-friendly interface; some users find the free plan limited. |

| Bloomberg Terminal | In-depth fundamental data, real-time market data, news and analytics, sophisticated charting tools, extensive research capabilities. | High subscription cost. | Highly regarded by professionals for its comprehensive data and analytical tools; cost is a major barrier for individual investors. |

| MetaTrader 4 | Widely used forex trading platform, supports automated trading (Expert Advisors), charting tools, technical indicators, various order types. | Free to download; brokerage fees apply. | Popular among forex traders for its customization options and automated trading capabilities; some users find the interface less intuitive than others. |

Technical Analysis Tools

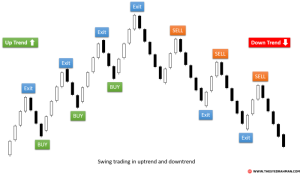

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. It differs from fundamental analysis, which focuses on a company’s financial statements and overall business prospects. Technical analysts believe that past market trends and patterns can predict future price movements. Various tools and indicators are employed to identify potential trading opportunities.Technical analysis tools provide traders and investors with visual representations of price movements and momentum, allowing for the identification of trends and potential reversal points.

These tools are not foolproof and should be used in conjunction with other forms of analysis, such as fundamental analysis and risk management strategies. Effective use requires understanding the underlying principles and limitations of each tool.

Common Technical Indicators

Several technical indicators are commonly used to analyze price charts and gauge market sentiment. These indicators provide different perspectives on price trends and momentum, helping traders to make informed decisions. Understanding their strengths and weaknesses is crucial for successful application.

- Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends. Simple moving averages (SMA) and exponential moving averages (EMA) are commonly used. SMAs give equal weight to all data points within the period, while EMAs give more weight to recent data. The intersection of different moving averages can signal buy or sell signals.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. Values above 70 generally suggest an overbought condition, while values below 30 suggest an oversold condition. These levels are not absolute buy/sell signals but rather indicate potential turning points.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line and a signal line. Crossovers between these lines, along with divergence between the MACD line and the price, can suggest potential changes in momentum.

Application and Interpretation of Moving Averages and RSI

Moving averages and the RSI are frequently used in combination to identify trading opportunities. Moving averages help to establish the overall trend, while the RSI helps to identify potential overbought or oversold conditions within that trend.For example, a bullish trend might be confirmed by an upward-sloping 50-day moving average and a 200-day moving average. However, if the RSI rises above 70 during this trend, it suggests the stock might be overbought and a potential pullback could occur.

Conversely, in a bearish trend, a drop in the RSI below 30 might indicate an oversold condition and a potential bounce. It’s crucial to remember that these are just potential signals and not guarantees of future price movements.

Using the Relative Strength Index (RSI) to Identify Buy/Sell Signals

The RSI, while not a standalone indicator, can be highly effective when used in conjunction with price action and other technical indicators. Here’s a step-by-step guide on using the RSI to identify potential buy/sell signals:

- Identify the RSI: Locate the RSI indicator on your chosen charting platform. It’s usually displayed as a separate line chart below the price chart.

- Observe RSI Values: Monitor the RSI values. Values above 70 generally suggest an overbought condition, while values below 30 suggest an oversold condition.

- Look for Divergence: Observe whether the RSI is diverging from the price action. Bullish divergence occurs when the price makes lower lows, but the RSI makes higher lows. This can signal a potential price reversal to the upside. Bearish divergence occurs when the price makes higher highs, but the RSI makes lower highs. This can signal a potential price reversal to the downside.

- Consider the Trend: Always consider the overall trend before acting on RSI signals. An RSI above 70 in a strong uptrend might not necessarily signal a sell signal, and an RSI below 30 in a strong downtrend might not necessarily signal a buy signal.

- Combine with Other Indicators: Use the RSI in conjunction with other technical indicators, such as moving averages or MACD, for confirmation before entering a trade.

- Manage Risk: Always use appropriate risk management techniques, such as stop-loss orders, to protect your capital.

Fundamental Analysis Tools

Fundamental analysis delves into a company’s financial health and intrinsic value to determine its potential for future growth and profitability. Unlike technical analysis which focuses on price charts and trends, fundamental analysis uses financial statements and other data to assess a company’s long-term prospects. This approach helps investors identify undervalued or overvalued securities based on their underlying fundamentals.

Key Financial Metrics in Fundamental Analysis

Several key financial metrics are crucial in fundamental analysis. Understanding these metrics allows investors to gauge a company’s profitability, financial strength, and efficiency. Analyzing these metrics in conjunction with each other provides a more comprehensive picture than examining any single metric in isolation.

- Price-to-Earnings Ratio (P/E Ratio): This ratio compares a company’s stock price to its earnings per share (EPS). A high P/E ratio may suggest that the market anticipates high future growth, while a low P/E ratio might indicate that the stock is undervalued. For example, a company with a P/E ratio of 20 is considered more expensive than a company with a P/E ratio of 10, assuming all other factors are equal.

However, it’s crucial to compare P/E ratios within the same industry and consider the company’s growth prospects.

- Earnings Per Share (EPS): EPS represents a company’s profit divided by the number of outstanding shares. It indicates the portion of a company’s earnings allocated to each share. A consistently increasing EPS generally signals strong financial performance. For instance, if a company’s EPS grows from $1 to $1.20 over a year, it demonstrates positive growth.

- Debt-to-Equity Ratio: This ratio measures a company’s financial leverage by comparing its total debt to its shareholders’ equity. A high debt-to-equity ratio indicates that a company relies heavily on debt financing, which can increase financial risk. Conversely, a low ratio suggests a more conservative financial approach. A debt-to-equity ratio of 1.0 means a company has equal amounts of debt and equity financing.

Comparison of Fundamental and Technical Analysis

Fundamental and technical analysis offer distinct approaches to investment decision-making. While both aim to identify profitable investment opportunities, their methodologies and focus differ significantly.Fundamental analysis prioritizes a company’s intrinsic value based on its financial health and future prospects. It’s a long-term strategy, often focusing on identifying undervalued companies with strong fundamentals regardless of short-term market fluctuations. Technical analysis, conversely, focuses on price charts, trading volume, and other market indicators to predict future price movements.

It’s a shorter-term strategy, concentrating on identifying trends and patterns to capitalize on short-term price changes. A balanced approach, incorporating both methods, can often provide a more comprehensive perspective. For example, a fundamentally strong company might experience a temporary dip in its stock price due to market sentiment (a technical factor), presenting a buying opportunity for long-term investors.

Resources for Fundamental Analysis

Reliable financial data is crucial for effective fundamental analysis. Several resources offer access to this information:

- Financial News Websites: Websites such as Yahoo Finance, Google Finance, and Bloomberg provide financial data, including company financials, stock prices, and news.

- Company Filings (SEC EDGAR): The U.S. Securities and Exchange Commission (SEC) database (EDGAR) contains company filings, including 10-K annual reports and 10-Q quarterly reports, providing detailed financial information.

- Financial Databases: Databases like FactSet, Bloomberg Terminal, and Refinitiv provide comprehensive financial data and analytical tools, often used by professional investors and analysts.

- Company Investor Relations Websites: Many publicly traded companies maintain investor relations sections on their websites, offering access to financial reports, presentations, and other relevant information.

Stock Screening and Portfolio Management Tools

Stock screening and portfolio management tools are invaluable assets for investors seeking to streamline their investment process and potentially improve returns. These tools leverage technology to automate tasks, analyze vast amounts of data, and ultimately help investors make more informed decisions. This section will explore the key features and functionalities of these tools, examining both their advantages and limitations.

Stock Screening Tool Features and Criteria

Stock screening tools allow investors to filter through thousands of securities based on pre-defined criteria, significantly reducing the time and effort required for research. This efficient filtering helps identify potential investment opportunities that align with an investor’s specific goals and risk tolerance. The criteria used can be incredibly diverse, ranging from fundamental metrics to technical indicators.

- Financial Metrics: Investors can screen for stocks based on metrics like Price-to-Earnings ratio (P/E), Price-to-Book ratio (P/B), dividend yield, revenue growth, and profit margins. For example, an investor might screen for companies with a P/E ratio below 15, indicating potentially undervalued stocks. Another investor might focus on companies with high dividend yields, seeking a steady stream of income.

- Technical Indicators: Technical analysis relies on chart patterns and indicators to predict future price movements. Screening tools can identify stocks exhibiting specific patterns, such as moving average crossovers, relative strength index (RSI) levels, or MACD signals. For instance, an investor could screen for stocks with an RSI below 30, suggesting they might be oversold and poised for a rebound.

- Industry and Sector: Investors can filter stocks based on their industry or sector, focusing on specific areas of the economy they believe will perform well. This allows for targeted diversification or concentrated exposure to a promising sector.

- Market Capitalization: Screening by market capitalization allows investors to target companies of specific sizes – large-cap, mid-cap, or small-cap – each carrying different levels of risk and growth potential.

Automated Portfolio Management Tool Benefits and Drawbacks

Automated portfolio management tools, also known as robo-advisors, utilize algorithms to manage investments based on an investor’s risk profile and financial goals. While offering several benefits, they also have limitations.

- Benefits: Robo-advisors offer convenience, low fees, diversification, and tax-loss harvesting. They automate the rebalancing process, ensuring the portfolio remains aligned with the investor’s goals over time. Their algorithms can adjust the portfolio dynamically based on market conditions.

- Drawbacks: The lack of personalized human interaction can be a drawback for some investors. Robo-advisors might not be suitable for complex investment strategies or those requiring personalized advice. Furthermore, their algorithms are based on historical data, which may not accurately predict future market movements.

Hypothetical Portfolio Construction

Let’s construct a hypothetical portfolio using specific stock screening criteria. Our goal is to create a diversified portfolio of growth stocks with a moderate risk profile.We will screen for stocks meeting the following criteria:

- Market capitalization between $10 billion and $100 billion (mid-cap)

- Positive earnings growth over the past three years

- P/E ratio below 25

- Belonging to the technology or healthcare sectors

Based on these criteria (and acknowledging that real-time data would be required for a true portfolio construction), we might hypothetically select companies like a fast-growing technology company with strong revenue growth and a relatively low P/E ratio, and a healthcare company demonstrating consistent profitability and innovation. The rationale is to combine growth potential with reasonable valuation metrics and diversification across sectors.

This is a hypothetical example, and actual stock selection requires thorough due diligence and consideration of individual risk tolerance.

Stock Market Data and Information Sources

Accessing reliable and comprehensive stock market data is crucial for effective investment analysis. The quality of your analysis is directly tied to the quality of your data, influencing decisions from identifying promising stocks to managing portfolio risk. A range of sources offers both real-time and historical data, each with its own strengths and weaknesses. Understanding these differences is key to making informed choices.The accuracy and reliability of stock market data are paramount.

Inaccurate or delayed data can lead to flawed analyses and potentially costly investment mistakes. Reliable sources employ robust data validation processes to minimize errors and ensure data integrity. Furthermore, understanding the potential biases inherent in certain data sources is crucial for interpreting information correctly. For instance, some sources might prioritize data that supports a particular narrative or investment strategy.

Sources of Real-Time and Historical Stock Market Data

Various sources provide access to stock market data, each catering to different needs and budgets. Financial news websites offer a blend of real-time and historical data, often freely available but with limitations on depth and detail. Brokerage firms typically provide data access as part of their services, often with real-time feeds for their clients. Dedicated data providers offer comprehensive and high-frequency data, often at a significant cost, but with unparalleled breadth and depth.

Data Accuracy and Reliability

Data accuracy and reliability are essential for informed decision-making in the stock market. Errors in data can lead to inaccurate analyses and potentially significant financial losses. Therefore, it’s vital to utilize reputable sources that employ rigorous data validation and quality control measures. Inconsistencies or discrepancies between data sources should be investigated and reconciled before making any investment decisions.

The timeliness of data is also crucial, especially for short-term trading strategies. Delays in data updates can lead to missed opportunities or incorrect interpretations of market trends.

Comparison of Data Sources

The following table compares three different data sources, highlighting their cost, data coverage, and data update frequency. Note that pricing can vary based on subscription levels and features.

| Data Source | Cost | Data Coverage | Data Update Frequency |

|---|---|---|---|

| Yahoo Finance | Free | Broad range of US and international stocks, indices, and some financial instruments. Limited historical data for some assets. | Real-time for many stocks, but delays may occur. Historical data updates are less frequent. |

| Bloomberg Terminal | Expensive (subscription-based) | Extensive coverage of global markets, including stocks, bonds, futures, options, and economic data. Deep historical data archives. | Real-time updates with very high frequency. |

| TradingView | Range of options, including free and paid subscriptions | Covers a wide range of global markets, with various technical analysis tools and charting capabilities. Historical data availability varies depending on the plan. | Real-time updates for most assets. Frequency of historical data updates varies. |

Risk Management in Stock Trading

Successful stock trading hinges not only on identifying profitable opportunities but also on effectively managing risk. Without a robust risk management strategy, even the most accurate analysis can lead to significant losses. This section explores key risk management techniques employed by traders, focusing on the crucial roles of stop-loss orders and position sizing.

Stop-Loss Orders and Position Sizing

Stop-loss orders and position sizing are fundamental risk management tools that work in tandem to limit potential losses. A stop-loss order is an instruction to your broker to sell a security when it reaches a predetermined price, thus automatically limiting your potential loss on a given trade. Position sizing, on the other hand, determines the amount of capital you allocate to each trade, thereby controlling the overall impact of a losing trade on your portfolio.

Effective use of both significantly reduces the risk of catastrophic losses.

Implementing Stop-Loss Orders

Implementing stop-loss orders requires careful consideration of several factors. Traders often set stop-loss orders at a level that represents a tolerable loss percentage on their investment, for example, 5% or 10%. The specific level is often influenced by technical analysis indicators like support levels or previous price action. It’s crucial to understand that stop-loss orders don’t guarantee the avoidance of losses; market gaps or rapid price movements can still result in a larger loss than anticipated.

However, they significantly reduce the likelihood of large, unexpected losses. Traders may also use trailing stop-loss orders, which adjust automatically as the price of the security moves in their favor, protecting profits while limiting losses.

Position Sizing Strategies

Position sizing strategies aim to control the impact of any single trade on the overall trading portfolio. A common approach is to limit the risk per trade to a small percentage of the total trading capital, often between 1% and 5%. This percentage is determined by the trader’s risk tolerance and overall trading plan. For example, a trader with a $10,000 trading account and a 2% risk tolerance per trade would only risk $200 on each trade.

This strategy helps to ensure that even a series of losing trades does not wipe out the entire trading capital. Various position sizing techniques exist, each with its own advantages and disadvantages, tailored to individual trading styles and risk appetites.

Hypothetical Trading Plan Incorporating Risk Management

Let’s consider a hypothetical trading plan using a moving average crossover strategy, a common technical analysis tool. Suppose a trader wants to invest in XYZ Corp. Using a 50-day and 200-day moving average, the trader identifies a buy signal when the 50-day moving average crosses above the 200-day moving average, indicating a potential uptrend. The trader sets a stop-loss order at 10% below the entry price, limiting potential losses.

With a $10,000 trading account and a 2% risk tolerance, the trader calculates a maximum position size of $200. This means they can purchase a specific number of shares of XYZ Corp. Once the 50-day moving average crosses back below the 200-day moving average, signaling a potential downtrend, the stop-loss order is triggered, limiting the potential loss to $200.

This plan demonstrates the integrated use of technical analysis (moving average crossover) and risk management (stop-loss orders and position sizing) to mitigate potential losses while aiming for profitable trades. This is a simplified example, and real-world trading requires more nuanced strategies and ongoing adjustments.

Mastering the art of stock market analysis requires a blend of knowledge, skill, and the right tools. This guide has provided a framework for understanding the various tools available, from technical and fundamental analysis platforms to stock screening and portfolio management software. By leveraging these resources effectively and incorporating sound risk management practices, investors can significantly enhance their decision-making process and navigate the market with greater confidence.

Remember that consistent learning and adaptation are key to long-term success in this dynamic environment.

Query Resolution

What is the difference between technical and fundamental analysis?

Technical analysis focuses on price charts and patterns to predict future price movements, while fundamental analysis examines a company’s financial health and intrinsic value to determine its investment potential.

Are stock market analysis tools free?

Many offer free versions with limited features, while others require subscriptions or one-time purchases. The cost varies widely depending on the tool’s capabilities and data coverage.

How accurate are stock market predictions from these tools?

No tool can guarantee accurate predictions. They provide insights and probabilities based on historical data and algorithms, but market movements are inherently unpredictable.

What is the best stock market analysis tool for beginners?

The “best” tool depends on individual needs and preferences. Beginners might start with user-friendly platforms offering educational resources and basic charting tools before progressing to more advanced features.