Understanding stock options can unlock a world of investment possibilities, but the complexities can seem daunting. This guide demystifies the process, providing a clear explanation of how stock options function, from the basics of calls and puts to advanced trading strategies. We’ll explore the risks and rewards, the factors influencing option pricing, and crucial risk management techniques, empowering you to make informed decisions in the dynamic world of options trading.

We will cover the fundamental differences between buying and selling options, examining various strategies such as covered calls and cash-secured puts. We will delve into the crucial role of “Greeks” in option pricing and explore how understanding these factors can help you manage risk effectively. Finally, we’ll place options trading within the broader context of the stock market, highlighting its use in hedging, speculation, and income generation.

What are Stock Options?

Stock options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). Think of them as insurance policies for your investment strategy, allowing you to hedge against potential losses or capitalize on anticipated gains.

They’re not the same as owning shares of the company directly; instead, they represent a bet on the future price movement of that stock.Stock options provide leveraged exposure to price movements, meaning you can control a larger position with a smaller upfront investment than buying the underlying shares outright. However, this leverage also magnifies both potential profits and losses.

Calls and Puts

Calls and puts are the two main types of stock options. A call option grants the buyer the right to

- buy* the underlying asset at the strike price, while a put option grants the buyer the right to

- sell* the underlying asset at the strike price. The seller of an option (the option writer) has the obligation to fulfill the buyer’s right if the option is exercised.

Call Option Example

Imagine you believe Company XYZ’s stock, currently trading at $50, will rise to $60 in the next few months. You could buy a call option with a strike price of $55 and an expiration date three months from now. If the stock price rises above $55 before the expiration date, you can exercise your option, buying the stock at $55 and immediately selling it at the market price of $60, making a profit (minus the cost of the option).

If the price stays below $55, your option expires worthless, and you only lose the initial premium paid for the option.

Put Option Example

Now, let’s say you believe Company ABC’s stock, currently at $100, is likely to fall to $80. You might buy a put option with a strike price of $90 and a three-month expiration. If the stock price drops below $90, you can exercise your option, selling the stock at $90 even though the market price is lower, limiting your losses.

If the price remains above $90, your option expires worthless, and you only lose the premium paid.

Comparison of Calls and Puts

| Option Type | Profit Potential | Risk | Example Scenario |

|---|---|---|---|

| Call | Unlimited (theoretically) | Limited to the premium paid | Buying a call option on a stock expected to rise. |

| Put | Limited to the strike price minus the premium paid | Limited to the premium paid | Buying a put option on a stock expected to fall. |

Buying vs. Selling Stock Options

Understanding the difference between buying and selling stock options is crucial for navigating the complexities of options trading. Buying options grants you the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) before a certain date (the expiration date). Selling options, conversely, obligates you to fulfill the buyer’s contract if they exercise their right.

Each approach carries distinct risks and rewards, influenced by market movements and your chosen strategy.

Buying Calls vs. Buying Puts

Buying a call option gives you the right to buy the underlying asset at the strike price. This strategy profits when the underlying asset’s price rises above the strike price plus the premium paid. Conversely, buying a put option grants the right to sell the underlying asset at the strike price. This strategy benefits when the price falls below the strike price minus the premium.

The maximum loss for both is limited to the premium paid, while the potential profit is theoretically unlimited for calls and limited to the strike price minus the premium for puts.For example, imagine you buy a call option for Stock XYZ with a strike price of $100 for a premium of $5. If the price of XYZ rises to $110, your profit is $5 (the $10 difference minus the $5 premium).

However, if the price remains below $100, your loss is the $5 premium. If you bought a put option at the same strike price and premium, and the price fell to $90, your profit would be $5 (the $10 difference minus the $5 premium). If the price stays above $100, your loss is again the $5 premium.

Selling Covered Calls vs. Selling Cash-Secured Puts

Selling covered calls involves selling call options on a stock you already own. This strategy generates income from the premium received, but limits potential upside if the stock price rises significantly above the strike price. Selling cash-secured puts involves selling put options and having enough cash to buy the underlying asset if the option is exercised. This strategy generates income from the premium, but exposes you to the risk of having to buy the stock at the strike price if it falls below that level.Let’s say you own 100 shares of Stock ABC at $50 per share.

You sell a covered call with a strike price of $55 and a premium of $2 per share. If the price stays below $55, you keep the $200 premium and your shares. If the price rises above $55, your shares will be called away at $55, resulting in a profit of $700 ($5500 – $5000 + $200). If you sell a cash-secured put on Stock DEF with a strike price of $40 and a premium of $1 per share, and the price stays above $40, you keep the $100 premium.

If the price falls below $40, you are obligated to buy 100 shares at $40, reducing your net profit by the difference between the share price and $40, but you still keep the premium.

Profit/Loss Scenarios

The following table illustrates potential profit and loss scenarios for different option strategies. Note that these are simplified examples and do not account for commissions or other fees. Actual results will vary depending on market conditions and the specific option contract.

| Strategy | Underlying Price at Expiration | Profit/Loss |

|---|---|---|

| Buy Call (Strike $100, Premium $5) | $110 | $5 |

| Buy Call (Strike $100, Premium $5) | $90 | -$5 |

| Buy Put (Strike $100, Premium $5) | $90 | $5 |

| Buy Put (Strike $100, Premium $5) | $110 | -$5 |

| Sell Covered Call (Strike $55, Premium $2) | $60 | $700 |

| Sell Covered Call (Strike $55, Premium $2) | $50 | $200 |

| Sell Cash-Secured Put (Strike $40, Premium $1) | $45 | $100 |

| Sell Cash-Secured Put (Strike $40, Premium $1) | $35 | -$400 + $100 = -$300 |

Option Pricing and Greeks

Option pricing is a complex interplay of several factors, making it crucial for traders to understand these influences to effectively manage risk and profit potential. While predicting the precise price of an option is impossible, understanding these key factors allows for more informed trading decisions. This section will explore the primary drivers of option prices and delve into the “Greeks,” a set of metrics that quantify the sensitivity of option prices to these factors.

Several key factors influence the price of an option contract. These factors interact dynamically, meaning a change in one can significantly affect the others and the overall option price. Understanding this dynamic relationship is vital for successful option trading.

Factors Influencing Option Prices

The price of an option is determined by the complex interaction of several key variables. A change in any of these variables will affect the option’s price, sometimes dramatically. Understanding these factors is fundamental to effective options trading.

- Underlying Asset Price: The price of the underlying asset (e.g., a stock) has a direct impact on the option’s price. For call options (the right to buy), a rising underlying asset price increases the option’s value, while a falling price decreases it. The opposite is true for put options (the right to sell). A significant price movement in the underlying asset will often lead to a proportionally larger change in the option’s price, particularly near the option’s strike price.

- Time to Expiration: Options lose value as they approach their expiration date. This is because there’s less time for the underlying asset’s price to move favorably. This time decay is often referred to as theta. Options with longer times to expiration generally have higher prices than those with shorter times to expiration, all else being equal.

- Volatility: Volatility measures the fluctuation of the underlying asset’s price. Higher volatility increases the chance of large price swings, making options more valuable because there’s a greater chance of the option ending in-the-money (profitable). Conversely, lower volatility decreases the option’s value as the probability of a significant price move diminishes.

- Interest Rates: Interest rates play a smaller, but still significant, role in option pricing, particularly for longer-dated options. Higher interest rates generally increase the value of call options and decrease the value of put options. This is because the potential future value of the underlying asset is discounted less heavily at higher interest rates for call options.

Understanding the Greeks

The “Greeks” are a set of risk measures that quantify the sensitivity of an option’s price to changes in the underlying factors. They are essential tools for understanding and managing the risk associated with option trading. Each Greek represents a specific aspect of an option’s price sensitivity, providing a nuanced picture of the risk profile.

Delta

Delta measures the rate of change of an option’s price for every $1 change in the price of the underlying asset. It ranges from 0 to 1 for call options and -1 to 0 for put options. A delta of 0.50 means that for every $1 increase in the underlying asset’s price, the option price is expected to increase by $0.50.

Delta is highest when the option is at-the-money (the strike price equals the underlying asset price) and decreases as the option moves further in or out-of-the-money.

- Delta indicates the probability of an option expiring in-the-money. A delta of 0.50 suggests approximately a 50% chance of the option expiring in-the-money.

- Delta changes as the underlying asset price changes; this change in delta is known as gamma.

Gamma

Gamma measures the rate of change of delta. It indicates how sensitive delta is to changes in the underlying asset price. A high gamma suggests that delta will change significantly with small movements in the underlying asset price. Gamma is highest when the option is at-the-money and decreases as the option moves further in or out-of-the-money. Gamma is always positive.

- High gamma options experience rapid changes in their delta, making them highly sensitive to price fluctuations in the underlying asset.

- Gamma is a measure of the option’s convexity; higher gamma implies greater potential for profit but also greater risk.

Theta

Theta measures the rate of change of an option’s price with respect to the passage of time. It represents the time decay of an option’s value. Theta is always negative because options lose value as time passes. Theta is highest when the option is close to expiration and lowest when the option has a long time until expiration.

- Theta represents the daily erosion of the option’s value due to the passage of time.

- Theta increases as the option nears expiration, accelerating the rate of time decay.

Vega

Vega measures the rate of change of an option’s price with respect to changes in the volatility of the underlying asset. Vega is always positive because higher volatility increases the value of options. Vega is highest when the option is at-the-money and decreases as the option moves further in or out-of-the-money. Note that vega is sometimes represented by the Greek letter kappa (κ).

- Increased volatility increases the value of options, as there is a greater probability of large price movements.

- Vega is a crucial factor to consider when trading options in volatile markets.

Stock Option Strategies

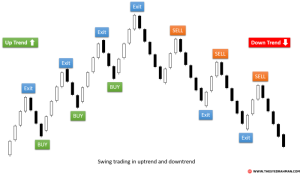

Stock option strategies offer a diverse range of approaches for investors to profit from market movements. Understanding these strategies is crucial for managing risk and maximizing potential returns. The complexity varies, so it’s important to choose strategies aligned with your experience level and risk tolerance.

Covered Calls

A covered call strategy involves selling call options on shares of stock you already own. This generates income immediately, and the profit potential is capped at the strike price of the option plus the premium received. However, you limit your potential upside on the underlying stock’s price appreciation.

- Order Placement: You first need to own the underlying stock. Then, you sell a call option contract with a strike price and expiration date of your choosing. The premium received is immediate income.

- Risk Management: The primary risk is the potential for missing out on significant upside if the stock price rises substantially above the strike price. Your maximum profit is limited to the strike price plus the premium received.

- Profit/Loss Profile: The profit/loss graph would show a diagonal line sloping upwards to the strike price, then flattening out. The maximum profit is achieved when the stock price is at or below the strike price at expiration. The maximum loss is the initial cost of the stock minus the premium received. If the stock price rises above the strike price, the profit levels off.

Protective Puts

A protective put strategy involves buying a put option on a stock you already own. This acts as insurance against potential losses if the stock price declines. While it costs money upfront, it provides a safety net.

- Order Placement: Purchase a put option contract on the stock you own, choosing a strike price and expiration date that reflects your risk tolerance. The premium paid is your cost of insurance.

- Risk Management: The primary risk is the cost of the put option premium, which is a sunk cost. However, this cost is offset by the protection it offers against significant price drops.

- Profit/Loss Profile: The profit/loss graph shows a limited loss scenario, with the maximum loss being the premium paid for the put option, plus any decline in the stock price below the strike price. As the stock price rises, the profit increases proportionally, as the put option expires worthless.

Straddles

A straddle involves simultaneously buying a call option and a put option with the same strike price and expiration date. This strategy profits from significant price movements in either direction, but loses money if the price remains relatively stable.

- Order Placement: Buy one call option and one put option with the same strike price and expiration date on the same underlying asset.

- Risk Management: The risk is substantial as you pay premiums for both options. The maximum loss is the total premium paid for both options. This strategy is best suited for situations where you anticipate significant volatility.

- Profit/Loss Profile: The profit/loss graph is V-shaped. Profits increase as the stock price moves significantly above or below the strike price. The maximum loss is the total premium paid, occurring if the price remains near the strike price at expiration.

| Strategy | Risk Profile | Potential Rewards | Suitable Market Conditions |

|---|---|---|---|

| Covered Calls | Limited upside potential, defined risk | Premium income, limited profit | Stable or slightly bullish market |

| Protective Puts | Premium cost, limited downside risk | Protection against losses, potential for profit if stock price rises | Uncertain or slightly bearish market |

| Straddles | High risk, high potential reward | Profit from significant price movements (up or down) | High volatility expected |

The Stock Market Context

Stock options, while complex, are an integral part of the broader stock market ecosystem. They provide a powerful tool for both seasoned investors and newcomers, offering diverse strategies for managing risk, generating income, and capitalizing on market movements. Understanding their role requires examining how they interact with other investment vehicles and the overall market dynamics.Options derive their value from the underlying stock’s price, creating a dynamic relationship where market trends directly influence option prices.

This interconnectedness highlights the importance of a robust understanding of market fundamentals before engaging in options trading. Ignoring market analysis increases the risk of significant losses.

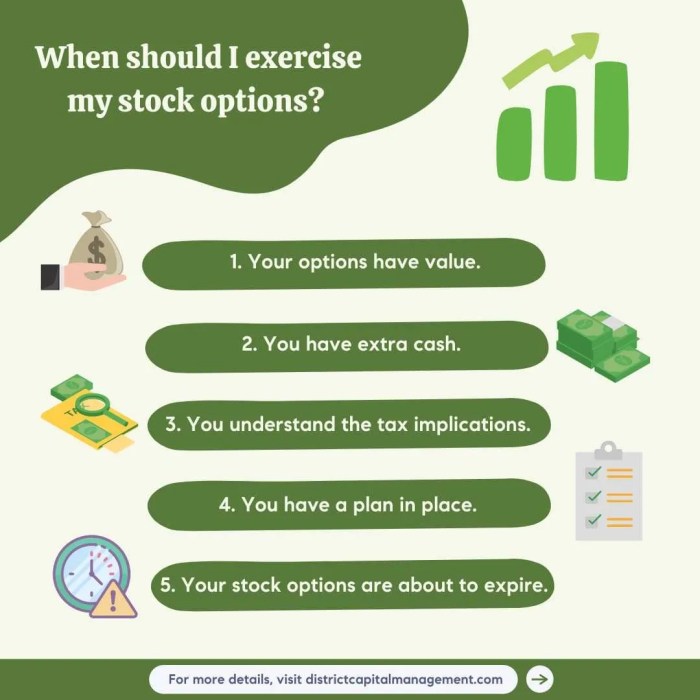

Options for Hedging, Speculation, and Income Generation

Stock options offer versatile applications depending on the investor’s goals and risk tolerance. Hedging involves using options to mitigate potential losses in an existing stock position. For example, an investor holding shares of a company might buy put options as insurance against a price drop. Speculation, on the other hand, focuses on profiting from anticipated price movements. Investors might buy call options if they believe the underlying stock will rise significantly, aiming for substantial gains.

Income generation strategies utilize options to generate income through premiums received from selling options, regardless of the underlying asset’s price direction. Covered call writing, for instance, involves selling call options on shares already owned, generating immediate income while limiting potential upside.

Comparison with Other Investment Vehicles

Stock options differ significantly from other investment vehicles like stocks, bonds, and ETFs. Stocks represent direct ownership in a company, offering potential for capital appreciation and dividends but carrying inherent risk. Bonds, conversely, are debt instruments offering fixed income streams and lower risk, but typically with lower potential returns compared to stocks. ETFs (Exchange-Traded Funds) offer diversified exposure to a basket of securities, providing a balance between risk and return.

Stock options, however, provide leveraged exposure to price movements, offering potentially higher returns but also significantly higher risk due to the time-sensitive nature of the contracts and the potential for complete loss of the premium paid.

Market Fundamentals and Options Trading

Understanding market fundamentals is paramount before trading options. Factors such as economic indicators (inflation, interest rates, GDP growth), industry trends, company-specific news (earnings reports, product launches, regulatory changes), and overall market sentiment significantly influence stock prices and, consequently, option prices. Ignoring these factors can lead to poorly informed decisions and substantial losses. For example, a negative earnings surprise could significantly impact the price of the underlying stock and render previously profitable options contracts worthless.

Thorough due diligence, including fundamental and technical analysis, is essential for informed options trading.

Stock Trading and Risk Management

Stock options trading offers significant potential for profit, but it also carries substantial risk. Understanding and effectively managing this risk is crucial for long-term success. Without a robust risk management strategy, even the most sophisticated trading plans can quickly unravel, leading to substantial financial losses. This section will Artikel key risk management techniques and address the psychological aspects of trading.

The Importance of Risk Management in Stock Options Trading

Options trading involves leverage, meaning you can control a larger position with a smaller initial investment. While this amplifies potential profits, it also magnifies potential losses. A poorly managed trade can quickly wipe out your entire trading capital. Effective risk management is not about avoiding losses altogether—it’s about limiting potential losses to a level you can comfortably afford, allowing you to remain in the market and learn from your mistakes.

Without a defined risk tolerance and a plan to manage losses, the emotional toll of trading can be significant, leading to impulsive decisions that exacerbate losses.

Best Practices for Managing Risk

Several key strategies contribute to effective risk management. These include position sizing, the strategic use of stop-loss orders, and portfolio diversification.

Position Sizing

Position sizing determines how much capital you allocate to each trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. For example, if you have a $10,000 trading account, you should risk no more than $100-$200 on a single trade. This approach prevents a single losing trade from significantly impacting your overall portfolio.

This percentage should be adjusted based on your risk tolerance and the specific characteristics of the trade. Higher-risk trades warrant smaller position sizes.

Stop-Loss Orders

Stop-loss orders are crucial for automatically limiting potential losses. A stop-loss order instructs your broker to sell a security when it reaches a predetermined price, helping to prevent further losses if the market moves against your position. Setting appropriate stop-loss levels requires careful consideration of the underlying asset’s volatility and your risk tolerance. It’s important to remember that stop-loss orders are not foolproof and may not always execute at the precise price specified, especially during periods of high market volatility.

Diversification

Diversification involves spreading your investments across multiple assets to reduce overall risk. Don’t put all your eggs in one basket. Diversifying your options portfolio across different underlying assets, expiration dates, and option strategies reduces the impact of a single losing trade or an unexpected market event. This strategy doesn’t eliminate risk but helps to mitigate it.

Psychological Aspects of Trading and Avoiding Emotional Decision-Making

Trading involves significant emotional challenges. Fear and greed can lead to impulsive decisions that often result in losses. Successful traders develop strategies to manage these emotions. This includes maintaining a disciplined approach, sticking to your trading plan, and avoiding overtrading. Keeping a trading journal to track performance and analyze mistakes can help identify emotional biases and improve decision-making.

Regularly reviewing your trading plan and adjusting it as needed, based on market conditions and your own performance, is essential.

Resources for Further Learning about Stock Trading and Options

Several resources can help you deepen your understanding of stock trading and options. These include books such as “Option Volatility and Pricing” by Sheldon Natenberg, online courses offered by platforms like Coursera and edX, and reputable financial websites providing market analysis and educational materials. Additionally, joining online communities and forums dedicated to options trading can provide valuable insights and support from experienced traders.

Remember that continuous learning is crucial for success in this complex field. Always be wary of get-rich-quick schemes and promises of guaranteed returns; sound investment practices are built on careful planning and risk management.

Understanding Stock Market Terminology

Navigating the world of stock options requires a solid grasp of specific terminology. This section provides definitions for key terms frequently encountered in stock market and options trading discussions. Understanding these terms is crucial for making informed investment decisions.

Glossary of Key Stock Market and Options Terms

The following glossary defines essential terms related to stock options trading. Familiarity with these terms is fundamental to comprehending options strategies and managing risk effectively.

| Term | Definition |

|---|---|

| Strike Price | The price at which the holder of an option can buy (call option) or sell (put option) the underlying asset. This price is predetermined when the option contract is created. For example, a strike price of $100 on a call option means the option holder can buy the underlying stock at $100 per share, regardless of the market price. |

| Expiration Date | The date on which an options contract ceases to exist. After this date, the option can no longer be exercised. Options typically expire on the third Friday of the expiration month. |

| Premium | The price paid to buy an options contract. This is the cost of acquiring the right, but not the obligation, to buy or sell the underlying asset at the strike price. Premiums are influenced by various factors, including the underlying asset’s price, time until expiration, volatility, and interest rates. |

| Intrinsic Value | The amount by which an option is “in the money.” For a call option, it’s the difference between the current market price of the underlying asset and the strike price (only positive values). For a put option, it’s the difference between the strike price and the current market price of the underlying asset (only positive values). If an option is “out of the money,” its intrinsic value is zero. For example, if the market price is $110 and the strike price is $100 for a call option, the intrinsic value is $10. |

| Extrinsic Value | The portion of an option’s premium that is not intrinsic value. It represents the value derived from factors such as time until expiration and implied volatility. Extrinsic value is always positive and decreases as the option approaches its expiration date. A higher implied volatility generally leads to a higher extrinsic value. |

| Implied Volatility | A market-derived estimate of the expected volatility of the underlying asset’s price over the life of the option. It reflects market participants’ expectations regarding future price fluctuations. Higher implied volatility typically leads to higher option premiums. |

| In the Money | An option is “in the money” when its intrinsic value is positive. For a call option, this occurs when the market price of the underlying asset is above the strike price. For a put option, this occurs when the market price is below the strike price. |

| Out of the Money | An option is “out of the money” when its intrinsic value is zero. For a call option, this occurs when the market price of the underlying asset is below the strike price. For a put option, this occurs when the market price is above the strike price. |

| At the Money | An option is “at the money” when its strike price is equal to the current market price of the underlying asset. Its intrinsic value is zero, but it still holds extrinsic value. |

Mastering stock options requires diligent study and practice, but the potential rewards can be significant. By understanding the underlying mechanics, risk profiles, and various strategies, you can navigate the options market with greater confidence. Remember that risk management is paramount, and thorough research and a well-defined trading plan are essential for success. This guide serves as a foundational stepping stone; continuous learning and practical experience will further refine your understanding and skills.

Expert Answers

What is the minimum account balance needed to trade options?

There’s no single minimum, but most brokers require a margin account and sufficient funds to cover potential losses. Requirements vary depending on the broker and the complexity of your trades.

Can I lose more money than I invest in options?

Yes, options trading carries significant risk. Unlike buying stocks, where your maximum loss is your initial investment, options can lead to losses exceeding your initial investment, particularly with uncovered positions.

How do taxes on stock options work?

Tax implications depend on whether you bought or sold the options, and whether you exercised them. Consult a tax professional for personalized advice, as tax laws can be complex and vary by jurisdiction.

What is an assignment?

Assignment occurs when you’re short an option (selling an option) and the buyer exercises their right to buy or sell the underlying asset. You’ll then be obligated to fulfill the contract.