Timing the stock market is a quest pursued by countless investors, a pursuit fraught with both challenge and potential reward. Understanding the best time to trade stocks involves more than just luck; it requires a sophisticated understanding of market cycles, economic indicators, global events, and the psychology of trading. This guide delves into the multifaceted aspects of this crucial question, providing insights to help you navigate the complexities of the stock market and make informed decisions.

From analyzing trading volume and volatility to understanding the influence of time zones and global events, we’ll explore a range of factors that significantly impact stock prices. We’ll also examine the importance of fundamental analysis, risk management techniques, and the crucial role of emotional discipline in achieving consistent success in the stock market. Ultimately, the goal is to equip you with the knowledge and strategies to improve your timing and increase your chances of profitable trades.

Understanding Market Cycles and Trends

The stock market’s performance is intricately linked to the overall health of the economy and global events. Understanding these relationships is crucial for navigating market cycles and making informed investment decisions. By analyzing economic indicators and historical market behavior, investors can gain a clearer picture of potential opportunities and risks.Economic Indicators and Stock Market PerformanceEconomic indicators such as Gross Domestic Product (GDP), inflation, and unemployment rates provide valuable insights into the direction of the economy and, consequently, the stock market.

Generally, a strong GDP growth, low inflation, and low unemployment suggest a healthy economy, often leading to positive stock market performance. Conversely, a declining GDP, high inflation (stagflation), and high unemployment usually signal economic weakness and can negatively impact stock prices. The relationship isn’t always linear, however; other factors can influence the market.

Historical Stock Market Performance During Economic Cycles

Historically, the stock market has demonstrated a tendency to perform well during periods of economic expansion. Expansions are characterized by increased consumer spending, business investment, and job creation, all of which fuel corporate profits and drive stock prices higher. Conversely, recessions, marked by a significant decline in economic activity, are often accompanied by a downturn in the stock market.

The severity of the market decline varies depending on the length and depth of the recession. For example, the 2008 financial crisis led to a sharp and prolonged decline in stock prices, while the recessions of the early 1980s and early 2000s resulted in shorter, albeit still significant, market corrections. It’s important to note that the stock market often anticipates economic downturns, beginning to decline before a recession is officially declared.

Geopolitical Events and Stock Market Volatility

Geopolitical events, such as wars, political instability, and international trade disputes, can significantly impact stock market volatility. Unexpected events often lead to increased uncertainty and risk aversion among investors, causing sharp price swings. For example, the Russian invasion of Ukraine in 2022 triggered significant market volatility, as investors reacted to the uncertainty surrounding the conflict and its potential economic consequences.

Similarly, the 9/11 terrorist attacks led to a temporary but substantial market crash. Conversely, positive geopolitical developments, such as the signing of a major trade agreement, can have a positive effect on market sentiment and lead to price increases. These events highlight the importance of monitoring global news and understanding its potential impact on investment portfolios.

Asset Class Performance Comparison During Different Market Conditions

The following table illustrates the general performance of different asset classes (stocks, bonds, and real estate) under various market conditions. It’s important to remember that past performance is not indicative of future results, and individual asset performance can vary significantly.

| Market Condition | Stocks | Bonds | Real Estate |

|---|---|---|---|

| Economic Expansion | Generally High Returns | Moderate Returns | Moderate to High Returns |

| Recession | Generally Low or Negative Returns | Generally Positive Returns (safe haven) | Variable, can decline significantly depending on the severity of the recession. |

| High Inflation | Variable, potential for high returns if inflation is anticipated and priced in, otherwise negative returns | Generally Low Returns | Can see increased returns if rents can be adjusted to match inflation |

| Low Inflation/Deflation | Generally positive returns | Generally positive returns | Generally positive returns, although appreciation may be slow |

Analyzing Trading Volume and Volatility

Understanding trading volume and volatility is crucial for navigating the stock market effectively. These two factors provide valuable insights into market sentiment and potential price movements, allowing traders to make more informed decisions and manage risk more effectively. By analyzing these elements alongside price action, traders can identify potential opportunities and avoid pitfalls.Trading volume reveals the number of shares traded within a specific period.

High volume often accompanies significant price movements, suggesting strong conviction behind the price change, whether upward or downward. Conversely, low volume during price movements might indicate a lack of conviction and potential for a price reversal. For example, a sharp price increase on high volume suggests a strong bullish sentiment, whereas a similar increase on low volume could signal a weak move susceptible to reversal.

Volume and Market Sentiment

High trading volume alongside a rising price typically signifies strong buying pressure and bullish sentiment. Investors are actively purchasing the asset, driving the price higher. Conversely, high volume accompanying a falling price indicates strong selling pressure and bearish sentiment, with investors actively liquidating their positions. Low volume during periods of sideways price movement suggests a lack of conviction in either direction, potentially indicating consolidation before a future breakout.

A significant increase in volume without a corresponding significant price movement can signal a change in market sentiment, potentially foreshadowing a future price surge or drop.

Volatility and Risk Management

High volatility periods, characterized by large price swings in short timeframes, present both opportunities and challenges. While these periods offer the potential for significant profits, they also significantly increase the risk of substantial losses. Effective risk management strategies are essential during high volatility. This includes using stop-loss orders to limit potential losses, diversifying your portfolio to reduce exposure to any single asset, and carefully sizing your positions to avoid over-exposure.

For example, during periods of heightened market uncertainty, like geopolitical events or economic crises, volatility tends to increase, requiring more cautious trading strategies.

Technical Indicators: RSI and Bollinger Bands

Technical indicators like the Relative Strength Index (RSI) and Bollinger Bands can help identify optimal entry and exit points by analyzing price and volume data. The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 often suggest an overbought market, potentially signaling a price reversal, while readings below 30 suggest an oversold market, potentially indicating a price bounce.

Bollinger Bands plot standard deviations around a moving average, highlighting price volatility. Price movements outside the bands can indicate significant price changes, potentially representing buying or selling opportunities. For example, a stock price breaking above the upper Bollinger Band on high volume could signal a strong bullish breakout.

Volume, Volatility, and Price: A Visual Representation

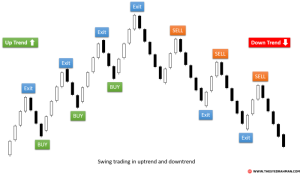

Imagine a graph with three lines: one for price, one for volume, and one for volatility (measured, for instance, by the average true range). During a strong uptrend, the price line would be rising steadily. The volume line would show high values, confirming the strength of the uptrend. The volatility line might be relatively high initially, then decrease as the trend establishes itself, indicating a more stable upward movement.

Conversely, during a sharp downturn, the price line would fall rapidly, the volume line would be high reflecting the selling pressure, and the volatility line would be elevated, reflecting the significant price swings. Periods of low volatility would show a relatively flat price line, low volume, and a low volatility line, representing market consolidation or sideways trading. The interaction of these three lines offers a comprehensive picture of market dynamics.

The Role of Time Zones and Global Events

The global nature of the stock market means that trading opportunities and price movements are significantly influenced by the opening and closing times of different exchanges around the world, as well as by major news events occurring in various time zones. Understanding these influences is crucial for developing effective trading strategies. This section will explore the interplay between global events, time zones, and stock market dynamics.Global markets operate on staggered schedules.

This creates a ripple effect; news impacting one market can quickly spread to others, causing correlated price movements. For example, a significant economic announcement in Asia during its trading hours might influence pre-market trading in Europe and later affect the opening bell in North America. Conversely, a major event in North America could significantly impact Asian markets the following day.

This interconnectedness demands a comprehensive understanding of global market timings and news cycles.

The Influence of Global Market Opening and Closing Times

Different global markets open and close at various times, creating a continuous trading cycle across the globe. The overlapping trading hours between major markets, such as the US and Europe, can provide opportunities for arbitrage or to capitalize on price discrepancies. However, the periods when only one major market is open, such as the early morning hours in North America before the European markets open, often present reduced liquidity and increased volatility.

Traders need to be aware of these variations in liquidity and volatility when formulating their trading plans. For example, a trader might choose to avoid making significant trades during the pre-market hours in New York, due to the thinner trading volume.

The Impact of News Events Across Time Zones

News events, ranging from economic data releases (like the US Non-Farm Payroll report or the European Central Bank interest rate decisions) to geopolitical announcements (such as unexpected political changes or international conflicts), can have immediate and significant effects on stock prices. The impact often depends on the perceived relevance of the news to specific sectors or companies. A positive economic report in the US might boost the Dow Jones Industrial Average, while a negative geopolitical development in the Middle East might negatively impact energy stocks globally.

The time zone in which the news breaks initially influences the immediate market reaction, but the ripple effect can continue across other markets as they open and react to the news.

Overnight Gaps and Trading Strategies

Overnight gaps refer to the price difference between the closing price of a stock at the end of one trading day and its opening price the next day. These gaps often occur due to news events that unfold outside of regular trading hours. For instance, a significant earnings announcement released after the market closes in the US will likely cause a gap up or down when the market reopens.

Traders must consider these gaps when developing their strategies. A large overnight gap can signal a significant shift in market sentiment, requiring a re-evaluation of trading positions. Conservative strategies might involve waiting for the market to consolidate after a large gap before entering or exiting positions.

Significant Global Events and Their Potential Effects on Stock Markets

Understanding the potential impact of significant global events is crucial for informed trading decisions.The following table provides examples:

| Event Type | Specific Example | Potential Market Impact |

|---|---|---|

| Economic Reports | US Non-Farm Payroll Report | Significant impact on the US dollar, interest rates, and overall market sentiment. Positive data generally leads to market increases; negative data, to decreases. |

| Central Bank Announcements | Federal Reserve interest rate decision | Affects interest rates, borrowing costs, and investor expectations for economic growth. Changes in interest rates can influence bond yields and stock valuations. |

| Geopolitical Events | International conflict or political instability | Can cause significant volatility and uncertainty, leading to market declines, especially in sectors directly impacted by the event (e.g., energy sector during a Middle East conflict). |

| Company-Specific News | Major earnings announcement | Can cause significant price swings, depending on whether the results surpass or disappoint market expectations. |

Stock Market Fundamentals and Sectoral Trends

Understanding a company’s financial health and the broader economic landscape is crucial for successful stock trading. Ignoring these factors can lead to significant losses, while a solid grasp of fundamentals can improve investment decisions and potentially boost returns. This section will explore the importance of fundamental analysis and sectoral trends in the context of stock market trading.Analyzing a company’s financial statements is paramount before investing.

These statements provide a detailed picture of the company’s financial performance and position.

Company Financial Statement Analysis

The income statement reveals a company’s profitability over a period. Key metrics like revenue, cost of goods sold, operating expenses, and net income offer insights into its revenue generation and expense management. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Analyzing the balance sheet helps assess the company’s financial strength and its ability to meet its obligations.

Finally, the cash flow statement tracks the movement of cash both into and out of the company. It’s crucial for understanding a company’s liquidity and its ability to generate cash from its operations. By carefully reviewing these three statements, investors can gain a comprehensive understanding of a company’s financial health, identify potential risks, and assess its future prospects.

For example, a consistently increasing net income coupled with strong cash flow from operations suggests a healthy and growing company, potentially making its stock a worthwhile investment. Conversely, declining revenues and high debt levels might signal financial distress.

Industry Trends and Technological Advancements

Industry trends and technological advancements significantly impact the performance of specific sectors. Rapid technological change can disrupt established industries, creating both opportunities and threats for companies within those sectors. For instance, the rise of e-commerce has dramatically altered the retail landscape, benefiting online retailers while challenging traditional brick-and-mortar stores. Similarly, advancements in renewable energy technologies are reshaping the energy sector, favoring companies involved in solar, wind, and other sustainable energy solutions.

Understanding these trends allows investors to identify promising sectors and companies poised for growth, while avoiding those facing obsolescence.

Sectoral Investment Potential Across Economic Stages

Different market sectors exhibit varying levels of investment potential depending on the stage of the economic cycle. During economic expansions, technology and consumer discretionary sectors often outperform, fueled by increased consumer spending and investment in innovation. The healthcare sector generally demonstrates relative stability throughout various economic cycles due to the consistent demand for healthcare services. Conversely, during economic downturns, defensive sectors like utilities and consumer staples tend to perform better, as these companies provide essential goods and services that are less sensitive to economic fluctuations.

The energy sector’s performance is heavily influenced by global events and commodity prices, making it more volatile than other sectors. For example, during periods of high oil prices, energy companies tend to thrive, while low prices can lead to significant losses.

Key Factors in Evaluating a Company’s Stock Price

Understanding the factors that influence a company’s stock price is essential for informed investment decisions.

- Earnings per share (EPS): Indicates a company’s profitability on a per-share basis.

- Price-to-earnings ratio (P/E): Compares a company’s stock price to its earnings per share, providing insights into its valuation relative to its peers.

- Debt-to-equity ratio: Measures a company’s financial leverage and its ability to meet its obligations.

- Revenue growth: Reflects the company’s ability to generate sales and expand its market share.

- Industry trends and competition: Assesses the company’s position within its industry and its competitive landscape.

- Management quality: Evaluates the competence and experience of the company’s leadership team.

- Economic conditions: Considers the overall macroeconomic environment and its potential impact on the company’s performance.

Successfully navigating the stock market requires a holistic approach that blends technical analysis, fundamental understanding, and emotional intelligence. While pinpointing the single “best” time is elusive, mastering the concepts Artikeld in this guide – from understanding market cycles and global events to employing effective risk management strategies – significantly enhances your ability to identify opportune moments for trading. Remember, consistent learning, disciplined execution, and a long-term perspective are key to navigating the dynamic world of stock trading and achieving your financial goals.

Essential Questionnaire

What is the impact of news events on stock prices?

News events, both positive and negative, can significantly impact stock prices. Unexpected events often lead to increased volatility and price swings. Positive news generally drives prices up, while negative news often pushes prices down.

How can I manage risk when trading stocks?

Risk management involves diversifying your portfolio, setting stop-loss orders to limit potential losses, and only investing an amount you can afford to lose. Thorough research and understanding your risk tolerance are also crucial.

What are some common trading biases to avoid?

Common biases include confirmation bias (seeking information confirming pre-existing beliefs), overconfidence bias (overestimating your abilities), and herd mentality (following the crowd without independent analysis). Maintaining objectivity and relying on data are key to mitigating these biases.

Should I use a day trading or long-term investment strategy?

The best strategy depends on your risk tolerance, time commitment, and financial goals. Day trading involves frequent buying and selling, while long-term investing focuses on holding assets for extended periods. Consider your personal circumstances before choosing a strategy.