Understanding stock market trading hours is crucial for anyone involved in global finance. These hours, which vary significantly across different exchanges worldwide, directly impact investment strategies, transaction execution, and overall portfolio management. From the bustling New York Stock Exchange to the dynamic markets of Asia, the timing of trading significantly affects both individual investors and large multinational corporations.

This exploration delves into the intricacies of these trading hours, examining their global variations, the implications for international trading, and the strategies employed to navigate this complex landscape.

We will examine the regular trading sessions of major exchanges, including the impact of after-hours trading and the challenges posed by holidays and time zone differences. We’ll also look at how technological advancements have influenced access to these markets and how various trading strategies are tailored to specific trading windows. Finally, we will explore the differences between trading stocks and stock options, and how understanding trading hours enhances risk management and maximizes investment opportunities.

US Stock Market Trading Hours and After-Hours Trading

The US stock market operates on a specific schedule, impacting when investors can buy and sell securities. Understanding these trading hours, particularly the distinction between regular and after-hours sessions, is crucial for informed investment decisions. This section will detail the regular trading hours of major exchanges and explore the characteristics of after-hours trading.

Regular Trading Hours of NYSE and Nasdaq

The New York Stock Exchange (NYSE) and the Nasdaq Stock Market, the two largest stock exchanges in the United States, maintain largely synchronized regular trading hours. Both exchanges open at 9:30 AM Eastern Time (ET) and close at 4:00 PM ET, Monday through Friday, excluding federal holidays. This six-and-a-half-hour window represents the core trading period for the majority of US-listed equities.

Consistent trading hours provide a predictable framework for market participants.

After-Hours Trading

After-hours trading refers to the trading sessions that occur outside the regular market hours, typically from 4:00 PM ET to 8:00 PM ET. This extended trading period allows investors to buy or sell stocks outside the main trading session. While providing additional flexibility, it’s important to note that after-hours trading generally features lower liquidity and higher price volatility than the regular trading session.

This is because fewer market makers participate, leading to wider bid-ask spreads and potentially more significant price fluctuations.

Liquidity and Price Volatility Comparison

Liquidity, the ease with which an asset can be bought or sold without significantly impacting its price, is considerably higher during regular trading hours. The presence of numerous market makers and high trading volume ensures that orders are executed quickly and efficiently. In contrast, after-hours trading often exhibits lower liquidity due to reduced participation. This can result in larger price discrepancies between the bid and ask prices and greater susceptibility to price manipulation by relatively small trades.

Price volatility, the rate at which prices fluctuate, is also generally higher during after-hours trading. The lower liquidity amplifies the impact of individual trades, leading to more pronounced price swings. For example, a large buy order in after-hours trading could significantly increase the price, while the same order during regular hours might have a more muted effect.

Typical Trading Day Sequence

The following flowchart illustrates the sequence of events in a typical trading day, including pre-market and after-hours sessions.[Diagram Description: A flowchart showing three main sections: Pre-Market (4:00 AM ET – 9:30 AM ET), Regular Trading Hours (9:30 AM ET – 4:00 PM ET), and After-Hours (4:00 PM ET – 8:00 PM ET). Arrows connect these sections indicating the flow of the trading day.

Each section could have sub-boxes detailing activities such as order placement, price discovery, and trade execution. The pre-market and after-hours sections are visually smaller than the regular trading hours section to represent the reduced trading volume and liquidity.]

Impact of Holidays on Stock Market Trading Hours

US stock market holidays significantly impact trading activity and present unique challenges for investors and traders. Understanding these impacts and implementing appropriate strategies is crucial for navigating the market effectively during these periods. The reduced trading hours or complete closures affect both trading volume and price volatility, requiring careful consideration of risk management.

Major US Holidays Affecting Stock Market Trading Hours

The following holidays typically result in either a shortened trading day or a complete closure of the major US stock exchanges, including the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. These closures are pre-announced well in advance, allowing traders time to adjust their strategies.

- New Year’s Day

- Martin Luther King, Jr. Day

- Presidents’ Day

- Good Friday

- Memorial Day

- Juneteenth National Independence Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

Holiday Impact on Trading Volume and Price Movements

On holidays, trading volume generally decreases substantially, sometimes to a fraction of normal levels. This reduced liquidity can lead to increased price volatility, as fewer trades mean that even small orders can have a disproportionate impact on prices. The price movements observed before and after holidays are often influenced by the accumulation of news and events during the closure period.

For example, a significant geopolitical event occurring during a holiday weekend might lead to sharp price changes at the market’s reopening.

Strategies to Mitigate Holiday-Related Market Risks

Several strategies can help traders mitigate the risks associated with holiday-related market closures. These strategies often involve adjusting trading positions before the holiday period, carefully monitoring news and global market events during the closure, and being prepared for potentially increased volatility upon the market’s reopening. For example, a trader might reduce their overall market exposure before a major holiday to limit potential losses due to unforeseen events.

They might also set stop-loss orders to automatically limit losses if prices move unexpectedly against their positions.

Exchange-Specific Holiday Closure Handling

While the major US stock exchanges generally observe the same holidays, there can be slight variations in their specific handling of closures, particularly concerning extended trading hours. It is important for traders to consult the specific rules and guidelines of each exchange they utilize to ensure compliance and avoid unexpected consequences. Differences might include the precise timing of closures and the availability of after-hours trading during periods surrounding holidays.

This information is typically available on the respective exchange websites.

Stock Options Trading Hours

Stock options, derivative instruments granting the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date), trade on regulated exchanges. Their trading hours are closely tied to the trading hours of the underlying asset, but with some subtle differences.Options contracts generally trade during the same hours as the underlying stock, mirroring the regular trading session of major US exchanges like the NYSE and Nasdaq.

This means the core trading hours typically align with 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays. However, the precise opening and closing times can vary slightly depending on the specific exchange and the option contract itself. It’s crucial to check with your broker for the most up-to-date information.

Trading Volume and Volatility Comparison

Options contracts often exhibit higher volatility than their underlying stocks. This increased volatility stems from the leveraged nature of options, where relatively small price movements in the underlying asset can lead to significant percentage changes in option prices. Trading volume in options can also be substantially higher than the underlying stock’s volume, particularly for popular or heavily traded stocks, as options offer diverse trading strategies and increased liquidity.

For example, a heavily traded stock like Apple (AAPL) will see far greater option contract volume than shares of the underlying stock traded on a given day. This increased activity reflects the use of options for hedging, speculation, and income generation.

Risk and Reward Comparison

Trading stock options presents both amplified risks and rewards compared to trading the underlying stock. The limited risk associated with options (in the case of buying puts or calls) is often contrasted by the potential for substantial gains or losses in a shorter time frame. Conversely, buying shares of a stock involves unlimited potential for losses (though theoretically capped at zero for the stock itself), but offers potentially slower, steadier growth over time.

The inherent leverage of options magnifies both profits and losses, making risk management crucial. For instance, a call option purchased at a low price could generate a substantial return if the underlying stock’s price rises significantly. However, if the price remains flat or falls, the option could expire worthless, leading to a total loss of the premium paid.

Hedging Market Risk with Options

Options contracts provide effective tools for hedging against market risk. Hedging strategies aim to mitigate potential losses from adverse price movements. For example, a company holding a large quantity of a particular stock could buy put options on that stock. These options would provide a safety net if the stock’s price were to fall, limiting the company’s potential losses.

Similarly, an investor anticipating a market downturn might use put options to protect a portfolio from declines. Conversely, investors who believe a stock price will rise can buy call options. These calls can offset losses on a long position in the same stock if the price does not rise as expected. This ability to tailor hedging strategies to specific risk profiles makes options valuable tools for sophisticated investors.

Stock Trading Strategies and Trading Hours

Understanding the nuances of stock market trading hours is crucial for successful trading. Different trading strategies are significantly impacted by the specific times the market is open, influencing entry and exit points, risk management, and overall profitability. The knowledge of trading hours isn’t just about knowing when to buy and sell; it’s a fundamental aspect of strategic planning and execution.

Day Trading and Trading Hours

Day trading, characterized by holding positions for short periods (often within the same trading day), is heavily reliant on market timing and intraday price fluctuations. Traders leverage the entire trading session to capitalize on short-term price movements. The market open and close often present unique opportunities. For instance, the opening bell frequently sees significant volatility, creating opportunities for quick trades based on early price action.

Conversely, the closing bell can also present opportunities as traders adjust positions before the market closes. Day traders must meticulously manage their positions throughout the trading day, accounting for potential gaps or sudden price swings that can occur during periods of low liquidity, often seen outside of core trading hours.

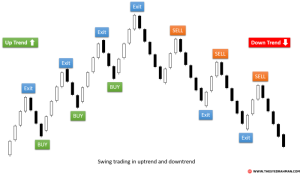

Swing Trading and Trading Hours

Swing trading involves holding positions for several days or even weeks, aiming to profit from larger price swings. While not as time-sensitive as day trading, swing trading still benefits from understanding trading hours. Traders may use the market open to establish positions, taking advantage of potential price gaps or increased liquidity. They might also use the market close to evaluate the day’s price action and adjust their positions accordingly.

However, swing traders are less concerned with intraday fluctuations and more focused on the overall trend, utilizing trading hours primarily to monitor their positions and react to significant market events.

The Role of Market Open and Close in Trading Strategies

The market open and close are pivotal moments for many trading strategies. The open often features heightened volatility as traders react to overnight news and adjust positions. This volatility can present both opportunities and risks. The close can also be volatile as traders square off positions before the market closes, potentially creating price swings. Some strategies specifically target these periods for entry and exit, while others may avoid them due to increased risk.

For example, a scalping strategy might focus exclusively on the opening and closing minutes to capitalize on quick price movements, while a longer-term position trader may choose to enter a position at the open and exit at a more favorable point later in the day, or even over several days.

Risk Management and Trading Hours

Knowledge of trading hours is integral to effective risk management. By understanding the periods of higher and lower liquidity, traders can adjust their trading styles and position sizes accordingly. For example, during periods of low liquidity (often outside of regular trading hours or during extended holidays), traders may choose to reduce their position sizes to limit potential losses from sudden price gaps or slippage.

Similarly, awareness of the increased volatility during market opens and closes allows traders to set appropriate stop-loss orders and manage their risk exposure more effectively. Understanding these nuances prevents impulsive decisions driven by emotional responses to price swings during periods of heightened volatility.

Technology and Stock Market Trading Hours

Technological advancements have revolutionized the way we interact with the stock market, significantly impacting access and trading activity across different hours. The integration of technology has blurred the traditional boundaries of trading hours, extending opportunities and presenting new challenges for investors and market makers alike.Electronic trading platforms have been instrumental in this transformation. These platforms offer 24/7 access to global markets, albeit with varying liquidity depending on the specific exchange and time zone.

This increased accessibility has democratized investing, allowing individuals to participate regardless of their geographical location or the traditional limitations of physical exchanges. Moreover, the speed and efficiency of electronic platforms have facilitated the growth of high-frequency trading and algorithmic trading strategies, significantly influencing market dynamics.

Electronic Trading Platforms and Extended Trading Hours

Electronic trading platforms have dramatically expanded access to stock markets beyond traditional trading hours. Before the widespread adoption of these platforms, trading was largely confined to the physical exchange’s operating hours. Now, investors can place orders and monitor their portfolios at any time, although the execution of those orders and the availability of liquidity will vary significantly depending on the time of day and the specific market.

For example, while the NYSE may be closed, a trader can still potentially execute trades on other exchanges in different time zones through an electronic platform. This expanded access has also led to increased participation from international investors, fostering a more globalized and interconnected market.

High-Frequency Trading and Market Liquidity

High-frequency trading (HFT) firms utilize sophisticated algorithms and powerful computer systems to execute a large volume of trades at extremely high speeds. These firms play a significant role in providing liquidity during various trading hours. During regular trading hours, HFT algorithms contribute to the overall depth and efficiency of the market. However, their impact is not uniform across all trading hours.

For instance, liquidity might be relatively lower during pre-market and after-hours sessions, meaning that the contribution of HFT firms in these periods may be less significant compared to their role during regular trading hours. The speed at which HFT algorithms can react to market changes allows them to quickly absorb and provide liquidity, though the overall effect on market stability is a subject of ongoing debate.

Algorithmic Trading Strategies and Trading Hour Constraints

Algorithmic trading strategies, encompassing a broad range of automated trading systems, are inherently affected by trading hour constraints. These strategies often rely on specific market conditions and data availability, which may differ significantly across trading hours. For instance, some algorithms might be designed to exploit price discrepancies that arise between the close of one trading session and the opening of the next.

Others might focus on exploiting intraday volatility during regular trading hours. The constraints imposed by trading hours influence the design and performance of these algorithms, as they need to be programmed to account for periods of inactivity or reduced liquidity outside of regular trading sessions. A strategy designed to capitalize on high-volume trading might perform poorly during pre-market or after-hours sessions, when trading volume is significantly lower.

Stock Market, Stock Options, and Stock Trading Overview

The stock market, stock options, and stock trading are interconnected concepts fundamental to modern finance. Understanding their relationships is crucial for anyone involved in or considering investment in the financial markets. This overview clarifies each term and explores their interdependencies.

The stock market is a public exchange where shares of publicly traded companies are bought and sold. It facilitates the trading of these shares, allowing investors to buy a portion of ownership in a company. This buying and selling activity determines the price of a stock, reflecting investor sentiment and the perceived value of the underlying company. Different stock markets exist globally, with the New York Stock Exchange (NYSE) and Nasdaq being prominent examples in the United States.

Stock trading is the act of buying and selling stocks within the stock market. Traders engage in this activity aiming to profit from price fluctuations. This can involve short-term speculation (day trading) or longer-term investment strategies based on fundamental analysis or technical analysis. Stock trading requires understanding market dynamics, risk management, and various trading strategies.

Stock options are derivative financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying stock at a predetermined price (strike price) on or before a specific date (expiration date). They are contracts, and their value is derived from the price movements of the underlying stock. Options trading provides leveraged exposure to price movements, allowing traders to control a larger position with a smaller initial investment compared to directly buying or selling shares.

This leverage, however, also amplifies potential losses.

Stock Market, Stock Options, and Stock Trading Interdependencies

The stock market provides the platform for stock trading and the underlying asset for stock options. Stock options’ value is directly tied to the price of stocks traded in the stock market. Stock trading utilizes the stock market’s infrastructure, while options trading leverages the price fluctuations within the stock market to generate profits. Essentially, stock options are a specialized form of stock trading that introduces leverage and added complexity.

Comparison of Stock Investing and Stock Options Trading

The following table highlights the key differences and similarities between investing in stocks and trading stock options:

| Feature | Investing in Stocks | Trading Stock Options |

|---|---|---|

| Risk | Limited to the initial investment | Potentially unlimited (for uncovered options) |

| Potential Return | Potentially unlimited (long-term growth) | Potentially unlimited (leveraged returns), but also potentially significant losses |

| Initial Investment | Requires the full purchase price of the stock | Requires a smaller initial investment (premium) |

| Time Horizon | Typically long-term | Can range from short-term to long-term |

| Complexity | Relatively simple | More complex, requiring understanding of options strategies |

| Leverage | No leverage | High leverage |

Stock Trading Strategies Utilizing Stock Options

Several trading strategies utilize stock options to manage risk, generate income, or speculate on price movements. Here are a few examples:

Covered Call Writing: An investor who owns shares of a stock might sell call options on those shares. This generates income from the option premium, but limits potential upside gains if the stock price rises significantly above the strike price. This strategy is often employed for income generation and risk reduction.

Protective Put Buying: An investor who owns shares of a stock might buy put options as insurance against potential price declines. The put option provides a floor price, limiting potential losses if the stock price falls below the strike price. This strategy protects against downside risk.

Straddle: This strategy involves simultaneously buying a call option and a put option with the same strike price and expiration date. This strategy profits if the stock price moves significantly in either direction (up or down) from the strike price, but loses if the price remains relatively stable.

Strangle: Similar to a straddle, but the call and put options have different strike prices. The put option has a lower strike price, and the call option has a higher strike price. This strategy profits if the stock price moves significantly above the call’s strike price or below the put’s strike price.

Mastering the complexities of global stock market trading hours is key to successful investing. By understanding the nuances of time zones, holiday closures, and the specific operating hours of various exchanges, investors can optimize their trading strategies, mitigate risks, and potentially improve returns. Whether you’re a seasoned professional or a novice investor, a thorough grasp of these trading hours provides a significant competitive edge in today’s dynamic global marketplace.

Remember to always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Answers to Common Questions

What happens if I place an order outside of regular trading hours?

Orders placed outside regular hours are typically executed at the start of the next trading session, unless specified as a limit order with a specific price and time condition.

How do extended-hours trading volumes compare to regular hours?

Extended-hours trading generally sees lower volume than regular trading hours, leading to potentially wider spreads and greater price volatility.

Are there any specific risks associated with after-hours trading?

Yes, the reduced liquidity and increased volatility during after-hours trading can lead to larger price discrepancies and increased risk of slippage when executing orders.

How do I find the trading hours for a specific foreign exchange?

You can typically find this information on the official website of the specific stock exchange or through reputable financial news sources.