Swing trading, a dynamic approach to the market, offers a compelling middle ground between the rapid-fire decisions of day trading and the long-term horizons of buy-and-hold investing. It involves holding assets for several days or weeks, capitalizing on price swings driven by market trends and technical patterns. This strategy allows for a balance between active participation and reduced time commitment, making it an attractive option for a range of investors.

This guide delves into the core principles of swing trading, equipping you with the knowledge to identify profitable opportunities, manage risk effectively, and develop a personalized trading plan. We’ll explore various technical indicators, candlestick patterns, and risk management techniques, comparing and contrasting different strategies to help you navigate the complexities of the market and achieve your investment goals. We will also touch upon the psychological aspects of trading and the importance of discipline in maintaining a successful approach.

Introduction to Swing Trading Strategies

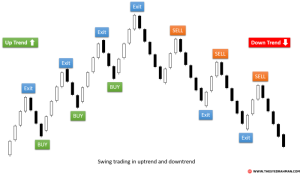

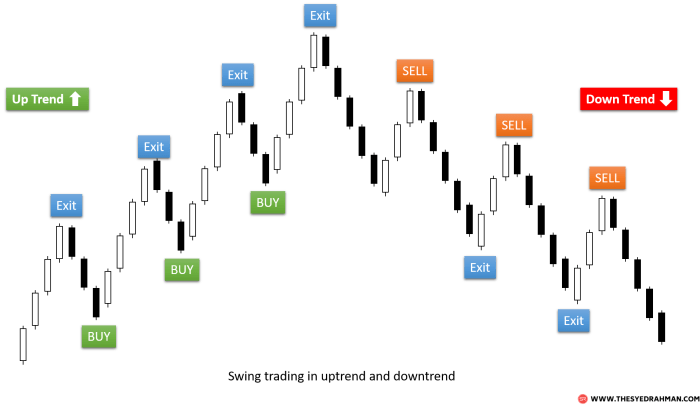

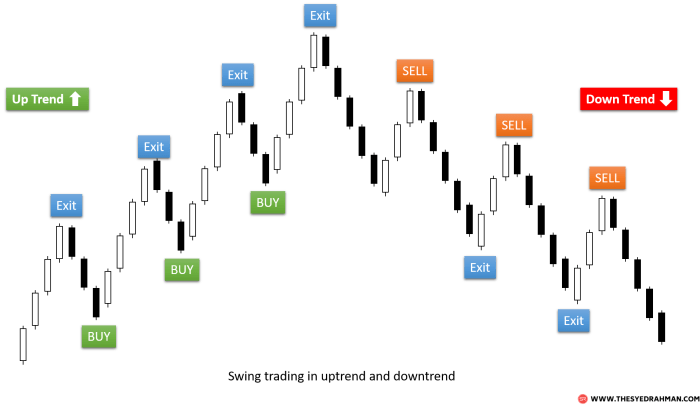

Swing trading is a style of trading that aims to capitalize on price fluctuations within a relatively short time frame, typically lasting from a few days to several weeks. Unlike day trading, which involves holding positions for only a few hours or even minutes, swing traders hold their positions overnight, taking advantage of larger price swings that often occur over several days.

This contrasts with long-term investing, where the investment horizon spans months or even years.Swing trading strategies hinge on identifying and exploiting intermediate-term price trends. Traders utilize technical analysis, fundamental analysis, or a combination of both, to pinpoint potential entry and exit points. The goal is to profit from the upward or downward movement of an asset’s price within a defined swing.

This requires a keen understanding of market dynamics, risk management, and disciplined execution.

Swing Trading Compared to Day Trading and Long-Term Investing

Swing trading occupies a middle ground between the short-term focus of day trading and the long-term perspective of buy-and-hold investing. Day trading demands constant monitoring and quick decision-making, often requiring specialized software and a high tolerance for risk. Long-term investing prioritizes steady growth over short-term gains, with investors often holding assets for years, weathering market fluctuations. Swing trading, however, offers a balance, allowing traders to capture significant price movements while requiring less constant attention than day trading.

For example, a day trader might buy and sell Apple stock multiple times in a single day, reacting to intraday price changes. A swing trader, on the other hand, might buy Apple stock anticipating a price increase over the next week or two, based on anticipated earnings announcements or other market events. A long-term investor, however, might hold Apple stock for several years, focused on its long-term growth potential.

Advantages of Swing Trading Strategies

Swing trading offers several compelling advantages. It requires less time commitment than day trading, allowing traders to balance their trading activities with other responsibilities. The extended holding periods reduce the impact of short-term market noise, leading to potentially greater gains than day trading. Furthermore, swing trading can be less stressful than day trading due to the reduced need for constant monitoring.

The potential for significant profits from substantial price swings is also a major draw. For instance, a successful swing trade on a volatile stock could yield a much higher return than a series of small gains from day trading.

Disadvantages of Swing Trading Strategies

Despite its advantages, swing trading also presents challenges. The risk of overnight gaps, where the price significantly changes between the closing and opening prices, is a considerable factor. Holding positions overnight exposes traders to unforeseen events, such as news announcements or market corrections, that could negatively impact their trades. Additionally, while requiring less time than day trading, swing trading still demands consistent monitoring and analysis to manage risk effectively.

Finally, accurately predicting the duration and magnitude of a price swing is inherently difficult, making consistent profitability a challenge. For example, an unexpected negative news report could cause a sharp price drop, resulting in a loss even if the overall trend was initially positive.

Identifying Swing Trading Opportunities

Swing trading aims to capitalize on price movements over a few days to several weeks. Successfully identifying these opportunities requires a blend of technical analysis, candlestick pattern recognition, and, to a lesser extent, fundamental analysis. This section details the key elements involved in pinpointing profitable swing trades.

Technical Indicators for Swing Trading

Several technical indicators can help filter potential swing trading setups. These indicators provide signals based on price and volume data, helping traders identify potential entry and exit points. While no indicator is perfect, combining several can significantly improve accuracy.

Candlestick Patterns for Entry and Exit Points

Candlestick patterns offer visual representations of price action, providing valuable clues about market sentiment and potential reversals. Recognizing these patterns can significantly improve a trader’s ability to time entries and exits. For instance, a bullish engulfing pattern might signal a potential upward swing, while a bearish harami could indicate a potential price reversal. Successful use of candlestick patterns requires practice and understanding of context within the broader market trend.

Fundamental Analysis in Swing Trading

While technical analysis forms the core of swing trading, fundamental analysis plays a supporting role. Understanding a company’s financial health, industry trends, and overall economic climate can provide context and help validate technical signals. For example, a strong earnings report might support a bullish technical setup, increasing the probability of a successful swing trade. Conversely, negative news could invalidate a bullish technical signal, prompting a trader to reconsider their entry.

Comparison of Technical Indicators

The following table compares four commonly used technical indicators for swing trading, highlighting their strengths and weaknesses. Remember that indicator selection should align with your trading style and risk tolerance.

| Indicator | Strengths | Weaknesses | Example Application |

|---|---|---|---|

| Relative Strength Index (RSI) | Identifies overbought and oversold conditions; useful for identifying potential reversals. | Can generate false signals; prone to whipsaws in sideways markets. | An RSI reading above 70 might suggest an overbought condition, signaling a potential pullback, while a reading below 30 could indicate an oversold condition, hinting at a potential bounce. |

| Moving Average Convergence Divergence (MACD) | Identifies momentum changes; useful for confirming trends and identifying potential crossovers. | Can lag behind price movements; susceptible to false signals in choppy markets. | A bullish crossover (MACD line crossing above the signal line) can signal a potential uptrend, while a bearish crossover can indicate a potential downtrend. |

| Bollinger Bands | Shows price volatility; identifies potential overbought and oversold conditions; can help identify breakout opportunities. | Can generate false signals; effectiveness depends on market volatility. | Price bounces off the lower Bollinger Band might signal a buying opportunity, while a breakout above the upper band could indicate a strong uptrend. |

| Stochastic Oscillator | Identifies overbought and oversold conditions; useful for identifying potential reversals and momentum shifts. | Prone to whipsaws; can generate false signals in sideways markets. | Similar to RSI, readings above 80 might suggest an overbought condition, while readings below 20 could indicate an oversold condition. |

Popular Swing Trading Strategies

Swing trading encompasses various approaches, each with its strengths and weaknesses. Understanding these differences is crucial for selecting a strategy aligned with your trading style and risk tolerance. This section will explore three popular swing trading strategies, comparing their methodologies and highlighting their advantages and disadvantages.

Moving Average Crossover Strategy

The moving average crossover strategy utilizes two or more moving averages (MAs) of different periods to identify potential entry and exit points. A common setup involves a short-term MA (e.g., 10-day MA) crossing above a long-term MA (e.g., 50-day MA) as a buy signal, and the reverse as a sell signal. The premise is that the shorter MA reacts more quickly to price changes, signaling shifts in momentum.

| Feature | Advantages | Disadvantages | Example |

|---|---|---|---|

| Two or more moving averages | Relatively simple to understand and implement; visually clear signals on charts. | Lagging indicator; prone to whipsaws (false signals) in choppy markets; requires careful selection of MA periods. | A 10-day MA crossing above a 50-day MA could be interpreted as a buy signal. A subsequent cross below the 50-day MA might trigger a sell signal. The trader would look for confirmation with price action and volume before executing trades. |

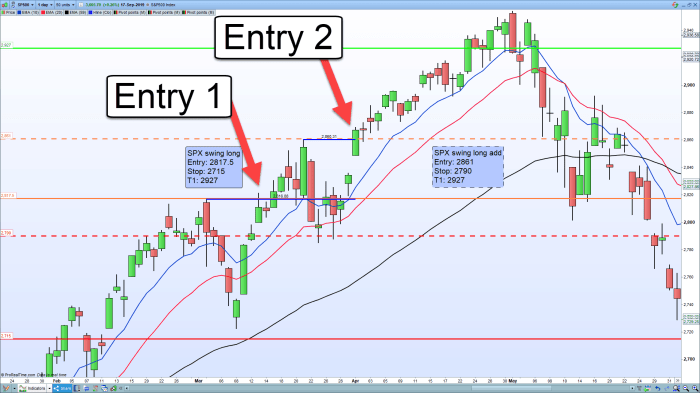

Support and Resistance Trading Strategy

This strategy focuses on identifying price levels where past price action has shown significant support (a price floor) or resistance (a price ceiling). Traders anticipate that these levels will continue to influence price movement, providing potential entry and exit points. Support levels are where buying pressure overcomes selling pressure, while resistance levels mark where selling pressure overwhelms buying pressure.

| Feature | Advantages | Disadvantages | Example |

|---|---|---|---|

| Identification of support and resistance levels | Provides clear entry and exit points; applicable across various markets and timeframes. | Subjective identification of support/resistance; breakouts can be false; requires careful observation of price action and volume. | If a stock consistently finds support at $50, a trader might buy near that level, anticipating a bounce. A break above a resistance level at $60 might signal a further price increase, providing an exit point or opportunity for a trailing stop-loss. |

Candlestick Pattern Trading Strategy

Candlestick patterns are visual representations of price action over a specific period, often revealing insights into market sentiment and potential price movements. Various candlestick patterns, such as bullish engulfing patterns (suggesting a price reversal to the upside) or bearish engulfing patterns (suggesting a price reversal to the downside), provide potential entry and exit signals. Confirmation with other indicators is usually advisable.

| Feature | Advantages | Disadvantages | Example |

|---|---|---|---|

| Interpretation of candlestick patterns | Provides visual clues about market sentiment and potential price reversals; can be combined with other strategies. | Subjective interpretation; requires experience and practice to identify reliable patterns; false signals are possible. | A bullish engulfing pattern, where a large green candle completely engulfs a preceding red candle, might signal a potential price reversal and a buy opportunity. A subsequent bearish engulfing pattern could indicate a potential sell opportunity. Volume confirmation is crucial in both scenarios. |

Swing Trading and Market Conditions

Swing trading strategies, while adaptable, are significantly influenced by prevailing market conditions. Understanding these conditions and adjusting your approach accordingly is crucial for success. Different market environments present unique opportunities and challenges, demanding a flexible and responsive trading plan.Market conditions broadly fall into three categories: bull markets, bear markets, and sideways (or ranging) markets. Each requires a distinct swing trading approach.

Volatility, a key factor influencing trading decisions, also varies across these market types and needs to be considered carefully.

Bull Market Swing Trading

Bull markets, characterized by sustained upward price trends, generally offer more opportunities for swing traders. The upward momentum allows for relatively straightforward identification of support and resistance levels, facilitating the selection of entry and exit points. However, even in bull markets, caution is necessary. Rapid price increases can lead to overbought conditions and potential corrections, requiring traders to manage risk effectively.

Successful swing trading in a bull market often involves identifying stocks that are outperforming the overall market, exhibiting strong relative strength. For example, during a strong bull market run in the tech sector, a swing trader might focus on identifying individual tech stocks showing exceptional growth potential, rather than trying to time the overall market top.

Bear Market Swing Trading

Bear markets, defined by sustained downward price trends, present a more challenging environment for swing traders. Identifying reliable support levels becomes crucial, as price declines can be swift and substantial. Short selling becomes a viable strategy in bear markets, but it requires a strong understanding of risk management, as losses can be magnified. The key is to identify stocks that are exhibiting relative strength within the declining market.

For instance, during a broader market downturn, a swing trader might find opportunities in defensive sectors like consumer staples or utilities, which often hold their value better than growth stocks during a bear market. The timing of entries and exits is critical, requiring a deep understanding of technical analysis and market sentiment.

Sideways Market Swing Trading

Sideways, or ranging, markets are characterized by price consolidation within a defined trading range. Swing trading in these markets focuses on identifying short-term price fluctuations within the range. Traders look for breakouts from the range or for price reversals at support and resistance levels. Volatility is often lower in sideways markets compared to bull or bear markets, resulting in smaller price swings and potentially lower profits.

However, the lower volatility can also mean lower risk. For example, a swing trader might focus on a stock trading between $50 and $60. They would look for opportunities to buy near $50 and sell near $60, capitalizing on the range-bound price action. Identifying accurate support and resistance levels is crucial in sideways markets.

Adapting to Volatility

Volatility significantly impacts swing trading strategies. High volatility markets, often seen during periods of economic uncertainty or geopolitical events, require more cautious and shorter-term trading approaches. Tight stop-loss orders are essential to limit potential losses. Conversely, low volatility markets may require longer holding periods to generate significant profits, necessitating patience and a focus on longer-term price trends.

Adjusting position sizing based on volatility is another key adaptation. In highly volatile markets, reducing position size minimizes risk. In low volatility markets, slightly larger positions might be considered, but always within the confines of a well-defined risk management plan.

Challenges in Specific Market Sectors

Swing trading in specific market sectors presents unique challenges. Highly volatile sectors like technology or biotech require a keen understanding of sector-specific news and events. Liquidity can be a concern in less liquid sectors, making it difficult to enter and exit positions efficiently. Regulatory changes or industry-specific developments can significantly impact price movements, requiring traders to stay informed about regulatory announcements and industry trends.

For instance, swing trading in the energy sector requires an understanding of global oil prices, geopolitical events, and government regulations. Similarly, trading in the healthcare sector requires knowledge of clinical trial results, FDA approvals, and competitive landscape.

Swing Trading and Stock Market Instruments

Swing trading, while often associated with individual stocks, is a versatile strategy applicable to a range of financial instruments. Its core principle – capitalizing on short-to-medium-term price fluctuations – remains consistent, though the specifics adapt to the unique characteristics of each instrument. This section explores the application of swing trading beyond stocks, focusing on options and highlighting key considerations for successful implementation across various market sectors.Swing trading strategies are not limited to equities.

Their adaptability extends to other instruments, each presenting a unique risk-reward profile. Understanding these nuances is crucial for effective portfolio management and maximizing profit potential. Careful consideration of factors such as volatility, liquidity, and transaction costs is paramount for success.

Swing Trading Stock Options

Swing trading stock options involves profiting from price movements within a relatively short timeframe, typically several days to a few weeks. Unlike outright stock ownership, options trading offers leverage, allowing traders to control a larger position with a smaller capital outlay. However, this leverage also magnifies potential losses. Successful swing trading with options requires a deep understanding of option pricing models, implied volatility, and time decay.

Traders often employ strategies like buying calls or puts to capitalize on anticipated price movements, or utilize more complex strategies like spreads to manage risk and enhance profitability. For example, a trader might buy a call option on a stock anticipating a price increase, aiming to sell it before expiration at a higher price to profit from the difference.

Conversely, a put option could be used to profit from a price decline. The choice of strategy will depend heavily on the trader’s market outlook and risk tolerance.

Considerations for Swing Trading Stocks

Several factors influence the success of swing trading stocks. Firstly, identifying suitable stocks is critical. Stocks with high liquidity and moderate volatility are generally preferred, allowing for relatively easy entry and exit points. Technical analysis plays a significant role, with traders relying on chart patterns, indicators, and other tools to identify potential swing trading opportunities. Risk management is paramount, employing stop-loss orders to limit potential losses and position sizing to prevent significant capital erosion from a single trade.

Furthermore, understanding the overall market context – prevailing trends, economic indicators, and news events – is crucial for informed decision-making. A well-diversified portfolio mitigates risk by spreading investments across various sectors and asset classes.

Swing Trading Stocks Versus Stock Options: Risk and Reward Comparison

Swing trading stocks and options both offer opportunities for profit, but they differ significantly in their risk profiles. Swing trading stocks involves direct ownership, limiting potential losses to the initial investment. Options trading, on the other hand, offers leverage, increasing both profit and loss potential. While options provide the possibility of substantial gains with a smaller initial investment, they carry a higher risk of total loss if the underlying asset moves against the trader’s prediction.

The risk-reward ratio is substantially higher with options. A successful swing trade in stocks might yield a 10-20% return, while a successful options trade could yield multiples of that, but an unsuccessful options trade could lead to a complete loss of the premium paid. The appropriate choice depends heavily on individual risk tolerance, trading experience, and investment goals.

Developing a Swing Trading Plan

A well-defined swing trading plan is crucial for success. It provides a structured approach, minimizing emotional decision-making and maximizing consistency. A robust plan acts as a roadmap, guiding your trades and helping you navigate market volatility. This section details the steps involved in creating your personalized swing trading plan and emphasizes the importance of backtesting and journaling.

Creating a Personalized Swing Trading Plan: A Step-by-Step Guide

Developing a successful swing trading plan requires careful consideration of several key factors. This step-by-step guide Artikels the process of creating a personalized plan tailored to your individual needs and risk tolerance. First, define your trading goals, then select your preferred instruments, and finally, establish your risk management strategy. Consistent application of these principles is paramount to long-term success.

- Define Your Trading Goals: Clearly articulate your financial objectives. What are you hoping to achieve through swing trading? Are you aiming for capital appreciation, income generation, or a combination of both? Setting realistic, measurable, achievable, relevant, and time-bound (SMART) goals is essential.

- Select Your Trading Instruments: Determine which assets you will trade. This could include stocks, ETFs, futures, or options. Consider factors such as liquidity, volatility, and your level of experience. Focus on instruments you understand well.

- Develop Your Trading Strategy: Choose a swing trading strategy that aligns with your goals and risk tolerance. This involves identifying entry and exit points, using technical indicators, and defining your position sizing.

- Establish Your Risk Management Strategy: Define your risk tolerance and implement appropriate risk management techniques. This includes setting stop-loss orders, diversifying your portfolio, and avoiding over-leveraging. Never risk more than you can afford to lose.

- Develop Your Trading Psychology: Acknowledge and address your emotional biases. Swing trading requires discipline and patience. Develop strategies to manage fear, greed, and other emotional influences on your decision-making process.

- Create a Trading Journal: Maintain a detailed trading journal to track your trades, analyze your performance, and identify areas for improvement. Consistent journaling helps you refine your strategy over time.

- Backtest Your Strategy: Before implementing your plan with real money, backtest your strategy using historical data. This allows you to assess its effectiveness and identify potential weaknesses.

Backtesting a Swing Trading Strategy

Backtesting involves applying your trading strategy to historical market data to evaluate its performance. This process helps to identify potential flaws and refine your approach before risking real capital. While it doesn’t guarantee future success, it significantly increases your chances of profitable trading.The process typically involves gathering historical price data for your chosen instrument, inputting this data into your trading strategy (either manually or using trading software), and analyzing the results.

Key metrics to track include win rate, average win/loss, maximum drawdown, and overall profitability. Identifying periods of significant underperformance helps to refine entry and exit rules.

Examples of Trading Journals and Their Usefulness

A trading journal serves as a crucial tool for self-assessment and improvement. Different formats exist, catering to diverse needs and preferences.A simple spreadsheet can track key metrics like entry price, exit price, profit/loss, and trade duration. More advanced journals might incorporate detailed notes on market conditions, technical indicators used, and emotional state during the trade. Some traders use dedicated trading journal software offering charting capabilities and performance analysis tools.

Regardless of format, the journal’s primary purpose is to document every trade, facilitating objective review and informed decision-making in future trades. Regular review identifies patterns in successful and unsuccessful trades, leading to strategy refinement and improved performance. The journal becomes a valuable repository of learning, contributing to long-term success.

Swing Trading Psychology and Discipline

Swing trading, while potentially lucrative, demands a high degree of emotional control and unwavering discipline. Success hinges not only on understanding market mechanics and identifying profitable opportunities but also on managing the psychological pressures inherent in the process. Without a robust psychological framework, even the most sophisticated trading strategies can falter.The ability to manage emotions is paramount in swing trading.

Market fluctuations are inevitable, and emotional responses to these swings can lead to impulsive decisions that undermine long-term profitability. Fear and greed, the two most powerful forces in the market, can cloud judgment and lead to losses. Fear can cause traders to prematurely exit profitable positions, while greed can lead to holding losing positions for too long, hoping for a recovery that may never come.

Maintaining objectivity and adhering to a well-defined plan is crucial to mitigating these risks.

Emotional Control in Swing Trading

Emotional control is the cornerstone of successful swing trading. It involves recognizing and managing feelings like fear, greed, and anxiety that can negatively influence trading decisions. A disciplined trader approaches the market with a rational, analytical mindset, focusing on objective data and predetermined trading plans rather than emotional impulses. This requires consistent self-awareness and the development of coping mechanisms to manage stress and emotional volatility.

For instance, a trader might utilize mindfulness techniques or journaling to track their emotional state and identify triggers that lead to impulsive actions. By understanding their own emotional responses, traders can develop strategies to mitigate their impact on trading performance.

Common Psychological Pitfalls in Swing Trading

Several psychological traps can ensnare even experienced swing traders. Overconfidence, stemming from a string of successful trades, can lead to excessive risk-taking and ignoring established risk management rules. Conversely, after experiencing losses, traders may become overly cautious, missing out on potentially profitable opportunities due to fear. Confirmation bias, the tendency to seek out information that confirms pre-existing beliefs while ignoring contradictory evidence, can lead to poor decision-making.

Another common pitfall is the tendency to average down in losing positions, hoping to reduce the average cost basis, which can exacerbate losses if the market continues to move against the trader.

Strategies for Maintaining Discipline and Avoiding Impulsive Decisions

Maintaining discipline in swing trading requires a proactive approach. This involves establishing a detailed trading plan that Artikels entry and exit strategies, risk tolerance levels, and position sizing. Sticking to this plan, regardless of market conditions or emotional impulses, is crucial. Regularly reviewing and adjusting the trading plan based on performance and market changes is also essential.

Utilizing tools like stop-loss orders can help limit potential losses and prevent emotional reactions from leading to larger-than-anticipated losses. Furthermore, keeping a trading journal to document trades, rationale, and emotional responses can provide valuable insights into trading behavior and help identify areas for improvement. Finally, seeking feedback from experienced traders or mentors can offer valuable perspective and support in maintaining discipline and avoiding impulsive decisions.

Regular self-reflection and continuous learning are also essential components of a successful and disciplined swing trading approach.

Mastering swing trading requires a blend of technical analysis, risk management, and emotional discipline. By understanding the principles Artikeld in this guide, and by consistently applying effective strategies, you can significantly improve your chances of success in this exciting and potentially lucrative approach to market trading. Remember that continuous learning, adaptation to market conditions, and rigorous self-assessment are crucial for long-term success in any trading endeavor.

FAQ Insights

What is the ideal timeframe for swing trades?

There’s no one-size-fits-all answer; it depends on your strategy and risk tolerance. Timeframes typically range from a few days to several weeks.

How much capital do I need to start swing trading?

The amount needed depends on your risk tolerance and chosen trading strategy. Start with a sum you’re comfortable losing, and gradually increase your capital as you gain experience and confidence.

Are swing trading strategies suitable for beginners?

While accessible to beginners, swing trading requires learning technical analysis, risk management, and market dynamics. Thorough education and practice are essential before risking real capital.

How often should I review my swing trading plan?

Regularly review and adjust your plan. Market conditions change, and your trading strategy should adapt accordingly. A weekly or monthly review is a good starting point.