Navigating the world of penny stocks can be both exhilarating and perilous. These highly volatile securities offer the potential for significant returns, but also carry substantial risk. This guide provides a practical framework for understanding penny stocks, identifying promising investments, developing effective trading strategies, and managing risk effectively. We’ll explore fundamental and technical analysis, various trading approaches, and crucial legal and ethical considerations, equipping you with the knowledge to make informed decisions in this dynamic market.

From understanding the unique characteristics of penny stocks and their inherent risks to mastering risk management techniques and ethical considerations, this guide serves as a comprehensive resource. We will delve into practical strategies, including fundamental and technical analysis, to help you identify potential investments and navigate the complexities of penny stock trading. Real-world examples will illustrate successful and unsuccessful trades, highlighting the importance of careful planning and execution.

Broader Stock Market Context

Penny stocks, while offering the potential for significant returns, are intrinsically linked to the performance of the broader stock market. Understanding this relationship, along with the nuances of stock and options trading, and various trading strategies, is crucial for navigating the inherent risks and maximizing potential profits in this volatile sector. Ignoring the wider market context can lead to significant losses.Penny stocks, often characterized by high volatility and lower trading volume compared to established blue-chip companies, tend to amplify the movements of the broader market.

During periods of market optimism, these stocks can experience substantial gains, while during bearish trends, they can plummet even more dramatically than their larger counterparts. This heightened sensitivity necessitates a keen awareness of macroeconomic factors, overall market sentiment, and prevailing industry trends.

The Relationship Between Penny Stocks and the Broader Stock Market

Penny stocks are not immune to the forces that shape the broader market. Major economic events, such as interest rate hikes, changes in government regulations, or geopolitical instability, can significantly impact their performance. For instance, a recessionary environment might lead to decreased investor confidence, causing a sell-off across all asset classes, including penny stocks. Conversely, periods of economic expansion often correlate with increased investor enthusiasm, potentially boosting the prices of even the riskiest penny stocks.

Analyzing market indices like the S&P 500 or the Dow Jones Industrial Average can provide valuable insights into the overall market sentiment and its potential impact on penny stock performance.

Stock Trading versus Options Trading

Stock trading involves buying and selling shares of a company’s stock, representing ownership in that company. Options trading, on the other hand, involves buying or selling contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a specific price (the strike price) on or before a specific date (the expiration date).

Stock trading offers more straightforward ownership and potential for long-term growth, while options trading provides leverage and flexibility, allowing traders to profit from price movements without owning the underlying asset. However, options trading carries a higher level of risk due to the time-sensitive nature of contracts and the potential for significant losses if the market moves against the trader’s position.

Stock Trading Strategies for Various Market Conditions

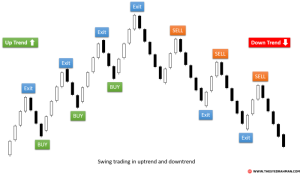

Different market conditions necessitate different trading strategies. During bull markets (periods of sustained price increases), growth investing strategies, focusing on companies with high growth potential, might be favored. Value investing, which focuses on undervalued companies, could be more suitable during bear markets (periods of sustained price decreases). Momentum trading, which capitalizes on short-term price trends, can be effective in both bull and bear markets but requires close monitoring and quick decision-making.

Swing trading, which involves holding positions for several days or weeks, aims to capture short-term price swings, offering a balance between short-term and long-term strategies. Finally, day trading, characterized by extremely short-term positions (often within a single day), requires intensive market analysis and quick reflexes.

Market Volatility and Penny Stock Performance

Market volatility, which refers to the rate and extent of price fluctuations, significantly impacts penny stock performance. High volatility can lead to dramatic price swings, creating opportunities for substantial profits but also increasing the risk of substantial losses. During periods of heightened volatility, penny stocks often experience amplified price movements compared to more established stocks. For example, a sudden news event impacting a specific penny stock’s sector can trigger a rapid and significant price increase or decrease.

Traders need to carefully assess their risk tolerance and employ appropriate risk management techniques, such as stop-loss orders, to mitigate potential losses in volatile market conditions.

Illustrative Examples of Penny Stock Scenarios

Penny stocks, known for their high volatility, offer significant potential for both substantial gains and substantial losses. Understanding the factors influencing their price movements is crucial for successful trading. The following scenarios illustrate the diverse outcomes possible when investing in penny stocks, highlighting the importance of thorough research and a well-defined trading strategy.

Successful Penny Stock Trade: Biotech Breakthrough

This scenario depicts a successful investment in a small biotechnology company developing a novel cancer treatment. Market conditions were characterized by investor optimism towards the healthcare sector, fueled by recent positive clinical trial results from other companies in the field. The trader, having conducted extensive due diligence, identified this penny stock as undervalued, anticipating a potential surge in price upon successful completion of their own Phase III trials.

The trader implemented a long-term buy-and-hold strategy, purchasing shares at $0.50. Over the next 18 months, the company announced positive trial results, leading to a significant increase in media coverage and investor interest. The stock price steadily rose to $5.00 per share, resulting in a tenfold return on the trader’s investment before they decided to partially liquidate their position.

Unsuccessful Penny Stock Trade: Pump and Dump Scheme

This scenario illustrates the dangers of investing in penny stocks without proper research. The trader, lured by online hype and promises of quick riches, invested in a penny stock that was the target of a pump-and-dump scheme. Market conditions were characterized by a general market downturn, creating a climate of heightened risk aversion among investors. The trader, lacking a clear understanding of the company’s fundamentals, purchased shares at $1.00 based solely on social media buzz.

Initially, the price did rise as orchestrated by the perpetrators of the scheme, creating a false sense of security. However, once the manipulators sold their shares, the price plummeted, leaving the trader with significant losses. The stock price eventually dropped to $0.10, representing a 90% loss for the trader. This highlights the importance of avoiding speculative trades based on hype rather than fundamental analysis.

Successful Penny Stock Trade: Merger and Acquisition

This scenario focuses on a successful investment based on a predicted merger and acquisition. The trader, through careful analysis of the company’s financial statements and industry news, anticipated a potential acquisition by a larger, more established company. Market conditions were favorable, with a strong M&A environment and increasing consolidation within the industry. The trader bought shares at $0.75, anticipating a premium offer price.

After several months of speculation and negotiation, the larger company announced a formal acquisition offer at $3.00 per share, resulting in a substantial profit for the trader. This demonstrates the potential for profit when exploiting market inefficiencies and recognizing upcoming corporate events.

Unsuccessful Penny Stock Trade: Regulatory Scrutiny

This scenario details an investment in a penny stock that faced significant regulatory scrutiny. The trader, despite initial positive sentiment, failed to account for the potential impact of impending regulatory changes on the company’s operations. Market conditions were characterized by increased regulatory oversight in the industry. The trader bought shares at $2.00 based on positive earnings reports, overlooking the potential for regulatory fines and operational disruptions.

The company subsequently faced significant regulatory fines and operational setbacks, leading to a sharp decline in its stock price to $0.25. This example highlights the crucial role of understanding regulatory risks when investing in penny stocks, especially in heavily regulated industries.

Successfully trading penny stocks requires a blend of knowledge, discipline, and risk management. While the potential for high returns is alluring, the inherent volatility demands a cautious approach. By understanding the characteristics of penny stocks, employing sound analytical techniques, and adhering to a robust risk management plan, you can increase your chances of success in this challenging yet potentially rewarding market.

Remember that thorough due diligence, continuous learning, and a realistic assessment of your risk tolerance are paramount to navigating the complexities of penny stock trading.

Question & Answer Hub

What is the minimum investment for penny stocks?

There’s no set minimum, but brokers usually have minimum order sizes. It’s best to check with your brokerage.

How often should I review my penny stock portfolio?

Regular monitoring is key. How often depends on your strategy (daily for day trading, weekly for swing trading), but consistent review is crucial.

Are penny stocks suitable for beginners?

Penny stocks are extremely risky and generally not recommended for beginners due to their volatility. Beginners should focus on learning fundamental investing principles first.

Where can I find reliable information on penny stock companies?

SEC filings (EDGAR database), company websites, and reputable financial news sources are good starting points. Always verify information from multiple sources.