Embarking on the journey of stock trading can feel daunting, but with the right knowledge and approach, it can be an exciting and potentially rewarding experience. This guide provides a structured path to understanding the complexities of the stock market, from opening a brokerage account to implementing effective risk management strategies. We’ll explore fundamental and technical analysis, different trading styles, and the importance of continuous learning, equipping you with the tools to navigate this dynamic world.

We’ll demystify the intricacies of financial statements, chart patterns, and trading strategies, providing practical examples and actionable insights. Whether you’re a complete beginner or seeking to refine your existing skills, this comprehensive guide will empower you to make informed investment decisions and confidently take your first steps in the world of stock trading.

Understanding the Stock Market

The stock market is a complex yet fascinating system where investors buy and sell shares of publicly traded companies. Understanding its basic functions is crucial for anyone considering participating in it. This section will cover the fundamentals, different market indices, investment strategies, and the process of executing a trade.

At its core, the stock market facilitates the exchange of company ownership. When you buy a share of stock, you’re essentially purchasing a tiny piece of that company. The price of a share fluctuates based on supply and demand, influenced by factors like company performance, economic conditions, and investor sentiment. This dynamic interplay creates both opportunities and risks for investors.

Stock Market Indices

Stock market indices are statistical measures that track the performance of a specific group of stocks. They provide a snapshot of the overall market health and are often used as benchmarks to compare investment performance. Different indices focus on different segments of the market, offering diverse perspectives.

For example, the Dow Jones Industrial Average (DJIA) tracks 30 large, publicly owned companies in the United States, while the S&P 500 index follows 500 large-cap companies, providing a broader representation of the US market. The NASDAQ Composite, on the other hand, is heavily weighted towards technology companies. These indices offer a valuable tool for understanding market trends and assessing the overall health of various sectors.

Investment Strategies

Various investment strategies exist within the stock market, each with its own risk-reward profile. The choice of strategy depends on an investor’s risk tolerance, investment goals, and time horizon.

Value investing focuses on identifying undervalued companies with strong fundamentals, aiming for long-term growth. Growth investing, conversely, targets companies with high growth potential, even if their current valuations are high. Index fund investing involves passively tracking a specific market index, aiming for diversified exposure and market returns. Day trading involves buying and selling stocks within the same day, aiming to profit from short-term price fluctuations; this is a high-risk strategy requiring significant expertise and discipline.

Each strategy requires a different level of research, market knowledge, and risk management.

Typical Stock Trade Execution

The process of executing a stock trade typically involves several steps.

A simple flowchart illustrating this process would look like this:

[Diagram Description] The flowchart would begin with “Decide on a Stock.” This would lead to “Place an Order (Buy/Sell)” which then branches into two paths: “Order Executed” and “Order Rejected/Cancelled”. “Order Executed” leads to “Monitor Investment” and “Order Rejected/Cancelled” leads back to “Place an Order”. “Monitor Investment” then leads to “Sell Stock (if desired)” which would return to “Decide on a Stock” creating a loop representing ongoing investment management.

The flowchart would visually represent the sequential steps, clearly showing the decision points and potential outcomes of each step in the trading process.

Opening a Brokerage Account

Embarking on your stock trading journey necessitates opening a brokerage account, which serves as your gateway to the financial markets. This account will hold your investments and provide the tools to buy and sell securities. Understanding the different account types and choosing a reputable broker are crucial first steps.Choosing the Right Brokerage Firm is Paramount. Selecting a reputable brokerage firm is a critical decision.

A trustworthy broker offers a secure platform, robust trading tools, competitive fees, and excellent customer support. Factors to consider include the firm’s regulatory oversight, its history, and the breadth of its services. A well-established broker with a strong track record of security and customer satisfaction minimizes risk and ensures a smoother trading experience.

Types of Brokerage Accounts

Brokerage accounts are categorized into various types, each designed to suit different investment strategies and risk tolerances. The two most common types are cash accounts and margin accounts. Understanding the differences is vital for making an informed choice.

- Cash Account: A cash account requires you to pay for your investments in full before executing trades. This eliminates the risk of debt and is generally preferred by beginners due to its simplicity and reduced risk. Funds must be available in your account before you can purchase securities.

- Margin Account: A margin account allows you to borrow money from your broker to purchase securities. This magnifies potential profits but also increases risk, as you could owe more than your initial investment if the market moves against you. Margin accounts are generally only suitable for experienced investors who understand the associated risks.

Opening a Brokerage Account: A Step-by-Step Guide

The process of opening a brokerage account is generally straightforward and can typically be completed online. However, it’s important to gather the necessary documents beforehand to expedite the process.

- Choose a Broker: Research and select a brokerage firm that aligns with your needs and investment goals. Consider factors such as fees, trading platforms, research tools, and customer support.

- Complete the Application: Visit the broker’s website and begin the online application process. You’ll be asked to provide personal information, including your name, address, date of birth, and Social Security number.

- Fund Your Account: Once your account is approved, you’ll need to deposit funds to begin trading. This can typically be done via bank transfer, wire transfer, or check.

- Review Account Agreements: Carefully review all account agreements and disclosures before signing. Understand the terms and conditions, fees, and risks associated with trading.

Essential Documents for Account Verification

To verify your identity and prevent fraud, you will typically need to provide the following documents:

- Government-Issued Identification: Such as a driver’s license or passport.

- Social Security Number (SSN) or Tax Identification Number (TIN): This is required for tax reporting purposes.

- Proof of Address: Such as a utility bill or bank statement.

Risk Management in Stock Trading

Navigating the stock market successfully requires a robust understanding of risk management. Without a well-defined strategy, even the most promising investments can lead to significant losses. This section will Artikel key strategies to help you protect your capital and navigate market volatility.Risk management isn’t about avoiding risk altogether; it’s about understanding and controlling it. It’s about making informed decisions, setting realistic expectations, and having a plan in place to mitigate potential losses.

A successful approach involves a combination of techniques tailored to your individual risk tolerance and investment goals.

Diversification and Position Sizing

Diversification is a cornerstone of risk management. It involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.), sectors, and geographical regions. This reduces the impact of any single investment performing poorly. Imagine investing all your money in a single company; if that company fails, you lose everything. Diversification acts as a buffer against such catastrophic events.

Position sizing complements diversification by controlling the amount of capital allocated to each investment. Instead of putting all your eggs in one basket, you strategically distribute your capital, limiting potential losses from any single position. For example, rather than investing 100% of your portfolio in one stock, you might allocate 5% to each of 20 different stocks across various sectors.

Stop-Loss Orders

Stop-loss orders are crucial for limiting potential losses. These are instructions to your broker to automatically sell a security when it reaches a predetermined price. Setting a stop-loss order helps to prevent significant losses if the price of your investment drops unexpectedly. For instance, if you bought a stock at $50 and set a stop-loss order at $45, your broker will automatically sell the stock once it hits $45, preventing further losses.

It’s important to choose a stop-loss price strategically, considering factors such as market volatility and your risk tolerance. Setting it too tightly might trigger a premature sale, while setting it too loosely might not offer sufficient protection.

Risk Tolerance

Risk tolerance refers to your capacity to accept the possibility of investment losses. It’s a personal characteristic influenced by factors such as your age, financial situation, and investment goals. A younger investor with a longer time horizon might have a higher risk tolerance than an older investor nearing retirement. Understanding your risk tolerance is paramount to making sound investment decisions.

Investors with low risk tolerance might prefer lower-risk investments like bonds, while those with high risk tolerance might allocate more capital to higher-risk, higher-reward assets like growth stocks. It’s crucial to align your investment strategy with your risk tolerance to avoid making decisions that cause undue stress or financial hardship.

Risk Management Techniques for Beginners

It’s essential for beginners to adopt a methodical approach to risk management. Here are some techniques to consider:

- Start Small: Begin with a small amount of capital you can afford to lose. This minimizes the impact of potential losses and allows you to gain experience without significant financial repercussions.

- Thorough Research: Conduct comprehensive research before investing in any security. Understand the company’s fundamentals, its industry, and its competitive landscape.

- Diversify Your Portfolio: Spread your investments across different asset classes and sectors to mitigate risk.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically sell a security when it reaches a predetermined price, limiting potential losses.

- Regularly Monitor Your Portfolio: Keep track of your investments and make adjustments as needed based on market conditions and your investment goals.

- Avoid Emotional Decision-Making: Don’t let fear or greed drive your investment decisions. Stick to your plan and avoid impulsive trades.

- Continuously Learn: Stay updated on market trends and investment strategies through continuous learning and research.

Stock Options Basics

Stock options are derivative instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). Understanding options requires grasping the concepts of leverage and risk, as they offer the potential for significant gains but also carry substantial losses.

Options contracts are standardized and traded on exchanges, providing liquidity and transparency.Options contracts derive their value from the price fluctuations of the underlying asset and the time remaining until expiration. Several factors influence option pricing, including the current market price of the underlying stock, the strike price, the time to expiration, and the implied volatility (a measure of market expectation of future price swings).

Call and Put Options

Call options grant the buyer the right to

- buy* the underlying asset at the strike price. Put options grant the buyer the right to

- sell* the underlying asset at the strike price. The seller (or writer) of an option is obligated to fulfill the buyer’s exercise if the option is “in the money” at expiration. A call option is “in the money” when the market price of the underlying asset exceeds the strike price; a put option is “in the money” when the market price is below the strike price.

The profit or loss for both buyers and sellers depends on the price movement of the underlying asset relative to the strike price at expiration.

Options Trading Strategies

Options offer a wide range of trading strategies, allowing investors to tailor their risk and reward profiles.Covered Calls: This strategy involves selling call options on shares of stock the investor already owns. This generates income from the option premium, but limits potential upside gains if the stock price rises significantly above the strike price. For example, an investor owning 100 shares of XYZ at $50 might sell one call option with a strike price of $55.

If the stock price remains below $55, the investor keeps the premium and the shares. If the price rises above $55, the options are exercised, the investor sells their shares at $55, limiting potential profits but guaranteeing the premium income.Protective Puts: This strategy involves buying put options on shares of stock the investor already owns. This acts as insurance against a potential decline in the stock price.

The cost of the put option is the premium paid, acting as a buffer against losses. For instance, an investor owning 100 shares of ABC at $75 might buy a put option with a strike price of $70. If the stock price falls below $70, the investor can exercise the put option, selling the shares at $70 and limiting losses.

Advantages of Options Trading

Options trading can be advantageous in several scenarios. They offer leverage, allowing investors to control a larger position with a smaller capital outlay compared to outright stock ownership. Options can also be used to hedge against risk, limit potential losses, or generate income. For example, a trader anticipating a short-term price increase in a stock might buy call options instead of buying the stock directly, potentially magnifying profits if the prediction is correct.

Conversely, an investor holding a stock they believe will experience a temporary price dip might buy put options to protect against losses. Options also provide flexibility, allowing investors to tailor their strategies to specific market outlooks and risk tolerances.

Stock Trading Strategies

Choosing the right stock trading strategy is crucial for success. Different strategies cater to varying risk tolerances, time commitments, and financial goals. Understanding the nuances of each approach is key to developing a personalized and effective trading plan. This section will explore three common strategies: day trading, swing trading, and value investing.

Day Trading

Day trading involves buying and selling securities within the same trading day. Traders aim to profit from small price fluctuations throughout the day, requiring constant market monitoring and quick decision-making. This high-frequency trading style demands significant technical analysis skills and a deep understanding of market dynamics.Advantages include the potential for quick profits and the ability to react swiftly to market changes.

However, the disadvantages are equally significant. The high-risk nature of day trading necessitates substantial capital and a high tolerance for losses. Furthermore, the intense focus and time commitment required can be demanding. The emotional toll and the potential for significant losses make it unsuitable for inexperienced traders.

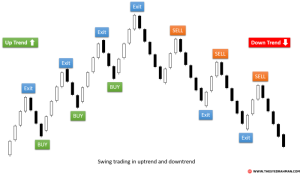

Swing Trading

Swing trading involves holding positions for a few days to several weeks, aiming to capitalize on short-term price swings. This strategy balances the short-term focus of day trading with the longer-term perspective of value investing. Swing traders often use technical analysis to identify entry and exit points, but also consider fundamental factors to gauge the underlying strength of the asset.Swing trading offers a more relaxed approach compared to day trading, requiring less time commitment.

The potential for profits is lower per trade, but the risk is also generally reduced. However, swing trading still requires active monitoring of the market and a willingness to manage risk effectively. Missed opportunities due to delayed reactions can impact profitability.

Value Investing

Value investing focuses on identifying undervalued companies with strong fundamentals. Traders employing this strategy typically hold their positions for extended periods, often years, allowing the market to recognize the intrinsic value of the investment. This approach emphasizes thorough fundamental analysis, including examining financial statements, assessing management quality, and understanding industry trends.Value investing is a long-term strategy with lower time commitment compared to day trading and swing trading.

The potential for significant returns exists, but it requires patience and the ability to withstand short-term market volatility. Finding truly undervalued companies requires extensive research and a keen understanding of financial analysis. The long holding periods can mean missed opportunities in other potentially profitable investments.

Comparison of Stock Trading Strategies

| Strategy | Time Commitment | Risk Level | Potential Returns |

|---|---|---|---|

| Day Trading | High (Full trading day) | High | High (but also high potential for losses) |

| Swing Trading | Moderate (Several hours per week) | Moderate | Moderate |

| Value Investing | Low (Occasional monitoring) | Low | High (long-term) |

Resources for Stock Market Learning

Embarking on a journey into the world of stock trading requires a commitment to continuous learning. This section Artikels valuable resources and strategies to enhance your understanding and improve your investment decisions. Success in the stock market is built upon a solid foundation of knowledge and a proactive approach to acquiring new information.

Reputable Websites and Books for Stock Market Education

Numerous resources are available to help you navigate the complexities of the stock market. Choosing reliable sources is crucial to ensure you receive accurate and unbiased information. Below are some examples of trusted websites and books that offer valuable insights for both beginners and experienced investors.

- Websites: Investopedia, Yahoo Finance, Google Finance, The Motley Fool, and Seeking Alpha provide a wealth of information, including market news, analysis, educational articles, and financial data. These platforms cater to different levels of expertise, offering beginner-friendly tutorials alongside advanced analysis for experienced traders.

- Books: “The Intelligent Investor” by Benjamin Graham is a classic text that emphasizes value investing. “A Random Walk Down Wall Street” by Burton Malkiel provides an overview of market behavior and investment strategies. “One Up On Wall Street” by Peter Lynch offers insights into identifying undervalued companies. These books offer diverse perspectives and strategies, allowing you to tailor your approach to your individual investment goals.

Benefits of Seeking Guidance from Financial Advisors

While self-learning is valuable, seeking professional guidance from a registered financial advisor can significantly benefit your investment journey. Financial advisors possess in-depth market knowledge, experience in portfolio management, and a personalized approach to investment planning. They can help you create a tailored investment strategy based on your risk tolerance, financial goals, and time horizon. Furthermore, a financial advisor can offer objective advice, helping you avoid emotional decision-making often associated with market volatility.

They can also provide ongoing support and guidance as your investment portfolio evolves. The cost of professional advice should be carefully considered against the potential benefits of improved investment outcomes.

The Importance of Continuous Learning in the Stock Market

The stock market is a dynamic environment constantly influenced by economic factors, geopolitical events, and technological advancements. Continuous learning is not just beneficial; it’s essential for long-term success. Staying updated on market trends, economic indicators, and emerging investment opportunities allows you to adapt your strategies and make informed decisions. Regularly reviewing your investment performance and adjusting your approach based on new information will help you navigate market fluctuations and maximize your returns.

The commitment to lifelong learning is a key differentiator between successful and unsuccessful investors.

Sample Learning Plan for a Beginner Investor

A structured learning plan can significantly accelerate your understanding of the stock market. The following plan Artikels a potential path for beginner investors:

- Phase 1 (Weeks 1-4): Focus on foundational knowledge. Utilize online resources like Investopedia to learn about basic financial concepts (stocks, bonds, mutual funds, ETFs), market indices (Dow Jones, S&P 500, Nasdaq), and fundamental analysis.

- Phase 2 (Weeks 5-8): Deepen your understanding of technical analysis, risk management strategies, and different investment styles (value investing, growth investing). Explore resources like Seeking Alpha and relevant chapters from investment books.

- Phase 3 (Weeks 9-12): Practice with a paper trading account. Simulate real-world trading without risking actual capital. This allows you to apply your knowledge and refine your strategies before investing real money. Simultaneously, begin researching potential investments and creating a watchlist.

- Phase 4 (Ongoing): Continuously monitor the market, read financial news, and stay updated on economic developments. Regularly review your investment performance and adjust your strategy as needed. Consider seeking guidance from a financial advisor to further enhance your investment approach.

Understanding Stock Market Terminology

Navigating the stock market requires familiarity with its specialized vocabulary. A solid grasp of common terms is crucial for making informed decisions and understanding market analyses. This section provides a glossary of essential terms, along with practical examples to illustrate their usage.

Common Stock Market Terms

Understanding the language of the stock market is paramount to successful trading. The following terms represent a foundation for interpreting market data and investment strategies.

| Term | Definition | Example | Relevance |

|---|---|---|---|

| Stock | A share of ownership in a publicly traded company. | Owning 100 shares of Apple (AAPL) means you own a tiny fraction of Apple Inc. | Fundamental unit of stock trading. |

| Share | A single unit of stock. | Buying one share of Google (GOOGL) represents owning one unit of the company’s stock. | Smallest tradable unit of a stock. |

| Brokerage Account | An account with a brokerage firm that allows you to buy and sell securities. | Opening an account with Fidelity or Charles Schwab allows you to trade stocks. | Necessary for participation in the stock market. |

| Dividend | A payment made by a company to its shareholders, usually from its profits. | A company might pay a $1 dividend per share annually to its shareholders. | Provides a return on investment beyond stock price appreciation. |

| Market Order | An order to buy or sell a stock at the current market price. | Placing a market order to buy 100 shares of Microsoft (MSFT) means buying them at whatever the current price is. | Fastest way to execute a trade but price is not guaranteed. |

| Limit Order | An order to buy or sell a stock at a specified price or better. | A limit order to buy 50 shares of Amazon (AMZN) at $100 means the trade only executes if the price drops to $100 or lower. | Guarantees a maximum purchase or minimum sale price. |

| Bid Price | The highest price a buyer is willing to pay for a stock. | If the bid price for a stock is $50, that’s the highest price someone is currently offering to buy it for. | Indicates buyer demand. |

| Ask Price | The lowest price a seller is willing to sell a stock for. | If the ask price for a stock is $52, that’s the lowest price someone is currently offering to sell it for. | Indicates seller supply. |

| Spread | The difference between the bid and ask price. | A spread of $2 means the ask price is $2 higher than the bid price. | Represents transaction costs and market liquidity. |

| Volume | The number of shares traded in a given period. | High volume indicates significant trading activity in a stock. | Reflects market interest and liquidity. |

| P/E Ratio (Price-to-Earnings Ratio) | The ratio of a company’s stock price to its earnings per share. | A P/E ratio of 20 means the stock price is 20 times the company’s earnings per share. | Used to assess a company’s valuation. |

| Market Capitalization | The total value of a company’s outstanding shares. | Market cap is calculated by multiplying the stock price by the number of outstanding shares. | Indicates the overall size of a company. |

Common Stock Options Terms

Stock options introduce a new layer of terminology. Understanding these terms is essential for anyone considering options trading.

| Term | Definition | Example | Relevance |

|---|---|---|---|

| Call Option | A contract giving the buyer the right, but not the obligation, to buy a stock at a specific price (strike price) before a certain date (expiration date). | Buying a call option on AAPL with a strike price of $150 and an expiration date of January 2024 gives the buyer the right to buy AAPL at $150 before January 2024. | Used to bet on price increases. |

| Put Option | A contract giving the buyer the right, but not the obligation, to sell a stock at a specific price (strike price) before a certain date (expiration date). | Buying a put option on AAPL with a strike price of $150 and an expiration date of January 2024 gives the buyer the right to sell AAPL at $150 before January 2024. | Used to bet on price decreases. |

| Strike Price | The price at which the option buyer can buy (call) or sell (put) the underlying stock. | If the strike price is $100, the option holder can buy or sell the stock at $100. | Crucial component of option contracts. |

| Expiration Date | The date on which an option contract expires. | Options typically expire on the third Friday of the month. | After this date, the option is worthless. |

| Premium | The price paid to buy an option contract. | The premium is the cost of acquiring the right to buy or sell the underlying asset. | The cost of the option contract. |

| In-the-Money | An option that would be profitable if exercised immediately. | A call option is in-the-money if the current stock price is above the strike price. | Indicates potential profitability. |

| Out-of-the-Money | An option that would not be profitable if exercised immediately. | A call option is out-of-the-money if the current stock price is below the strike price. | Indicates potential loss. |

| At-the-Money | An option whose strike price is equal to the current market price of the underlying asset. | An option is at-the-money when the current stock price equals the strike price. | Neutral position. |

Mastering the art of stock trading is a continuous journey of learning and adaptation. While this guide provides a solid foundation, remember that consistent effort, disciplined risk management, and a commitment to ongoing education are crucial for long-term success. By understanding the fundamentals, employing sound strategies, and staying informed about market trends, you can build a strong base for your investment endeavors.

Embrace the challenges, learn from your experiences, and remember that patience and perseverance are key to navigating the dynamic landscape of the stock market.

Question & Answer Hub

What is the minimum amount of money needed to start stock trading?

There’s no minimum, but starting with a small amount you’re comfortable losing is advisable. Many brokerages allow fractional shares, letting you buy parts of a stock.

How much time should I dedicate to stock trading?

This depends on your chosen strategy. Day trading demands significant time, while value investing allows for a more passive approach. Find a balance fitting your lifestyle.

What are the tax implications of stock trading?

Capital gains taxes apply to profits from selling stocks. Consult a tax professional to understand your specific tax obligations.

Are there any fees associated with stock trading?

Yes, brokerages often charge commissions or fees per trade. Some offer commission-free trading, but other fees might apply.

How can I protect myself from scams?

Stick to reputable brokerages, research thoroughly before investing, and be wary of promises of guaranteed returns.