Unlocking the potential of the stock market often involves navigating complex strategies. Selling stock options presents a compelling avenue for profit, but it demands a thorough understanding of the underlying mechanics and inherent risks. This guide delves into the world of option selling, equipping you with the knowledge to make informed decisions and potentially increase your investment returns. We will explore various strategies, risk management techniques, and essential market fundamentals, empowering you to confidently navigate this dynamic landscape.

From grasping the nuances of call and put options to mastering strategies like covered calls and cash-secured puts, we’ll cover the spectrum of option selling. We’ll examine the crucial role of risk management, emphasizing the importance of diversification and stop-loss orders. Furthermore, this guide will equip you with the fundamental knowledge of stock market analysis and mechanics needed to execute successful trades.

Understanding Stock Options

Stock options are derivative instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). Understanding options involves grasping their different types and the factors influencing their prices. This knowledge is crucial for successfully trading them for profit.

Types of Stock Options

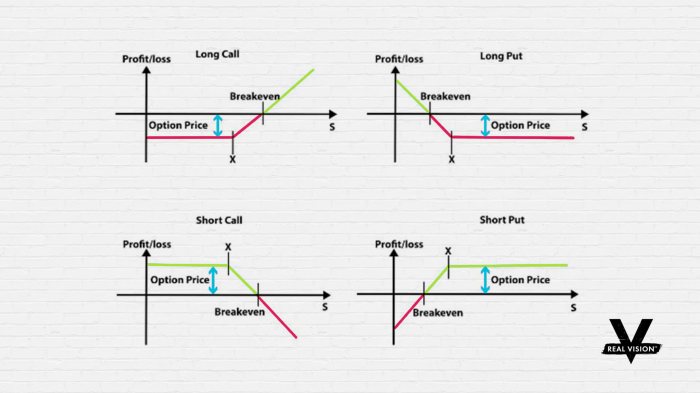

There are two primary types of stock options: calls and puts. Call options grant the holder the right to

- buy* the underlying asset at the strike price, while put options grant the right to

- sell* the underlying asset at the strike price. The buyer of an option pays a premium to the seller (the option writer) for this right. Both buyers and sellers can profit from options trading, depending on market movements and their chosen strategies.

Factors Influencing Option Prices

Several key factors interact to determine an option’s price. The most significant are the underlying asset’s price, volatility, time to expiration, and interest rates. A higher underlying asset price generally increases the value of a call option and decreases the value of a put option. Conversely, increased volatility tends to increase the price of both calls and puts, as higher volatility means a greater chance of large price swings.

Options closer to their expiration date have less time value, making them cheaper, while higher interest rates generally benefit call options and hurt put options.

Option Strategies for Beginners

Beginners should focus on simpler strategies to learn the mechanics of options trading before venturing into more complex ones. One basic strategy is buying a call option if you believe the underlying asset’s price will rise. Alternatively, buying a put option is suitable if you anticipate a price decline. These strategies are relatively straightforward and allow for learning the basics of option pricing and payoff.

It is crucial to remember that option trading involves risk, and losses can exceed the premium paid.

Call and Put Option Comparison

| Feature | Call Option | Put Option |

|---|---|---|

| Right Granted | To buy the underlying asset | To sell the underlying asset |

| Profit Potential | Unlimited (theoretically) | Limited to the strike price |

| Maximum Loss | Premium paid | Premium paid |

| Payoff Profile | Profit increases as underlying price rises above strike price | Profit increases as underlying price falls below strike price |

Strategies for Profitable Option Selling

Selling options can be a lucrative strategy for generating income, but it requires a thorough understanding of the risks involved. Successful option selling hinges on accurately predicting market movements and managing your risk tolerance effectively. Different strategies cater to varying risk appetites and market outlooks. This section explores several popular approaches, highlighting their potential benefits and drawbacks.

Covered Call Writing

Covered call writing involves selling call options on shares of stock you already own. This strategy generates immediate income from the option premium, and if the stock price remains below the strike price at expiration, you keep both the premium and your shares. However, your upside potential is capped at the strike price. The risk is limited to the initial investment in the underlying stock.

For example, owning 100 shares of XYZ at $50 and selling a call option with a $55 strike price generates immediate income. If XYZ stays below $55, you keep the premium and your shares. If it rises above $55, your shares will be called away, limiting your profit to the strike price plus the premium received. The risk/reward profile is generally considered moderate, offering a defined profit potential but limiting significant gains.

Cash-Secured Puts

A cash-secured put involves selling a put option, requiring you to have sufficient cash in your account to buy the underlying shares if the option is exercised. This strategy generates income from the premium, and if the option expires out-of-the-money, you keep the premium. If the option is exercised, you are obligated to buy the shares at the strike price.

The potential benefits include generating income and potentially acquiring shares at a discounted price. The drawbacks include the risk of being assigned the shares at a price you may not find desirable and tying up capital. Consider selling a cash-secured put on a company you’d be willing to own at the strike price. If the price drops below the strike price, you’ll acquire the shares.

If the price remains above the strike price, you keep the premium. The risk/reward profile is generally considered moderate to high, depending on the chosen strike price and the underlying asset’s volatility.

Bull Call Spread and Bear Put Spread Comparison

Bull call spreads and bear put spreads are both defined-risk strategies, but they work in opposite market directions. A bull call spread profits from rising stock prices, while a bear put spread profits from falling prices. A bull call spread involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price.

The maximum profit is limited to the difference between the strike prices minus the net premium paid. A bear put spread involves buying a put option with a higher strike price and simultaneously selling a put option with a lower strike price. The maximum profit is also limited to the difference between the strike prices minus the net premium paid.

The risk is defined and limited to the net premium paid in both strategies. The bull call spread benefits from upward price movements, while the bear put spread benefits from downward movements. The choice between these strategies depends entirely on your market outlook.

Hypothetical Portfolio Using Option Selling Strategies

A diversified portfolio might incorporate all three strategies. For example, an investor could sell covered calls on a portion of their existing stock holdings (generating income and potentially limiting upside), sell cash-secured puts on stocks they are interested in owning at a lower price (generating income and potentially acquiring shares at a discount), and employ bull call spreads or bear put spreads based on their short-term market outlook on specific stocks (defined risk, limited profit potential).

The specific allocation would depend on the investor’s risk tolerance, capital, and market expectations. This portfolio aims for income generation while mitigating risk through defined risk strategies and diversification.

Risk Management in Option Selling

Option selling, while potentially lucrative, carries inherent risks that must be carefully considered and managed. Understanding these risks and implementing appropriate mitigation strategies is crucial for long-term success and preventing significant financial losses. Ignoring risk management can quickly transform profitable trades into substantial setbacks.Option selling’s primary risk is the potential for unlimited losses, particularly with uncovered calls. Unlike buying options, where your maximum loss is limited to the premium paid, selling options exposes you to potentially unlimited losses if the underlying asset’s price moves sharply against your position.

Effective risk management aims to mitigate this exposure and protect your capital.

Strategies for Managing Risk in Option Selling

Several strategies can significantly reduce the risk associated with selling options. A well-defined risk management plan should be an integral part of any option selling strategy. These strategies work best when implemented in combination.

- Setting Stop-Loss Orders: Stop-loss orders automatically sell your position when the underlying asset reaches a predetermined price, limiting potential losses. For example, if you sell a put option on a stock trading at $100, you might set a stop-loss order at $90. If the stock price falls to $90, your position will be automatically closed, preventing further losses. This is especially useful for mitigating the risks of unexpected market movements.

- Diversifying Holdings: Don’t put all your eggs in one basket. Diversification across different underlying assets, expiration dates, and option types reduces the impact of a single losing trade. Spreading your risk across multiple positions helps cushion the blow of any individual trade going against you. For instance, instead of selling options on just one tech stock, diversify across sectors like energy, healthcare, and consumer goods.

- Using Covered Calls: Selling covered calls involves selling call options on stocks you already own. This limits your potential losses to the difference between the stock’s current price and the strike price of the call option, plus any commissions. This strategy reduces risk as the stock acts as a buffer against large price increases.

- Adjusting Position Size: Carefully managing your position size is critical. Never risk more capital than you can afford to lose on any single trade. Start with smaller positions and gradually increase them as your experience and understanding grow. This approach prevents catastrophic losses from wiping out your trading account.

Best Practices for Risk Mitigation in Option Trading

Effective risk management is a continuous process, not a one-time event. The following best practices contribute to a robust risk management framework.

- Thorough Due Diligence: Before selling any option, conduct thorough research on the underlying asset, its historical volatility, and the overall market conditions. Understanding the factors that could influence the price is crucial for informed decision-making.

- Regular Monitoring: Actively monitor your positions and adjust your strategies as needed. Market conditions can change rapidly, and staying informed allows you to react quickly to potential risks.

- Paper Trading: Practice option selling strategies in a paper trading account before using real money. This allows you to gain experience and refine your approach without risking your capital.

- Continual Learning: Stay updated on market trends, option strategies, and risk management techniques. The option market is dynamic, and continuous learning is essential for adapting to changing conditions.

Examples of Significant Losses in Option Selling

Several scenarios can lead to significant losses when selling options.

Consider a scenario where an investor sells uncovered call options on a technology stock expecting a limited price increase. However, unexpectedly positive news triggers a rapid surge in the stock price, far exceeding the investor’s expectations. This could result in a substantial loss as the investor is obligated to sell the stock at a significantly lower price than the market value, leading to an unlimited loss potential.

Another example involves selling put options on a company experiencing unforeseen financial difficulties. A sudden drop in the stock price can trigger a significant loss, forcing the investor to purchase the stock at a much higher price than the market value. This demonstrates the importance of understanding the fundamentals of the underlying asset before entering any option trade.

Stock Market Fundamentals for Option Sellers

Successful option selling hinges on a solid understanding of the stock market’s underlying dynamics. Ignoring these fundamentals can lead to significant losses, even with the best strategies. This section will explore the crucial relationship between stock prices and options, the role of fundamental and technical analysis, and key indicators to monitor before entering a short option position.Understanding the intricate dance between stock prices and option prices is paramount.

Option prices are intrinsically linked to the price of the underlying asset (the stock). As the stock price moves, option prices respond accordingly. For example, a call option’s price will generally increase as the underlying stock price rises, while a put option’s price will increase if the underlying stock price falls. This relationship, however, isn’t linear; it’s influenced by factors like time decay (theta), implied volatility (IV), and interest rates.

Ignoring these interconnected factors can lead to miscalculations and unexpected losses.

The Importance of Fundamental Analysis in Underlying Asset Selection

Fundamental analysis assesses the intrinsic value of a company by examining its financial statements, business model, competitive landscape, and management team. This helps determine whether a stock is overvalued or undervalued. For option sellers, focusing on fundamentally strong companies with stable earnings and a history of dividend payments reduces the risk of significant price drops that could trigger losses on short positions.

For example, a company with strong revenue growth and a healthy balance sheet is generally less likely to experience a sharp decline, reducing the risk of assignment on a sold put option.

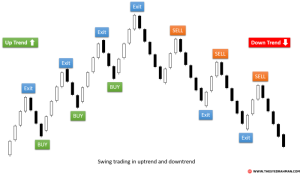

The Role of Technical Analysis in Identifying Entry and Exit Points

Technical analysis uses price charts and indicators to identify trends and patterns in the market. While fundamental analysis focuses on the company’s intrinsic value, technical analysis helps pinpoint optimal entry and exit points for option trades. By studying price action, support and resistance levels, and various indicators like moving averages and RSI, option sellers can identify potentially favorable times to sell options and manage their positions effectively.

For instance, selling covered calls near resistance levels, where the price is likely to consolidate or pull back, can enhance profit potential while limiting risk.

Key Indicators to Monitor Before Selling Options

Before selling any options, it’s crucial to carefully consider several key indicators. These indicators provide a holistic view of the market and the underlying asset, helping to mitigate potential risks.

- Implied Volatility (IV): High IV generally translates to higher option premiums, offering attractive selling opportunities. However, extremely high IV can also indicate increased market uncertainty, potentially leading to larger price swings and greater risk.

- Time Decay (Theta): Understanding time decay is crucial as it erodes the value of options over time. Selling options closer to expiration maximizes the benefit of theta decay, but also increases the risk of assignment.

- Stock Price Momentum: Analyzing recent price trends helps determine the direction and strength of the underlying asset’s movement. Selling options against a stock trending sideways or in a slow downtrend can be more favorable than selling against a sharply rising stock.

- Volume and Open Interest: High volume and open interest often indicate increased market participation and liquidity, which can be beneficial for option selling. However, extremely high open interest might suggest a concentrated group of traders, potentially influencing price movements.

- Earnings Announcements: Earnings reports can significantly impact stock prices. It’s generally advisable to avoid selling options immediately before or during the earnings announcement period, as the price volatility can be substantially higher.

Stock Option Trading Mechanics

Successfully navigating the world of stock options requires a solid understanding of the trading mechanics involved. This section details the process of buying and selling options contracts, the role of brokerage accounts and platforms, and the various order types available. Mastering these mechanics is crucial for executing your chosen strategies effectively and minimizing risk.Buying and selling options contracts involves using a brokerage account to place orders on a trading platform.

The process mirrors that of buying and selling stocks, but with the added complexity of option-specific parameters like expiration date and strike price. A successful trade hinges on a precise understanding of these parameters and the market’s dynamics.

Brokerage Accounts and Trading Platforms

Brokerage accounts serve as the gateway to the options market. These accounts, offered by various financial institutions, provide the necessary infrastructure for placing trades. Trading platforms, often integrated within the brokerage account, offer user-friendly interfaces for monitoring market data, placing orders, and managing your portfolio. Different platforms offer varying levels of sophistication and functionality, catering to both novice and experienced traders.

Features like charting tools, real-time quotes, and advanced order types are common. Choosing a reputable brokerage with a reliable and intuitive platform is paramount for a smooth trading experience.

Option Order Types

Several order types facilitate the execution of options trades, each offering a different degree of control and risk.Market Orders: Market orders are straightforward; they execute at the best available price immediately. This offers speed but may not always result in the most favorable price, especially in volatile markets. For example, if the market is rapidly moving, a market order might execute at a less advantageous price than anticipated.Limit Orders: Limit orders allow you to specify the maximum price (for buying) or minimum price (for selling) you’re willing to pay.

This offers greater control over price but carries the risk that the order might not be filled if the market doesn’t reach your specified price. A limit order to buy a call option at $2.50 will only be executed if the market price reaches or falls below $2.50.Stop Orders: Stop orders are designed to limit potential losses or lock in profits.

A stop-loss order automatically becomes a market order once the price of the underlying asset reaches a predetermined level, protecting against further losses. Conversely, a stop-limit order combines elements of both limit and stop orders, ensuring a more controlled execution at a specified price or better. Stop orders are often used to mitigate risk in volatile markets.

Placing an Option Trade: A Step-by-Step Guide

Placing an option trade typically involves these steps:

1. Log in to your brokerage account

Access your account through the brokerage’s website or trading platform.

2. Search for the underlying asset

Locate the stock or ETF you want to trade options on.

3. Select the option contract

Choose the specific option contract (call or put), strike price, and expiration date.

4. Specify the order type

Select the desired order type (market, limit, or stop).

5. Enter the quantity

Indicate the number of contracts you want to buy or sell.

6. Review the order details

Carefully check all details before submitting.

7. Submit the order

Once you’re satisfied, submit the order to execute the trade. The trade will be confirmed once executed, and the details will be recorded in your trading history.

Stock Market, Stock Options, and Stock Trading Overview

Understanding the differences between stock trading and options trading is crucial for success in either market. Both involve investing in publicly traded companies, but their mechanisms and risk profiles differ significantly. This section will compare and contrast these approaches, highlighting the advantages and disadvantages of each, and exploring the role of leverage in options trading, along with the impact of market conditions on option pricing and trading strategies.Options trading offers a different way to profit from the stock market compared to simply buying and selling shares.

While both involve exposure to market fluctuations, the mechanics, risks, and potential rewards differ substantially.

Stock Trading versus Options Trading

Stock trading involves buying and selling shares of a company’s stock. You own a portion of the company, and your profit or loss is directly tied to the stock’s price movement. Options trading, on the other hand, involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a specific price (the strike price) on or before a specific date (the expiration date).

This allows for more complex strategies and leveraged positions.

Advantages and Disadvantages of Stock Trading

Advantages: Stock trading offers relatively straightforward ownership and potential for long-term growth. Profits are directly linked to the appreciation of the stock’s value. It’s generally considered a less complex investment strategy than options trading.

Disadvantages: Stock trading requires a significant capital investment to realize substantial gains. Losses can be substantial if the stock price declines significantly. The potential for profit is limited to the stock’s price appreciation.

Advantages and Disadvantages of Options Trading

Advantages: Options trading offers leverage, allowing investors to control a larger position with a smaller capital outlay. It offers a wider range of strategies to profit from both rising and falling markets (e.g., buying calls, buying puts, selling covered calls, selling cash-secured puts). Options can be used to hedge against risk or generate income.

Disadvantages: Options trading is significantly more complex than stock trading, requiring a deeper understanding of market mechanics and risk management. Options have a limited lifespan (expiration date), meaning time decay can erode the value of the option even if the underlying asset price moves favorably. The potential for substantial losses exists, especially for inexperienced traders.

The Role of Leverage in Options Trading

Leverage in options trading amplifies both potential profits and losses. A small investment in an option contract can control a much larger position in the underlying stock. For example, a single options contract might control 100 shares of a stock. If the stock price moves significantly in the desired direction, the option’s value can increase disproportionately to the initial investment.

However, the reverse is also true: losses can quickly exceed the initial investment if the market moves against the trader. This inherent leverage is a double-edged sword, requiring careful risk management.

Market Conditions and Option Pricing

Market volatility significantly impacts option prices. Higher volatility generally leads to higher option premiums (the price of the option), as the chance of large price swings increases. Conversely, low volatility leads to lower premiums. This relationship is reflected in implied volatility, a key metric used to assess market expectations of future price movements. For example, during periods of heightened market uncertainty (e.g., economic downturns, geopolitical events), implied volatility tends to increase, leading to higher option prices.

Conversely, during periods of market stability, implied volatility decreases, resulting in lower option prices. This dynamic significantly influences trading strategies. Traders might favor strategies that profit from volatility in uncertain markets and strategies that benefit from low volatility in stable markets.

Illustrative Examples of Option Selling

Option selling strategies, while potentially lucrative, require a thorough understanding of market dynamics and risk management. The following examples illustrate both successful and unsuccessful scenarios, highlighting the importance of careful planning and execution. These examples are for illustrative purposes only and do not constitute financial advice.

Profitable Covered Call Scenario

Let’s say an investor owns 100 shares of XYZ Corp. trading at $50 per share. They believe the stock price is unlikely to rise significantly in the near term but are comfortable holding the shares. To generate income, they sell one covered call option contract (representing 100 shares) with a strike price of $55 and an expiration date one month out.

The premium received is $2 per share, or $200 total. If the stock price remains below $55 at expiration, the call option expires worthless, and the investor keeps both the shares and the $200 premium. Their profit is $200. Even if the stock price rises above $55, the investor still retains the $200 premium, though they will have their shares called away at $55.

If the shares were purchased at a lower price, this would still represent a profit. For example, if the purchase price was $45, the profit would be $1200 ($5500 – $4500) + $200 = $1400.

Successful Cash-Secured Put Strategy

An investor believes that ABC Company stock, currently trading at $40, is undervalued and likely to rise in price. They decide to implement a cash-secured put strategy. They sell one put option contract with a strike price of $35 and an expiration date of three months. The premium received is $1.50 per share, or $150 total. The investor must have $3500 in their account (100 shares x $35 strike price) to cover the potential obligation to buy the shares if the stock price falls below $35 at expiration.

If the stock price remains above $35 at expiration, the put option expires worthless, and the investor keeps the $150 premium as profit. If the stock price falls below $35, the investor is obligated to buy 100 shares at $35, but they still retain the $150 premium, reducing their effective cost basis to $33.50 per share. If the price rises later, they can sell the shares at a profit, offsetting any potential losses.

Unprofitable Option Selling Scenario

An investor sells a naked call option (without owning the underlying shares) on DEF Corp. stock, believing the price will remain stable or decline. They sell one call option contract with a strike price of $60 and an expiration date of one month. The premium received is $3 per share, or $300. However, unexpectedly, DEF Corp.

announces strong earnings, and the stock price surges to $75. The investor is obligated to buy 100 shares at $60 and immediately sell them at $75, resulting in a net profit of $1500 ($7500 – $6000). However, this profit is significantly less than the potential unlimited loss. If the stock price had risen further, their losses would have been considerably higher.

The $300 premium received is insignificant compared to the potential loss if the stock price had increased even further. This highlights the significant risk associated with selling naked options.

Profit/Loss Profile of a Covered Call

This example shows a text-based representation. Imagine a graph with the x-axis representing the stock price at expiration and the y-axis representing profit/loss.Stock Price at Expiration | Profit/Loss

———————–|————

Below $55 | $200 (premium received)$55 | $200 (premium received)$55 – $60 | $200 (premium received) + (Stock Price – $55)

100 (Profit from share price increase up to strike price before shares are called away)

Above $60 | $200 (premium received) + ($55 – Purchase Price)

100 (Profit if shares were bought at lower price)

This simplified representation illustrates how the profit is capped at the premium received plus potential gains if the shares were purchased below the strike price. Losses are limited to the initial cost of the shares minus the premium. The exact numbers would depend on the initial cost basis of the underlying shares.

Successfully selling stock options for profit requires a blend of knowledge, discipline, and risk management. While the potential for significant returns exists, it’s crucial to understand the inherent risks and to approach option selling with a well-defined strategy. By mastering the concepts Artikeld in this guide – from understanding option types and pricing factors to implementing effective risk management techniques – you can enhance your chances of achieving profitable outcomes in the dynamic world of options trading.

Remember, consistent learning and adaptation are key to long-term success in this field.

Popular Questions

What is the difference between a long and short option position?

A long position involves buying an option, hoping the price moves favorably. A short position involves selling an option, profiting from the option expiring worthless.

How much capital do I need to start selling options?

The capital required depends on the specific options strategy and the underlying asset. Brokerage accounts will have margin requirements that need to be met.

What are the tax implications of selling options?

Tax implications vary depending on your jurisdiction and the specific option strategy. Consult a tax professional for personalized advice.

What are some common mistakes beginners make when selling options?

Common mistakes include poor risk management, inadequate understanding of option pricing, and neglecting market analysis.