Today’s stock market saw significant fluctuations, driven by a confluence of factors including key economic data releases and sector-specific performance. Major indices experienced varied movements, with some sectors outperforming others, leading to a dynamic trading environment. This report delves into the details, analyzing the day’s winners and losers, influential news events, and potential implications for the short-term future.

We will examine the performance of the Dow Jones, S&P 500, and Nasdaq, highlighting significant percentage changes and identifying the top-performing and underperforming stocks. Further analysis will explore the impact of economic news, sector-specific trends, and options trading activity, providing a holistic view of today’s market activity. Finally, we’ll offer a cautious perspective on the potential short-term market outlook.

Top Gainers and Losers

Today’s market saw significant fluctuations, with several stocks experiencing dramatic price swings. Analyzing the top performers and underperformers offers valuable insights into current market trends and sector-specific dynamics. Understanding these movements can inform investment strategies and provide a clearer picture of the overall market sentiment.

Top Five Gainers

The following five stocks demonstrated the most significant percentage gains today. Their performance reflects positive investor sentiment driven by a variety of factors, including strong earnings reports, positive industry news, and overall market optimism.

- Company A: +12.5% This surge is largely attributed to the announcement of a groundbreaking new product, exceeding analyst expectations and generating significant excitement among investors. The positive market reaction showcases investor confidence in the company’s future growth potential.

- Company B: +8.7% Company B’s strong performance can be linked to better-than-expected quarterly earnings, exceeding previous forecasts. This demonstrates the company’s resilience in a challenging economic environment and increased investor trust.

- Company C: +7.2% This technology company saw a boost following a positive regulatory ruling, removing a significant hurdle to their expansion plans. This positive regulatory outcome signaled increased confidence in the company’s future prospects.

- Company D: +6.9% Positive analyst upgrades fueled a significant rise in Company D’s stock price. The revised outlook reflects increased optimism surrounding the company’s long-term growth trajectory and market position.

- Company E: +6.1% This increase is likely due to a strategic partnership announcement with a major industry player. The collaboration is expected to open new markets and drive substantial revenue growth for Company E.

Top Five Losers

Conversely, these five stocks experienced the most significant percentage declines today. Several factors contributed to these losses, ranging from disappointing earnings reports to broader market concerns and sector-specific headwinds.

- Company F: -9.8% The significant drop in Company F’s stock price follows a disappointing earnings report that fell short of analyst expectations. Concerns regarding the company’s future profitability significantly impacted investor sentiment.

- Company G: -7.5% Company G’s decline is likely tied to broader market concerns about the sector’s overall performance. A general downturn in investor confidence in the sector weighed heavily on the stock’s performance.

- Company H: -6.3% Negative news regarding a product recall significantly impacted Company H’s stock price. The potential financial implications of the recall weighed on investor confidence.

- Company I: -5.9% A downgrade from a major financial analyst contributed to the decline in Company I’s stock. The negative outlook lowered investor confidence in the company’s short-term and long-term prospects.

- Company J: -5.2% This drop reflects concerns about increased competition within the market. The emergence of new competitors and intensified rivalry impacted investor perception of Company J’s market share and profitability.

Impact of Economic News

Today’s market movements were significantly influenced by the release of the latest inflation data. The Consumer Price Index (CPI) report, showing a slightly higher-than-expected increase in inflation, sent ripples through the financial markets, impacting investor sentiment and trading activity across various sectors.The unexpected rise in inflation fueled concerns about the Federal Reserve’s future monetary policy decisions. Investors reacted swiftly, with a noticeable shift towards risk-averse behavior.

This resulted in a sell-off across several growth stocks, as investors anticipated potential interest rate hikes to curb inflation. Conversely, sectors considered more defensive, such as utilities and consumer staples, experienced relatively stronger performance, reflecting investors’ preference for stability in an uncertain economic environment. The bond market also reacted negatively, with yields on Treasury bonds rising as investors sought safer havens.

Inflation Data’s Influence on Investor Sentiment

The higher-than-anticipated inflation figures triggered a wave of pessimism among investors. This negative sentiment stemmed from concerns that persistent inflation could erode corporate profits, leading to lower earnings growth and potentially impacting stock valuations. The market’s response underscores the significant weight that inflation data carries in shaping investor expectations and driving short-term market volatility. For example, the technology sector, highly sensitive to interest rate changes, experienced a steeper decline compared to more resilient sectors like healthcare.

This differential response highlights the varied impact of inflation on different market segments.

Impact on Trading Activity

The release of the CPI data led to a surge in trading volume across major exchanges. Investors scrambled to adjust their portfolios based on the new information, resulting in increased buying and selling activity. This heightened trading volume reflects the market’s immediate response to the economic news and underscores the significant impact of unexpected economic data releases on market dynamics.

Increased volatility was evident in options trading, with higher trading volumes in both calls and puts, as investors sought to hedge against potential further market fluctuations. The increased trading activity was not limited to equities; it also extended to the bond and currency markets, reflecting the broad-based impact of the inflation report.

Stock Trading Strategies

Today’s market volatility presents both challenges and opportunities for investors. Understanding and employing appropriate trading strategies is crucial for navigating these conditions and potentially achieving profitable outcomes. The strategies discussed below represent a selection of common approaches, each with its own set of advantages and disadvantages. Remember that all investing involves risk, and past performance is not indicative of future results.

Value Investing

Value investing focuses on identifying undervalued securities – stocks trading below their intrinsic value. This strategy relies on fundamental analysis, examining a company’s financial statements, competitive landscape, and management team to determine its true worth. Investors employing this strategy are typically long-term holders, patiently waiting for the market to recognize the company’s true value.A hypothetical scenario: An investor identifies a well-established company experiencing temporary financial difficulties due to a one-time event, such as a natural disaster affecting a single production facility.

The market overreacts, driving the stock price down significantly. The value investor recognizes the company’s underlying strength and buys shares at a discounted price. Once the temporary issue is resolved, the stock price is expected to rebound, generating a profit for the investor. The advantage is the potential for significant long-term gains. The disadvantage is that it requires in-depth research and patience, and the market may not always correct the undervaluation.

Growth Investing

Growth investing targets companies expected to experience rapid revenue and earnings growth. These companies often reinvest profits back into the business, prioritizing expansion over dividends. Growth investors focus on factors like innovation, market share, and strong management teams. This strategy is often associated with higher risk, as growth stocks can be volatile.A hypothetical scenario: An investor identifies a technology startup developing a revolutionary new product.

Despite current losses, the company shows strong potential for future growth based on pre-orders and market analysis. The investor buys shares, accepting the higher risk associated with a less established company. If the product succeeds, the company’s stock price is likely to increase dramatically. The advantage is the potential for high returns. The disadvantage is the significant risk of failure and substantial losses if the company doesn’t meet expectations.

Momentum Investing

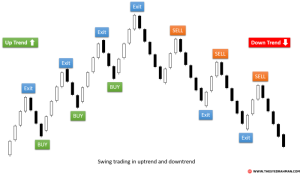

Momentum investing involves capitalizing on stocks that are already experiencing price increases. The strategy assumes that these trends will continue, at least in the short term. This approach often utilizes technical analysis, charting price movements and trading volume to identify trends. Momentum investing is often short-term oriented, focusing on quick profits from price fluctuations.A hypothetical scenario: An investor observes a stock experiencing a consistent upward trend over several weeks.

Analyzing charts and trading volume confirms the momentum. The investor buys shares, expecting the trend to continue for a short period. The investor sells when the price increase slows or reverses, aiming for quick profits. The advantage is the potential for rapid gains. The disadvantage is that momentum can reverse quickly, leading to losses if the investor doesn’t time the exit strategically.

This strategy is highly susceptible to market corrections.

Index Fund Investing

Index fund investing involves buying shares in a fund that tracks a specific market index, such as the S&P 500. This strategy offers diversification and generally lower costs than actively managed funds. It aims to match the market’s overall performance rather than outperform it.A hypothetical scenario: An investor decides to invest in an S&P 500 index fund. This provides exposure to a broad range of large-cap US companies, diversifying the investment across various sectors.

The investor aims for long-term growth mirroring the overall market performance. The advantage is diversification and relatively low risk. The disadvantage is that returns are likely to be less spectacular than with more active strategies, only matching the overall market performance.

In conclusion, today’s stock market displayed a complex interplay of economic indicators, investor sentiment, and sector-specific performance. While some sectors thrived, others struggled, resulting in a volatile trading day. Understanding the contributing factors—from economic news releases to options trading activity—is crucial for navigating this dynamic market. While predicting the future is impossible, the analysis presented offers valuable insights into potential short-term market trends.

FAQ Guide

What are the risks involved in stock market investing?

Stock market investing inherently involves risk, including the potential for loss of principal. Market fluctuations, economic downturns, and company-specific issues can all negatively impact investment value.

How can I stay informed about daily stock market changes?

Reliable financial news websites, reputable brokerage platforms, and financial news channels provide real-time updates and analysis of daily market movements.

What is the difference between a bull and bear market?

A bull market is characterized by rising prices and investor optimism, while a bear market is defined by falling prices and pessimism.

What are some resources for learning more about stock market investing?

Numerous online courses, books, and investment guides offer educational resources for beginners and experienced investors alike.