Navigating the world of stock trading can feel daunting, but understanding the fundamentals empowers you to make informed decisions and potentially achieve your financial goals. This guide demystifies the process, providing a clear path from understanding basic market concepts to implementing effective trading strategies. We’ll explore various approaches, risk management techniques, and ethical considerations to equip you with the knowledge needed to navigate this dynamic landscape responsibly.

From comprehending stock market mechanics and selecting promising investments to managing risk and diversifying your portfolio, we will cover essential aspects of successful stock trading. We’ll examine both fundamental and technical analysis, helping you develop a personalized investment strategy tailored to your risk tolerance and financial objectives.

Stock Selection Strategies

Choosing the right stocks is crucial for successful investing. This involves understanding and applying various strategies, primarily categorized as fundamental analysis and technical analysis. Both approaches offer valuable insights, and often, a combination of both is employed for a more comprehensive view.Fundamental Analysis and Financial RatiosFundamental analysis focuses on evaluating a company’s intrinsic value by examining its financial statements, business model, and competitive landscape.

A key component of this is the use of financial ratios, which provide insights into a company’s profitability, liquidity, solvency, and efficiency.

Profitability Ratios

Profitability ratios assess a company’s ability to generate earnings. Key examples include Gross Profit Margin (Revenue – Cost of Goods Sold / Revenue), Net Profit Margin (Net Income / Revenue), and Return on Equity (Net Income / Shareholder Equity). A consistently high net profit margin, for instance, suggests strong pricing power and efficient cost management. Analyzing trends in these ratios over time is crucial to understand the company’s performance and growth trajectory.

For example, a company showing consistently increasing net profit margins over several years would be viewed more favorably than one showing declining margins.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. The Current Ratio (Current Assets / Current Liabilities) and Quick Ratio ((Current Assets – Inventory) / Current Liabilities) are commonly used. A healthy current ratio, typically above 1, indicates sufficient liquid assets to cover short-term debts. A company with a low current ratio might face difficulties meeting its immediate financial obligations.

Consider, for instance, a retail company facing unexpected supply chain disruptions. A low current ratio in this scenario would signal increased risk.

Solvency Ratios

Solvency ratios assess a company’s ability to meet its long-term obligations. The Debt-to-Equity Ratio (Total Debt / Total Equity) and Times Interest Earned (Earnings Before Interest and Taxes / Interest Expense) are important indicators. A high debt-to-equity ratio suggests significant reliance on debt financing, potentially increasing financial risk. A low times interest earned ratio indicates difficulty in covering interest payments, potentially leading to financial distress.

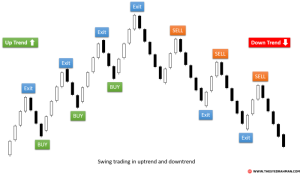

For example, a highly leveraged company in a declining industry might face solvency issues.Technical Analysis and IndicatorsTechnical analysis focuses on identifying trading opportunities by studying historical price and volume data. It assumes that past price movements can predict future price trends. Various technical indicators are used to interpret these patterns.

Moving Averages

Moving averages smooth out price fluctuations, revealing underlying trends. Simple Moving Average (SMA) and Exponential Moving Average (EMA) are commonly used. A bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, suggesting a potential uptrend. Conversely, a bearish crossover suggests a potential downtrend. For example, a 50-day SMA crossing above a 200-day SMA is often considered a bullish signal.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 are generally considered overbought, while readings below 30 are considered oversold. These levels don’t guarantee reversals, but they can signal potential turning points. A stock with an RSI above 70 might be due for a correction, while a stock with an RSI below 30 might be ripe for a bounce.A Step-by-Step Stock Selection ProcessThis process Artikels a systematic approach to stock selection based on a defined investment strategy.

Step-by-Step Stock Selection

1. Define Investment Goals and Risk Tolerance

Determine your investment objectives (e.g., long-term growth, income generation) and your comfort level with risk. This will guide your stock selection strategy.

2. Identify Potential Sectors and Companies

Research industries aligned with your investment goals and identify companies within those sectors that meet your criteria.

3. Conduct Fundamental Analysis

Evaluate the financial health and competitive position of potential companies using financial ratios and qualitative factors.

4. Conduct Technical Analysis

Analyze price charts and technical indicators to identify potential entry and exit points.

5. Diversify your Portfolio

Spread your investments across multiple stocks to mitigate risk.

6. Monitor and Adjust

Regularly review your portfolio’s performance and make adjustments as needed.

Risk Management and Diversification

Successful stock trading isn’t solely about identifying winning stocks; it’s equally, if not more, about managing risk effectively. Uncontrolled risk can quickly erode profits and even lead to significant losses. A robust risk management strategy is the cornerstone of long-term success in the stock market. This section will explore key strategies for mitigating risk and protecting your investment capital.Risk management in stock trading involves identifying potential threats to your investments and implementing strategies to minimize their impact.

This includes understanding market volatility, economic fluctuations, and the inherent uncertainties associated with individual company performance. Effective risk management isn’t about avoiding risk altogether – it’s about making informed decisions, understanding your tolerance for risk, and implementing strategies to limit potential losses while maximizing potential gains. A key component of this is diversification.

Diversification Strategies

Diversification is a fundamental risk management technique that involves spreading investments across a range of assets to reduce the impact of any single investment’s poor performance. This can be achieved by investing in different sectors, industries, asset classes (stocks, bonds, real estate), and geographical regions. For example, instead of investing heavily in only technology stocks, a diversified portfolio might include a mix of technology, healthcare, energy, and consumer goods stocks.

This reduces the overall portfolio’s vulnerability to downturns in a single sector. A well-diversified portfolio is designed to dampen volatility, reducing the potential for substantial losses. The level of diversification will vary based on individual risk tolerance and investment goals. For example, a younger investor with a longer time horizon might tolerate a higher level of risk and opt for a less diversified portfolio focused on growth stocks.

Conversely, an older investor closer to retirement might prioritize capital preservation and choose a more conservative, diversified portfolio with a greater allocation to bonds.

Position Sizing Techniques

Position sizing refers to determining the appropriate amount of capital to allocate to each individual stock within your portfolio. This is crucial for managing risk because it limits the potential loss from any single investment. A common approach is to limit the percentage of your total portfolio allocated to any one stock. For instance, a conservative investor might limit their position size to a maximum of 5% of their total portfolio for any single stock.

This means that even if that stock were to completely fail, the investor’s overall portfolio would only experience a 5% loss. More aggressive investors might allocate a larger percentage, but it’s vital to always have a defined position sizing strategy in place.

Risk Management Tools and Techniques

Several tools and techniques can assist in managing risk. Stop-loss orders automatically sell a stock when it reaches a predetermined price, limiting potential losses. Trailing stop-loss orders adjust the stop-loss price as the stock price increases, locking in profits while still protecting against significant declines. Diversification, as discussed above, is another critical tool. Furthermore, regular portfolio reviews allow for adjustments based on changing market conditions and individual stock performance.

Thorough research and due diligence before investing also significantly reduce risk. Finally, understanding your own risk tolerance is paramount – only invest in assets that align with your comfort level.

Common Investment Risks and Mitigation Strategies

Understanding common investment risks and how to mitigate them is vital. Below is a list of some key risks and strategies to minimize their impact:

- Market Risk: The risk of overall market downturns. Mitigation: Diversification across asset classes and sectors, and holding a mix of defensive and growth stocks.

- Company-Specific Risk: The risk of a specific company underperforming or failing. Mitigation: Thorough due diligence, diversification across multiple companies, and avoiding highly speculative investments.

- Interest Rate Risk: The risk of changes in interest rates affecting bond prices and investment returns. Mitigation: Diversification, holding short-term bonds, or using hedging strategies.

- Inflation Risk: The risk that inflation erodes the purchasing power of your investments. Mitigation: Investing in inflation-protected securities, real estate, or commodities.

- Liquidity Risk: The risk of not being able to easily sell an investment when needed. Mitigation: Investing in liquid assets, such as publicly traded stocks and ETFs.

Stock Options Trading

Stock options offer a powerful tool for both experienced and novice investors to manage risk and potentially enhance returns. Unlike buying shares outright, options provide the

- right*, but not the

- obligation*, to buy or sell an underlying stock at a specific price (the strike price) on or before a certain date (the expiration date). Understanding the nuances of options trading is crucial, however, as the potential for significant losses exists alongside the potential for substantial gains.

Call and Put Options

Call options grant the buyer the right to

- buy* a certain number of shares of the underlying stock at the strike price before the expiration date. Put options, conversely, grant the buyer the right to

- sell* a certain number of shares at the strike price before expiration. The seller (or writer) of an option receives a premium for taking on this obligation. Whether a call or put option is profitable depends on the movement of the underlying stock price relative to the strike price and the premium paid or received.

Option Strategies

Several strategies utilize options to achieve specific financial goals. A

- covered call* involves selling call options on shares you already own. This generates income from the premium received, but limits potential upside if the stock price rises significantly. A

- protective put* involves buying put options on shares you own. This acts as insurance, limiting potential losses if the stock price falls. Other strategies, such as straddles and strangles, involve buying both calls and puts at different strike prices to profit from large price movements in either direction. These are more complex and carry higher risk.

Risk Management and Income Generation with Options

Options can be used to manage risk effectively. For instance, a protective put can safeguard against substantial losses in a portfolio. By purchasing a put option, an investor insures against a decline in the value of their stock holdings. The cost of this insurance is the premium paid for the put option. On the other hand, covered calls can generate income by collecting premiums, although this strategy limits potential upside.

This is particularly attractive for investors who are bullish on a stock’s short-term prospects but are content with a capped return.

Option Profit/Loss Calculation Example

Let’s consider a simple example of a call option. Suppose you buy one call option contract (representing 100 shares) for XYZ stock with a strike price of $100 and a premium of $5 per share. The total cost is $500 ($5 premium/share

- 100 shares). If, at expiration, the stock price is $110, you can exercise your option to buy 100 shares at $100 and immediately sell them at $110, making a profit of $1000 ($10 profit/share

- 100 shares). Subtracting the $500 premium, your net profit is $500. However, if the stock price remains below $100 at expiration, the option expires worthless, and you lose the entire $500 premium. This highlights the potential for both significant gains and losses in options trading. The calculation is simplified and doesn’t include commissions or fees.

More complex strategies involve more intricate calculations.

Successfully trading stocks requires a blend of knowledge, discipline, and a long-term perspective. While this guide provides a strong foundation, continuous learning and adaptation are crucial. Remember to prioritize risk management, diversify your investments, and stay informed about market trends. By combining a thorough understanding of the market with responsible trading practices, you can increase your chances of achieving sustainable financial success in the world of stock trading.

FAQ Insights

What is the minimum amount I need to start trading stocks?

The minimum amount varies depending on your brokerage. Some offer fractional shares, allowing you to invest with very small amounts. Others may require a higher minimum deposit.

How often should I check my stock portfolio?

The frequency depends on your investment strategy. Long-term investors may check less frequently, while day traders check constantly. Avoid emotional decision-making based on short-term market fluctuations.

What are the tax implications of stock trading?

Capital gains taxes apply to profits from selling stocks. The tax rate depends on your holding period and income bracket. Consult a tax professional for personalized advice.

What are some common mistakes new investors make?

Common mistakes include emotional trading, neglecting diversification, ignoring risk management, and chasing quick profits without sufficient research.